Wealth Building: Increasing Income Streams is not just about earning more money; it’s about securing financial stability and long-term independence. In today’s dynamic economy, relying on a single source of income — typically a salary — is no longer sufficient. Building multiple income streams provides resilience against economic uncertainty and creates opportunities for exponential wealth growth.

Understanding Income Streams

An income stream refers to any regular inflow of money, whether from employment, business, or investments. The key is to balance active and passive streams to ensure both stability and freedom.

Types of Income Streams

- Active Income: Money earned directly from labor — salaries, freelance work, or consultancy fees.

- Passive Income: Earnings generated with minimal ongoing effort, such as dividends, rental income, or royalties.

- Portfolio Income: Income derived from investments in stocks, crypto assets, or mutual funds.

- Business Income: Profits generated from business ownership or partnerships.

- Residual Income: Money that continues to flow from a one-time effort, like a course sale or software license.

Why Increasing Income Streams Matters

Diversifying income reduces risk and builds financial flexibility. For instance, if your job income stops, rental income or dividend payments can continue supporting your lifestyle. This diversification is the foundation of financial resilience.

Step-by-Step: Building New Income Streams

1. Evaluate Your Skills and Resources

Start by identifying what you can offer. For example, if you’re good at graphic design, consider freelance gigs or create online templates. If you own a spare room, explore rental opportunities.

2. Build an Active Side Hustle

Active hustles boost your income immediately. Examples include freelance writing, tutoring, or part-time ecommerce. These require effort but provide quick returns.

3. Convert Effort into Passive Income

Once you generate enough capital, reinvest it into assets that earn while you sleep. Examples include:

- Stock market investments for dividends.

- Creating digital products like eBooks or online courses.

- Affiliate marketing via niche websites or YouTube channels.

4. Automate and Manage Your Cash Flow

Use tools or spreadsheets to track cash flow. Automating investments and savings ensures your money continuously works for you without manual effort each month.

Example Interactive Calculation

Here’s a simple formula to visualize how adding new income streams affects your total earning potential:

Total Monthly Income = Active Income + Passive Income + Investment IncomeExample: If you earn ₹70,000/month from your job, ₹20,000 from freelancing, and ₹10,000 from dividends:

Total = ₹70,000 + ₹20,000 + ₹10,000 = ₹1,00,000/monthVisualizing Wealth Growth

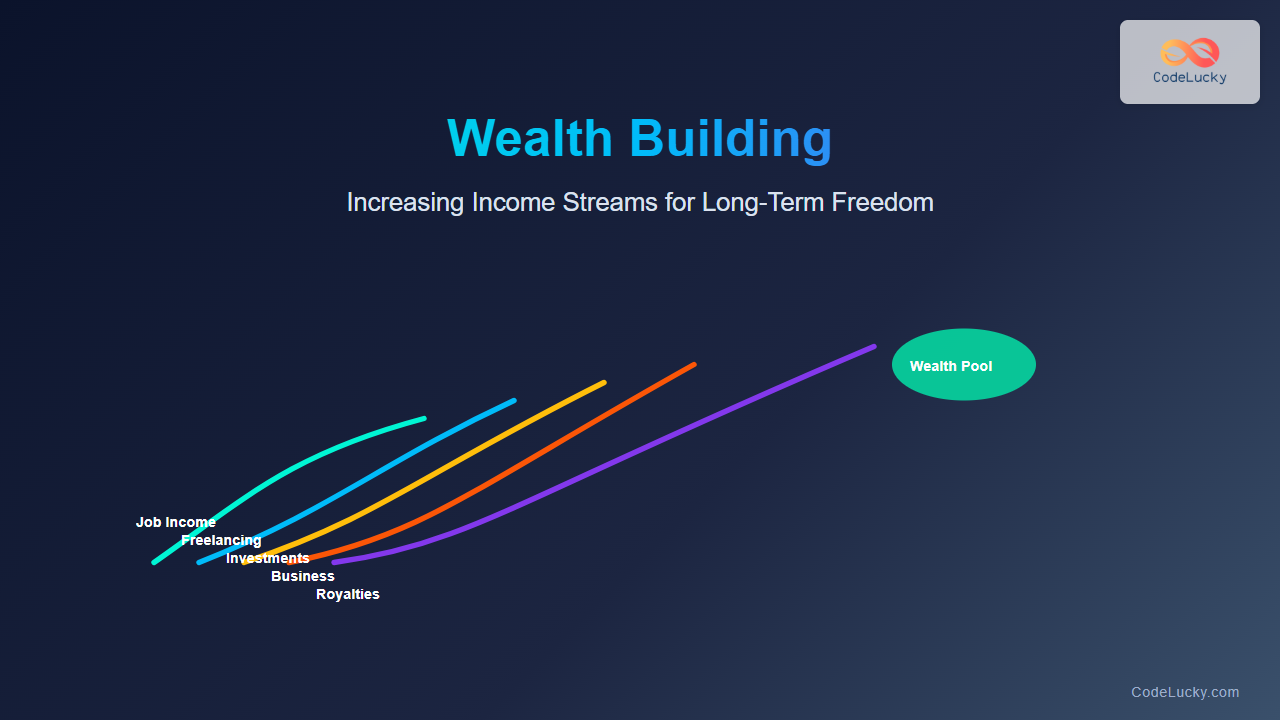

Each new income stream stacks upon your base, compounding over time. This snowball effect is illustrated below:

Digital Age Opportunities

The internet has unlocked numerous income opportunities. Consider these scalable modern options:

- Monetized content creation (YouTube, podcasts, blogs).

- E-commerce with drop-shipping or print-on-demand models.

- Developing and licensing mobile or web apps.

- Investing in peer-to-peer lending or real estate crowdfunding.

Common Pitfalls and How to Avoid Them

- Lack of Focus: Don’t chase too many ideas; focus on one until it’s sustainable.

- Neglecting Financial Literacy: Learn basics of taxation, budgeting, and investment tools.

- High Upfront Costs: Start low-risk projects first to minimize capital exposure.

Long-Term Strategy for Sustainable Wealth

Building wealth isn’t instant; it’s about consistency, reinvestment, and smart scaling. Aim to:

- Achieve savings discipline — invest at least 20% of your income.

- Automate growth — reinvest all passive income streams.

- Diversify intelligently — spread income across unrelated sectors.

- Monitor performance monthly — use financial dashboards to track ROI.

Final Thoughts

Wealth building through increasing income streams is an achievable and highly strategic process. With time, discipline, and smart reinvestment, your diverse streams will merge into a powerful river of financial independence. Whether you’re just starting or already investing, the best wealth-building move you can make today is to begin creating your next income stream.