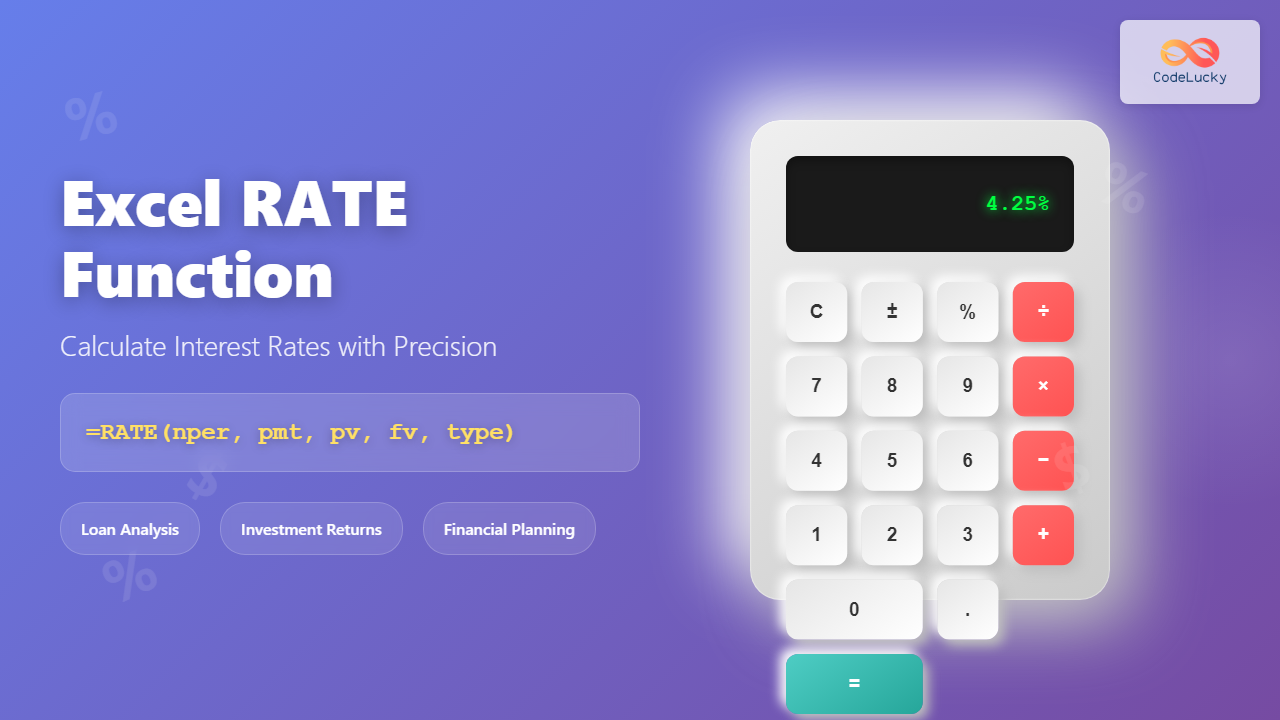

The Excel RATE function is a powerful financial tool that calculates the interest rate per period for an annuity or loan. Whether you’re analyzing investment returns, calculating loan rates, or performing complex financial modeling, understanding the RATE function is essential for accurate financial analysis.

What is the Excel RATE Function?

The RATE function in Excel determines the interest rate per period of an annuity by using an iterative process. It’s particularly useful when you know the payment amount, number of periods, and present value, but need to find the interest rate that makes the equation balance.

This function is commonly used in scenarios such as:

- Calculating the annual percentage rate (APR) on loans

- Determining investment return rates

- Analyzing lease agreements

- Evaluating bond yields

- Financial planning and budgeting

RATE Function Syntax

The complete syntax for the RATE function is:

=RATE(nper, pmt, pv, [fv], [type], [guess])Required Arguments

nper – The total number of payment periods in an annuity. For monthly payments over 5 years, this would be 60 periods.

pmt – The payment made each period, which cannot change over the life of the annuity. This includes principal and interest but excludes fees or taxes. For loans, this is typically negative since it represents money going out.

pv – The present value, or the total amount that a series of future payments is worth now. For loans, this is the loan amount (positive value).

Optional Arguments

[fv] – The future value, or cash balance you want to attain after the last payment is made. If omitted, Excel assumes 0 (zero).

[type] – Indicates when payments are due:

- 0 (default) – Payments are due at the end of the period

- 1 – Payments are due at the beginning of the period

[guess] – Your guess for what the rate will be. If omitted, Excel uses 10% as the default starting point for its iterative calculation.

