The Excel NPV (Net Present Value) function is one of the most powerful financial tools available in Microsoft Excel, enabling users to evaluate investment opportunities and make informed financial decisions. This comprehensive guide will walk you through everything you need to know about the NPV function, from basic syntax to advanced applications.

What is the NPV Function in Excel?

The NPV function calculates the net present value of an investment based on a series of periodic cash flows and a discount rate. Net Present Value represents the difference between the present value of cash inflows and outflows over a period of time, helping determine whether an investment will be profitable.

The function is essential for:

- Investment analysis and decision-making

- Capital budgeting processes

- Project evaluation and comparison

- Financial planning and forecasting

Excel NPV Function Syntax

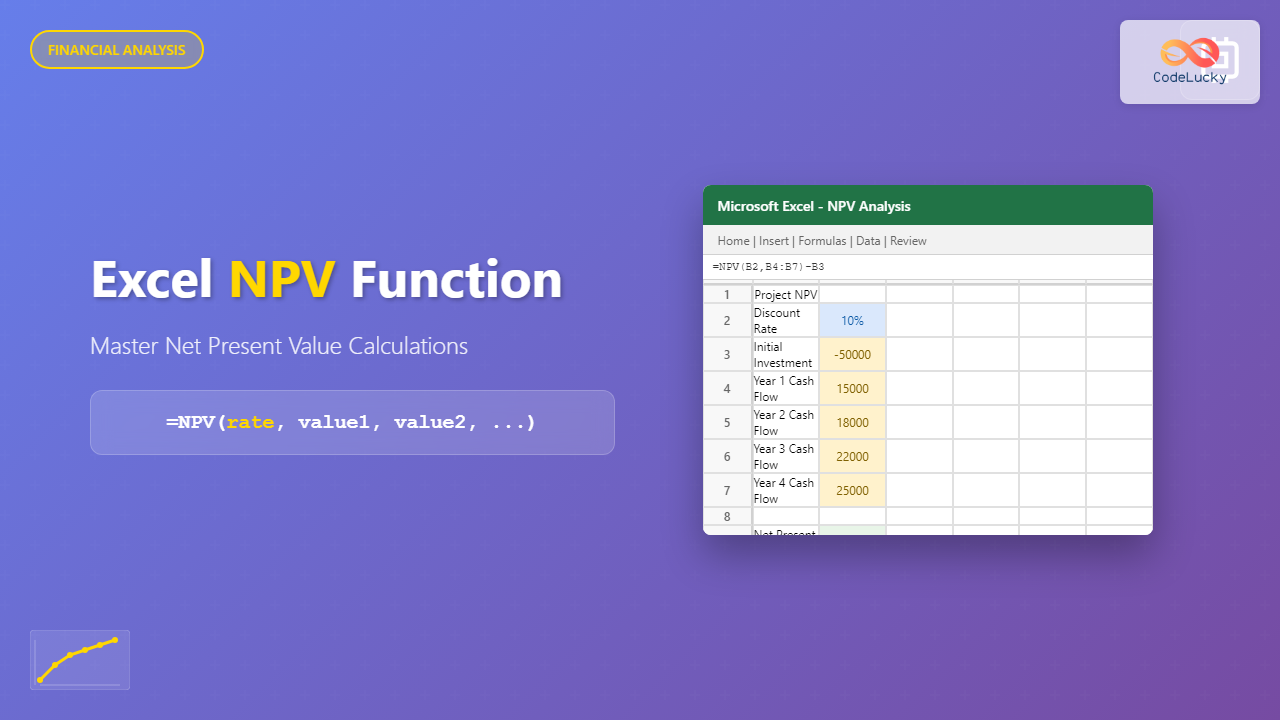

The basic syntax for the NPV function is:

=NPV(rate, value1, [value2], [value3], ...)

Parameters Explained

- rate (required): The discount rate per period, expressed as a decimal or percentage

- value1 (required): The first cash flow value, typically occurring at the end of the first period

- value2, value3… (optional): Additional cash flow values for subsequent periods

Important NPV Function Rules and Limitations

Key Points to Remember

- The NPV function assumes cash flows occur at the end of each period

- Cash flows must be equally spaced in time

- The function can accept up to 254 value arguments

- Negative values represent cash outflows (investments)

- Positive values represent cash inflows (returns)

Initial Investment Consideration

The NPV function does not include the initial investment (Period 0) in its calculation. If you have an initial investment, you must subtract it separately from the NPV result:

=NPV(rate, cash_flows) - initial_investment

Step-by-Step NPV Calculation Examples

Example 1: Basic NPV Calculation

Let’s calculate the NPV for a project with the following details:

- Initial investment: $10,000

- Discount rate: 8%

- Year 1 cash flow: $3,000

- Year 2 cash flow: $4,000

- Year 3 cash flow: $5,000

Formula:

=NPV(0.08, 3000, 4000, 5000) - 10000

Result: This would return approximately $361.25, indicating a profitable investment.

