Taxes are an essential part of any economy, directly influencing government revenue and social welfare programs. In India, the Income Tax system operates on a structured framework known as tax slabs, determining how much tax individuals pay based on their earnings. This article explains what tax slabs are, how they work, and how you can calculate your tax liability step-by-step.

What Are Tax Slabs?

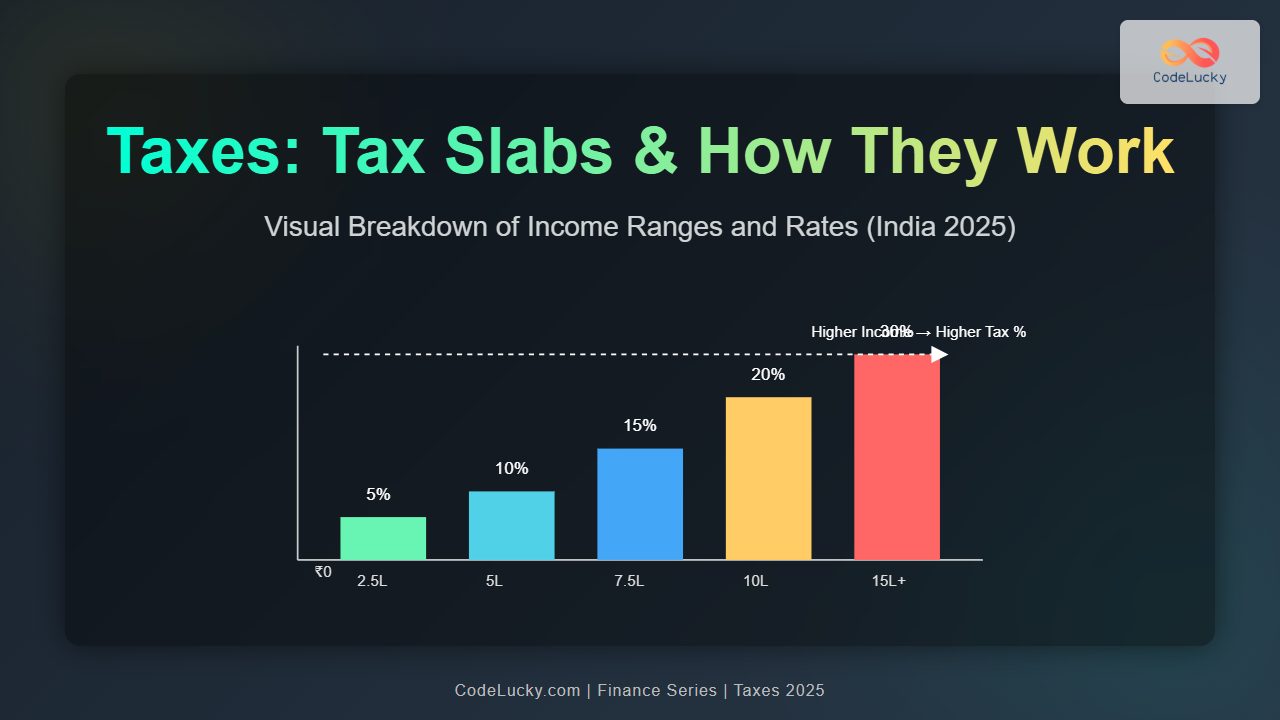

Tax slabs refer to the ranges of income that are taxed at different rates. India follows a progressive tax system, meaning individuals earning higher incomes pay a higher percentage of tax. The slab structure ensures fairness by distributing the tax burden according to income capacity.

For example, a person earning ₹3,00,000 might fall under a 5% bracket, while someone earning ₹15,00,000 may be taxed at 30% for the higher portion of their income.

Old vs. New Tax Regime

Since 2020, taxpayers in India can choose between two tax regimes:

- Old Regime: Offers deductions and exemptions (like Section 80C, HRA, etc.) but has higher tax rates.

- New Regime: Lower tax rates but no major deductions allowed.

Comparison of Tax Rates (FY 2025–26)

| Income Range | Old Regime Rate | New Regime Rate |

|---|---|---|

| Up to ₹2,50,000 | Nil | Nil |

| ₹2,50,001 – ₹5,00,000 | 5% | 5% |

| ₹5,00,001 – ₹7,50,000 | 10% | 10% |

| ₹7,50,001 – ₹10,00,000 | 15% | 15% |

| ₹10,00,001 – ₹12,50,000 | 20% | 20% |

| ₹12,50,001 – ₹15,00,000 | 25% | 25% |

| Above ₹15,00,000 | 30% | 30% |

How Tax is Calculated

Tax calculation uses a slab-wise incremental method. You only pay the respective rate for income within that bracket — not on your entire income.

Example: Calculating Tax under Old Regime

Let’s assume Rahul’s annual income is ₹10,00,000 under the old regime.

This example shows how rates apply incrementally, not uniformly.

Understanding Rebates and Exemptions

Even under the new system, certain reliefs remain:

- Section 87A: Individuals with income up to ₹7,00,000 (under the new regime) pay zero tax after rebate.

- Standard Deduction: ₹50,000 deduction allowed for salaried individuals in both regimes (as per 2025 guidelines).

Effective Tax Planning Tips

Choosing the right regime depends on your income composition and deductions available. Here are some best practices:

- Compute your tax liability under both regimes and compare results using trusted calculators.

- If you have significant deductions (like home loan interest, ELSS investments, or insurance), the old regime is often better.

- If you have minimal investments or exemptions, the new regime’s simplicity might save more tax.

- Re-assess yearly as income, exemptions, and government policies change.

Visual Example: Choosing Between Regimes

Interactive Tax Example (Try It Yourself)

Use this simple formula interactively in your browser (console or JavaScript-enabled editor):

function calculateTax(income) {

let tax = 0;

if (income > 250000) tax += Math.min(income - 250000, 250000) * 0.05;

if (income > 500000) tax += Math.min(income - 500000, 250000) * 0.10;

if (income > 750000) tax += Math.min(income - 750000, 250000) * 0.15;

if (income > 1000000) tax += (income - 1000000) * 0.30;

return tax;

}

console.log(calculateTax(1000000)); // Outputs tax for ₹10,00,000 income

Conclusion

Tax slabs simplify the process of progressive taxation, ensuring every citizen contributes fairly. Whether you choose the old or new tax regime, understanding slab rates helps you optimize deductions, plan investments, and make informed financial decisions.

Smart taxpayers don’t just pay taxes—they plan them.