Understanding Cash Flow Convention

The RATE function follows standard financial cash flow conventions where:

- Positive values represent cash received (inflows)

- Negative values represent cash paid out (outflows)

For a typical loan scenario, the loan amount (pv) is positive because you receive the money, while the monthly payments (pmt) are negative because you pay them out.

Practical Examples of RATE Function

Example 1: Calculate Loan Interest Rate

Suppose you have a $250,000 mortgage with monthly payments of $1,342.05 for 30 years. To find the annual interest rate:

=RATE(360, -1342.05, 250000) * 12This formula returns approximately 0.04 or 4% annual interest rate. We multiply by 12 to convert the monthly rate to an annual rate.

Example 2: Investment Return Calculation

If you invest $1,000 monthly for 20 years and end up with $500,000, the annual return rate would be:

=RATE(240, -1000, 0, 500000) * 12This calculates the monthly return rate and converts it to annual by multiplying by 12.

Example 3: Bond Yield Calculation

For a bond with a $1,000 face value, $50 annual coupon payments, and current price of $950:

=RATE(10, 50, -950, 1000)This gives you the annual yield to maturity for a 10-year bond.

Advanced RATE Function Applications

Irregular Payment Scenarios

When dealing with irregular payment schedules or varying amounts, you might need to combine RATE with other functions like IRR (Internal Rate of Return) for more complex calculations.

Sensitivity Analysis

Use the RATE function in data tables to perform sensitivity analysis, showing how interest rates change with different payment amounts or loan terms.

Goal Seek Integration

Combine RATE with Excel’s Goal Seek feature to determine what payment amount would achieve a specific interest rate target.

Common Errors and Troubleshooting

#NUM! Error

This error occurs when:

- Excel cannot find a solution after 20 iterations

- The guess value leads to divergent results

- The payment and present value have the same sign (both positive or both negative)

Solution: Adjust your guess parameter or verify your cash flow signs are correct.

#VALUE! Error

This happens when arguments contain non-numeric values or text.

Solution: Ensure all arguments are numbers, not text or blank cells.

Tips for Accurate RATE Calculations

1. Verify Cash Flow Signs

Always double-check that inflows are positive and outflows are negative. Incorrect signs are the most common source of errors.

2. Use Appropriate Guess Values

If the default 10% guess doesn’t work, try values closer to your expected result. For very low or high interest rates, adjust the guess accordingly.

3. Consider Compounding Frequency

Remember to convert between different compounding periods. Monthly rates need to be multiplied by 12 for annual rates, quarterly by 4, etc.

4. Validate Results

Cross-check your RATE function results using the PMT function with your calculated rate to verify accuracy.

Alternative Functions to Consider

IRR Function

Use IRR when you have irregular cash flows or need to calculate internal rate of return for investment projects.

XIRR Function

Choose XIRR when dealing with cash flows that occur at irregular intervals with specific dates.

NOMINAL and EFFECT Functions

These functions help convert between nominal and effective interest rates when dealing with different compounding frequencies.

Real-World Applications

Loan Comparison

Use RATE to compare different loan offers by calculating the effective interest rate for each option, considering fees and different payment structures.

Investment Analysis

Evaluate investment performance by calculating the rate of return on contributions to retirement accounts or other investment vehicles.

Lease vs. Buy Decisions

Calculate the implicit interest rate in lease agreements to compare with loan rates for purchase decisions.

Performance Optimization

When using RATE in large spreadsheets:

- Provide good guess values to reduce calculation time

- Consider using array formulas for multiple calculations

- Cache results when possible to avoid repeated calculations

Integration with Other Excel Features

Data Validation

Set up data validation rules to ensure input values are within reasonable ranges before RATE calculations.

Conditional Formatting

Use conditional formatting to highlight interest rates that fall outside acceptable ranges.

Charts and Visualization

Create dynamic charts showing how interest rates change with different variables using RATE function results.

Best Practices for Financial Modeling

When incorporating RATE functions into financial models:

- Document your assumptions clearly

- Use named ranges for better formula readability

- Include error checking and validation

- Test edge cases and boundary conditions

- Provide clear explanations for end users

Conclusion

The Excel RATE function is an indispensable tool for financial analysis, enabling you to calculate interest rates with precision and flexibility. By understanding its syntax, cash flow conventions, and practical applications, you can leverage this function for everything from simple loan calculations to complex investment analysis.

Remember to always verify your results, use appropriate cash flow signs, and consider the compounding frequency when interpreting your calculations. With practice and attention to detail, the RATE function will become a valuable asset in your financial analysis toolkit.

Whether you’re a financial professional, business analyst, or individual managing personal finances, mastering the RATE function will enhance your ability to make informed financial decisions and perform accurate calculations in Excel.