Understanding candlestick patterns is a crucial skill for anyone starting their trading journey. These visual price representations help traders interpret emotions, trends, and potential reversals in the market at a glance. In this guide, we’ll simplify complex concepts into practical insights you can start using right away.

What Are Candlestick Patterns?

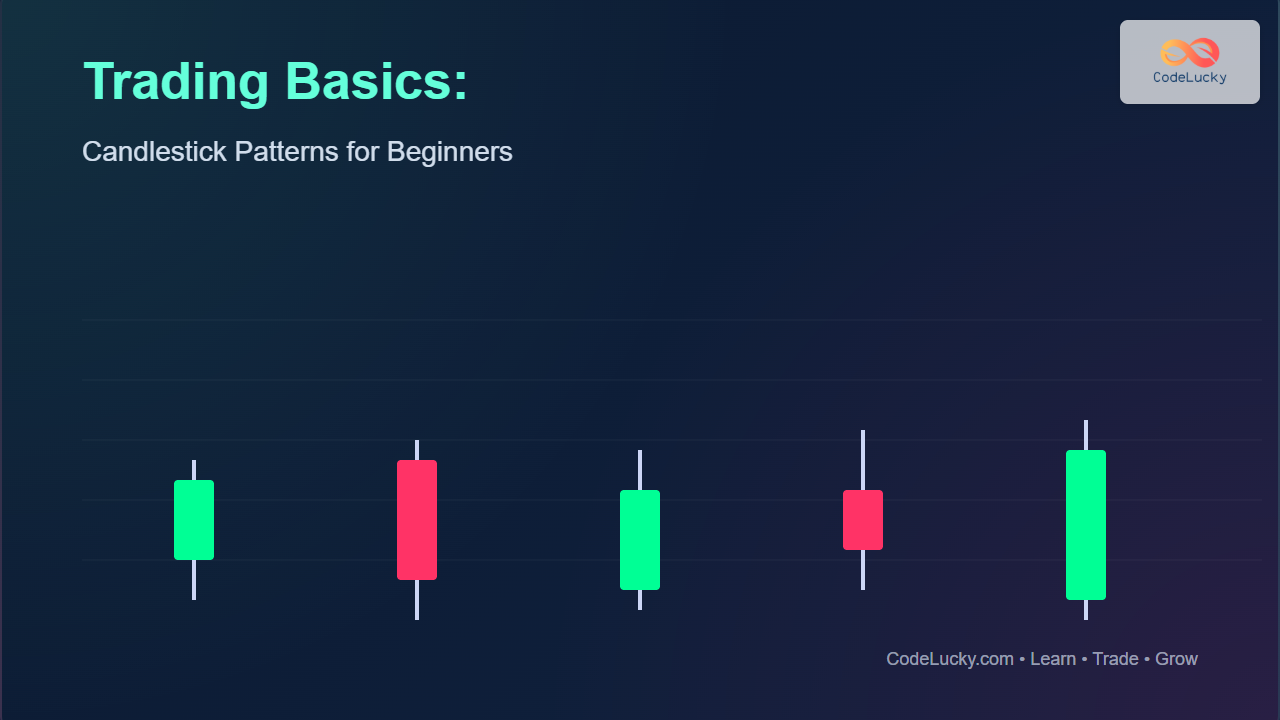

Candlestick patterns are graphical representations of price movements over a specific time frame—such as one minute, one hour, or one day. Each candlestick shows four key data points:

- Open: The price at which the candle started its time frame.

- Close: The price at which it ended.

- High: The maximum price reached during the period.

- Low: The minimum price reached during the period.

A green (or white) candle generally means the closing price was higher than the open (bullish), while a red (or black) candle means the closing price was lower (bearish).

Reading a Single Candlestick

Each candlestick tells a small story about market psychology. For example:

- Long body: Strong momentum in one direction.

- Short body: Market indecision or consolidation.

- Long upper shadow: Buyers pushed up but couldn’t hold.

- Long lower shadow: Sellers drove price down but faced resistance.

Common Candlestick Patterns for Beginners

1. Doji – The Indecision Candle

A Doji occurs when the open and close prices are nearly the same. It signals indecision in the market, often leading to a trend reversal or continuation depending on context.

Interpretation: After a long bullish run, a Doji might signal buyers are losing strength, hinting a possible reversal.

2. Hammer – The Bullish Reversal

The Hammer forms at the end of a downtrend, with a small body and a long lower shadow. It shows sellers pushed prices low, but buyers stepped in to recover strongly.

Pro Tip: A hammer followed by a bullish candle adds confirmation that a reversal is likely.

3. Shooting Star – The Bearish Reversal

A Shooting Star appears at the top of an uptrend and looks like an inverted hammer. It signals that buyers tried to push higher but lost control by the close.

Trader Insight: If the next candle confirms with a bearish move, it strengthens the reversal signal.

4. Bullish Engulfing Pattern

The Bullish Engulfing pattern consists of two candles—where a small red candle is followed by a large green one that completely engulfs it. It’s a powerful bullish reversal indicator during a downtrend.

5. Bearish Engulfing Pattern

Opposite to the bullish version, the Bearish Engulfing pattern occurs when a small green candle is followed by a larger red candle that engulfs it, signaling sellers taking control.

How to Use Candlestick Patterns in Trading

While candlestick patterns can be insightful, they’re best used in combination with other tools like volume analysis, moving averages, or support and resistance levels. Here’s a simple approach:

- Identify the trend: Always know if the market is generally moving up or down.

- Spot the pattern: Recognize formations like Doji, Hammer, or Engulfing.

- Confirm with indicators: Use RSI, MACD, or volume for validation.

- Plan entry and exit: Place stop-loss levels under/above candle wicks to manage risk.

Practice Interactive Learning

To deepen your understanding, use platforms that allow interactive candle simulation. You can visualize each pattern step-by-step, changing parameters like open, close, and market trend. This builds real-world pattern recognition faster than passive observation.

Final Thoughts

Reading candlestick patterns is less about memorization and more about understanding trader emotions behind price movements. Start by focusing on major patterns and practice observing them on demo charts daily. Over time, you’ll instinctively grasp the rhythm of the market and find clarity in the chaos of candles.

Next Step: Explore our next article in the Finance series — “Trading Basics: Understanding Support and Resistance Levels.”