The PPMT function in Microsoft Excel is a powerful financial tool that calculates the principal payment for a specific period of a loan or investment. Whether you’re managing personal finances, creating loan amortization schedules, or analyzing investment returns, understanding the PPMT function is essential for accurate financial modeling.

What is the Excel PPMT Function?

PPMT stands for “Principal Payment” and is one of Excel’s built-in financial functions. It calculates the principal portion of a payment for a given period in a loan or annuity, based on constant payments and a constant interest rate. This function is particularly useful when you need to separate the principal component from the total payment amount.

The principal payment is the portion of your loan payment that goes toward reducing the actual loan balance, excluding interest charges. As you progress through a loan’s payment schedule, the principal portion typically increases while the interest portion decreases.

PPMT Function Syntax

The syntax for the PPMT function is:

=PPMT(rate, per, nper, pv, [fv], [type])Required Parameters:

- rate: The interest rate per period

- per: The specific period for which you want to calculate the principal payment (must be between 1 and nper)

- nper: The total number of payment periods

- pv: The present value or principal amount of the loan

Optional Parameters:

- fv: The future value or cash balance after the final payment (defaults to 0)

- type: When payments are due (0 for end of period, 1 for beginning of period; defaults to 0)

Understanding PPMT Function Parameters

Interest Rate (rate)

The interest rate must be consistent with the payment period. If you have an annual interest rate but make monthly payments, divide the annual rate by 12. For example, a 6% annual rate becomes 0.06/12 = 0.005 for monthly calculations.

Period (per)

This specifies which payment period you’re analyzing. For a 30-year mortgage with monthly payments, period 1 represents the first month, period 12 represents the first year’s final payment, and period 360 represents the final payment.

Number of Periods (nper)

The total number of payments over the loan’s life. For a 30-year mortgage with monthly payments, this would be 30 × 12 = 360 periods.

Present Value (pv)

The initial loan amount or principal. This should be entered as a negative value since it represents money you owe, or as a positive value if you’re calculating from the lender’s perspective.

Basic PPMT Function Examples

Example 1: Monthly Mortgage Payment

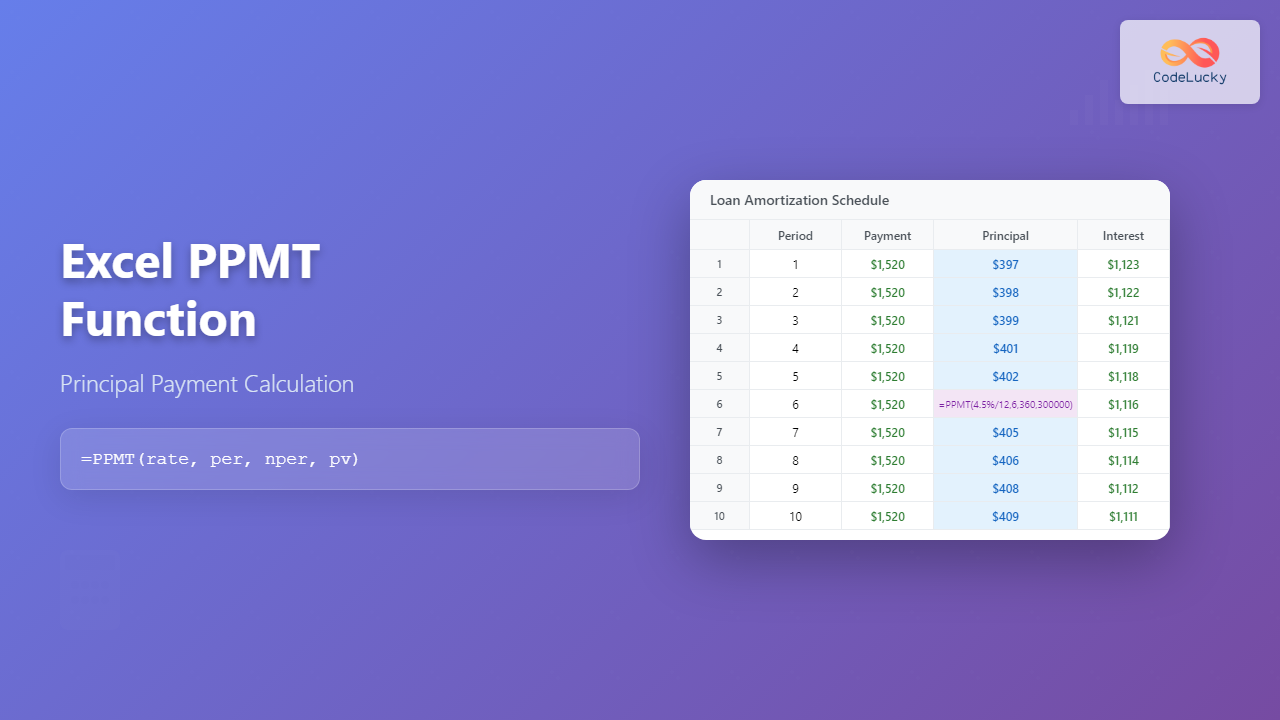

Let’s calculate the principal payment for the first month of a $300,000 mortgage at 4.5% annual interest over 30 years:

=PPMT(4.5%/12, 1, 30*12, 300000)This returns approximately -$397.07, indicating that $397.07 of the first payment goes toward principal reduction.

