Filing your Income Tax Return (ITR) is not just a legal requirement—it’s a key step in managing your personal finances effectively. Whether you’re a salaried employee, freelancer, or small business owner, understanding the step-by-step process helps ensure compliance, avoid penalties, and even claim refunds efficiently.

What is Income Tax Return (ITR)?

An Income Tax Return is a form where you report your income, deductions, and taxes paid to the government. Filing your ITR ensures transparency and allows the Income Tax Department to calculate whether you owe additional taxes or deserve a refund.

Why Filing ITR Matters

- Legally mandatory if income exceeds the basic exemption limit.

- Claim deductions under sections like 80C, 80D, and 24(b).

- Proof of income for loans, visas, or credit card approvals.

- Carry forward losses to reduce tax in future years.

Documents Required Before Filing

Gather all essential documents to ensure an error-free filing process:

- PAN and Aadhaar card

- Form 16 from your employer (for salaried individuals)

- Form 26AS or AIS (Annual Information Statement)

- Bank account details and passbook

- Investment proofs (e.g., LIC, ELSS, PF)

- Rent receipts, interest statements, home loan certificate (if applicable)

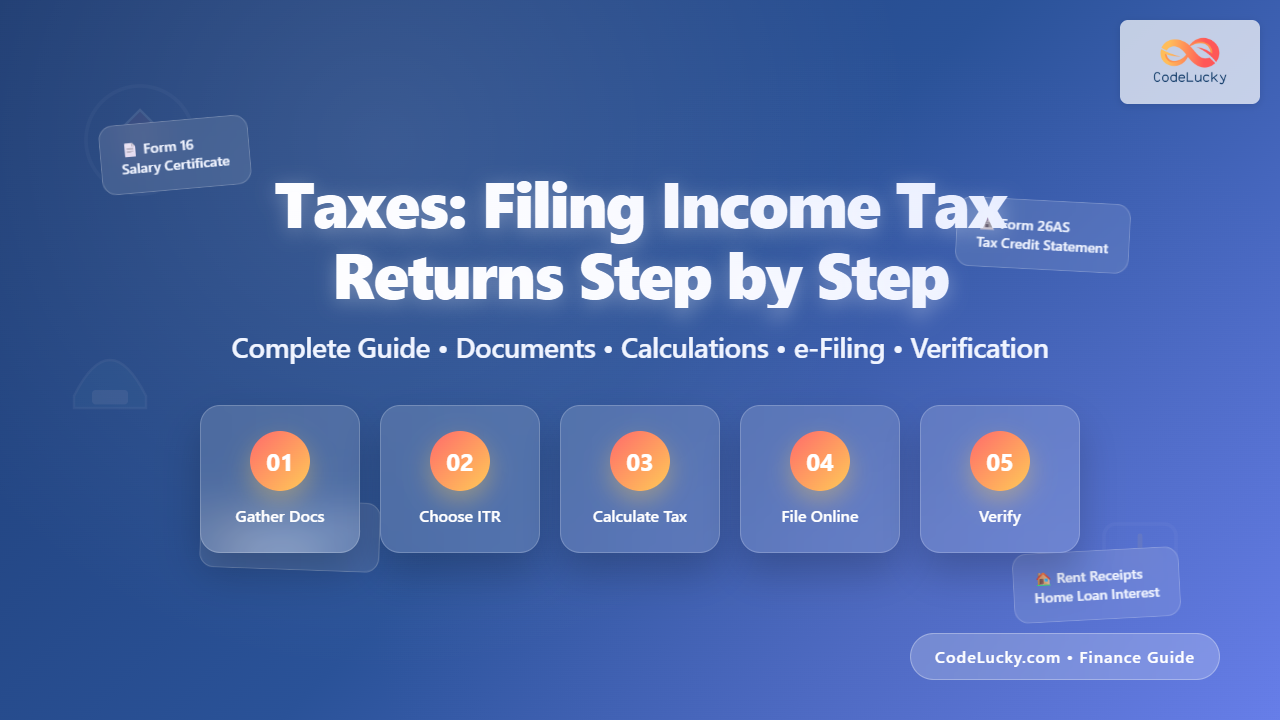

Step-by-Step Process to File Income Tax Returns

Step 1: Determine Which ITR Form to Use

Choose the right form based on your income source:

| ITR Form | Applicable For |

|---|---|

| ITR-1 (Sahaj) | Salaried individuals with income up to ₹50 lakh. |

| ITR-2 | Individuals with capital gains, more than one property, or foreign income. |

| ITR-3 | Professionals or business income (proprietorship). |

| ITR-4 (Sugam) | Presumptive taxation for small businesses or professionals. |

Step 2: Calculate Gross Total Income

Add income from all heads such as:

- Salary

- House property

- Capital gains

- Business or profession

- Other sources (bank interest, dividends, etc.)

Example:

If your salary is ₹12,00,000, interest income ₹20,000, and house rent income ₹30,000, your gross total income is ₹12,50,000.

Step 3: Apply Deductions

Deductions help reduce your taxable income. For instance:

Section 80C: Investments in ELSS, PPF, or Life Insurance (up to ₹1.5 lakh).Section 80D: Medical insurance premiums.Section 24(b): Home loan interest (up to ₹2 lakh).

Example: If your total income is ₹12,50,000 and you claim ₹1,50,000 under 80C and ₹25,000 under 80D, the taxable income is ₹10,75,000.

Step 4: Compute Tax Liability

Apply the latest income tax slab rates to calculate the tax due. Say, for FY 2024-25 (Old Regime):

| Taxable Income | Tax Rate |

|---|---|

| Up to ₹2.5 lakh | Nil |

| ₹2.5 lakh – ₹5 lakh | 5% |

| ₹5 lakh – ₹10 lakh | 20% |

| Above ₹10 lakh | 30% |

Calculation Example:

For ₹10,75,000 – Tax = (2.5L × 0) + (2.5L × 5%) + (5L × 20%) + (75,000 × 30%) = ₹1,77,500 + cess (4%).

Step 5: File ITR Online (e-Filing)

Visit incometax.gov.in and:

- Log in using your PAN and password.

- Choose “File Income Tax Return”.

- Select the assessment year and the appropriate ITR form.

- Fill in income and deduction details.

- Preview and validate all data.

Step 6: Verify Your ITR

ITR filing is incomplete without verification. Verification options include:

- e-Verification via Aadhaar OTP

- Net banking verification

- Demat account-based verification

- Sending physical ITR-V to CPC, Bengaluru

Step 7: Track Refund or Processing Status

After submission, track your return status on the e-filing portal. If everything is correct, the refund (if any) is credited directly to your linked bank account.

Common Mistakes to Avoid

- Entering incorrect bank account or PAN details.

- Choosing the wrong ITR form.

- Forgetting to verify the return.

- Not matching Form 26AS or AIS with declared income.

Interactive Example: Estimate Your Tax

Try a simple calculation: enter your total income and deductions to estimate your approximate tax (illustrative only).

Final Thoughts

Filing income tax returns isn’t as intimidating as it seems. Once you understand the steps—collecting documents, choosing the right form, entering accurate data, and verifying—you can complete the process in under an hour. Regular filing not only keeps you compliant but also strengthens your financial record for the future.

Disclaimer: This article is for educational purposes. Tax laws may change; always verify with an official source or consult a qualified tax professional.