Example 2: Using Cell References

For better spreadsheet management, use cell references:

| Cell | Description | Value |

|---|---|---|

| A1 | Discount Rate | 8% |

| A2 | Initial Investment | -10000 |

| A3:A5 | Cash Flows (Years 1-3) | 3000, 4000, 5000 |

Formula:

=NPV(A1, A3:A5) + A2

Advanced NPV Applications

Comparing Multiple Investment Options

Use NPV to compare different investment opportunities. The project with the higher NPV is generally more attractive:

| Project | NPV Formula | Result |

|---|---|---|

| Project A | =NPV(10%, B2:B6) – B1 | $2,845 |

| Project B | =NPV(10%, C2:C6) – C1 | $3,120 |

Sensitivity Analysis

Create a data table to analyze how changes in the discount rate affect NPV:

- Set up your base NPV formula

- Create a column with different discount rates

- Use Excel’s Data Table feature to calculate NPV for each rate

- Visualize results with a chart

Common NPV Function Errors and Solutions

#VALUE! Error

Cause: Non-numeric values in cash flow arguments

Solution: Ensure all cash flow values are numbers, not text

#NUM! Error

Cause: Invalid discount rate (usually negative rates that are too large)

Solution: Check that your discount rate is reasonable and properly formatted

Incorrect Results

Cause: Forgetting to account for initial investment

Solution: Remember to subtract initial investment from NPV result

NPV vs IRR: Understanding the Difference

While NPV gives you the dollar value of an investment’s profitability, IRR (Internal Rate of Return) provides the rate of return. Use both functions together for comprehensive investment analysis:

- NPV > 0: Investment is profitable at the given discount rate

- NPV = 0: Investment breaks even

- NPV < 0: Investment loses money at the given discount rate

Best Practices for Using Excel NPV Function

1. Choose Appropriate Discount Rates

Use rates that reflect:

- Cost of capital

- Risk level of the investment

- Inflation expectations

- Alternative investment opportunities

2. Organize Your Data Clearly

- Label your cash flows by period

- Use consistent time intervals

- Clearly separate inflows and outflows

- Document assumptions and sources

3. Perform Sensitivity Analysis

- Test different discount rates

- Vary cash flow assumptions

- Create scenario models

- Use data tables for multiple variables

Real-World NPV Applications

Business Investment Decisions

- Equipment purchases

- Facility expansions

- Technology upgrades

- Market entry strategies

Personal Finance

- Real estate investments

- Education financing decisions

- Retirement planning

- Major purchase evaluations

Excel NPV Function Tips and Tricks

Dynamic NPV Models

Create flexible models using named ranges and data validation:

=NPV(INDIRECT("DiscountRate"), INDIRECT("CashFlows")) - INDIRECT("InitialInvestment")

Array Formulas for Complex Scenarios

Use array formulas to handle irregular cash flows or multiple scenarios simultaneously.

Conditional NPV Calculations

Combine NPV with IF statements for scenario-based analysis:

=IF(MarketCondition="Good", NPV(LowRate, CashFlows), NPV(HighRate, CashFlows))

Conclusion

The Excel NPV function is an indispensable tool for financial analysis and investment decision-making. By understanding its syntax, limitations, and best practices, you can leverage this powerful function to make informed financial decisions and conduct thorough investment analyses.

Remember that NPV is just one metric in investment analysis. Always consider it alongside other financial indicators like IRR, payback period, and profitability index for comprehensive evaluation. With practice and proper application, the NPV function will become an essential part of your Excel financial toolkit.

Start implementing these NPV techniques in your own financial models, and you’ll quickly discover how this function can enhance your investment analysis capabilities and support better business decisions.

- What is the NPV Function in Excel?

- Excel NPV Function Syntax

- Important NPV Function Rules and Limitations

- Step-by-Step NPV Calculation Examples

- Advanced NPV Applications

- Common NPV Function Errors and Solutions

- NPV vs IRR: Understanding the Difference

- Best Practices for Using Excel NPV Function

- Real-World NPV Applications

- Excel NPV Function Tips and Tricks

- Conclusion