Example 2: Car Loan Principal Payment

For a $25,000 car loan at 3.9% annual interest over 5 years, the principal payment in month 24 would be:

=PPMT(3.9%/12, 24, 5*12, 25000)This returns approximately -$395.83 for the 24th month’s principal payment.

Advanced PPMT Applications

Creating Loan Amortization Schedules

The PPMT function is essential for building comprehensive amortization schedules. Combined with the IPMT function (which calculates interest payments), you can create detailed payment breakdowns:

| Period | Total Payment | Principal | Interest | Balance |

|---|---|---|---|---|

| 1 | =PMT(rate,nper,pv) | =PPMT(rate,1,nper,pv) | =IPMT(rate,1,nper,pv) | =pv+PPMT(rate,1,nper,pv) |

Calculating Cumulative Principal Payments

To find the total principal paid over multiple periods, use the CUMPRINC function in combination with PPMT:

=CUMPRINC(rate, nper, pv, start_period, end_period, type)Common PPMT Function Errors and Solutions

#NUM! Error

This error occurs when:

- The period (per) is less than 1 or greater than nper

- The interest rate makes the calculation impossible

Solution: Verify that your period value falls within the valid range and that your interest rate is reasonable.

#VALUE! Error

This happens when non-numeric values are used in numeric parameters.

Solution: Ensure all parameters contain valid numbers or cell references to numeric values.

PPMT vs Related Functions

PPMT vs PMT

While PMT calculates the total payment amount, PPMT specifically returns only the principal portion. The relationship is: PMT = PPMT + IPMT

PPMT vs IPMT

IPMT calculates the interest portion of a payment, while PPMT calculates the principal portion. Together, they sum to the total payment amount.

Practical PPMT Use Cases

Refinancing Analysis

Use PPMT to compare principal payments between your current loan and potential refinancing options. Higher principal payments mean faster equity building.

Extra Payment Impact

Calculate how additional principal payments affect your loan timeline by analyzing how extra payments change the principal reduction pattern.

Investment Analysis

For annuity investments, PPMT helps determine how much of each payment contributes to the principal accumulation versus interest earnings.

Tips for Using PPMT Effectively

Consistency in Units

Always ensure your rate and nper parameters use consistent time periods. Annual rates require annual periods, monthly rates require monthly periods.

Sign Conventions

Excel uses negative values for outgoing cash flows and positive values for incoming cash flows. Be consistent with your sign conventions throughout your calculations.

Rounding Considerations

Financial calculations can produce very precise decimal results. Consider using the ROUND function to match real-world payment scenarios:

=ROUND(PPMT(rate, per, nper, pv), 2)Building Dynamic PPMT Models

Using Cell References

Instead of hardcoding values, use cell references to create flexible models:

=PPMT($B$2/12, A10, $B$3*12, $B$1)Where B1 contains loan amount, B2 contains annual rate, B3 contains loan term in years, and A10 contains the period number.

Data Tables for Scenario Analysis

Create data tables to analyze how different interest rates or loan terms affect principal payments across various periods.

PPMT Function Limitations

The PPMT function assumes:

- Constant payment amounts throughout the loan term

- Fixed interest rates

- Regular payment intervals

For variable rate loans or irregular payment schedules, you’ll need more complex modeling approaches.

Integration with Other Excel Features

Conditional Formatting

Apply conditional formatting to highlight periods where principal payments exceed certain thresholds or to visualize the changing principal-to-interest ratio over time.

Charts and Graphs

Create visual representations of principal payments over time using Excel’s charting features. Line charts effectively show how principal payments increase throughout a loan’s life.

Best Practices for PPMT Implementation

- Always validate your inputs before applying the PPMT function

- Use absolute cell references for loan parameters that don’t change

- Include error handling using IFERROR to manage potential calculation errors

- Document your assumptions clearly in your spreadsheet

- Test your calculations with known values to ensure accuracy

Conclusion

The Excel PPMT function is an indispensable tool for financial analysis and loan management. By understanding its syntax, parameters, and applications, you can create sophisticated financial models that provide valuable insights into loan structures and payment schedules. Whether you’re a financial professional, business analyst, or individual managing personal finances, mastering the PPMT function will enhance your ability to make informed financial decisions.

Remember to always verify your calculations and consider the real-world implications of your financial models. The PPMT function provides the mathematical foundation, but sound financial judgment ensures practical application of the results.

- What is the Excel PPMT Function?

- PPMT Function Syntax

- Understanding PPMT Function Parameters

- Basic PPMT Function Examples

- Advanced PPMT Applications

- Common PPMT Function Errors and Solutions

- PPMT vs Related Functions

- Practical PPMT Use Cases

- Tips for Using PPMT Effectively

- Building Dynamic PPMT Models

- PPMT Function Limitations

- Integration with Other Excel Features

- Best Practices for PPMT Implementation

- Conclusion