Every successful startup undergoes multiple funding stages before it becomes a financially stable business. Understanding these stages helps founders plan their financial roadmap, attract the right investors, and manage equity strategically.

In this article, we’ll walk through each startup funding stage—from the earliest concept phase to public market entry—with examples, diagrams, and real-world insights to make the journey crystal clear.

Importance of Understanding Funding Stages

Startup funding isn’t just about getting money—it’s about fueling growth at the right time, for the right purpose. Each stage reflects a startup’s maturity and the investor’s confidence in its product, team, and potential.

- Early stages focus on building an idea and proof of concept.

- Middle stages aim at scaling operations and user growth.

- Late stages emphasize profitability, market dominance, and exit planning.

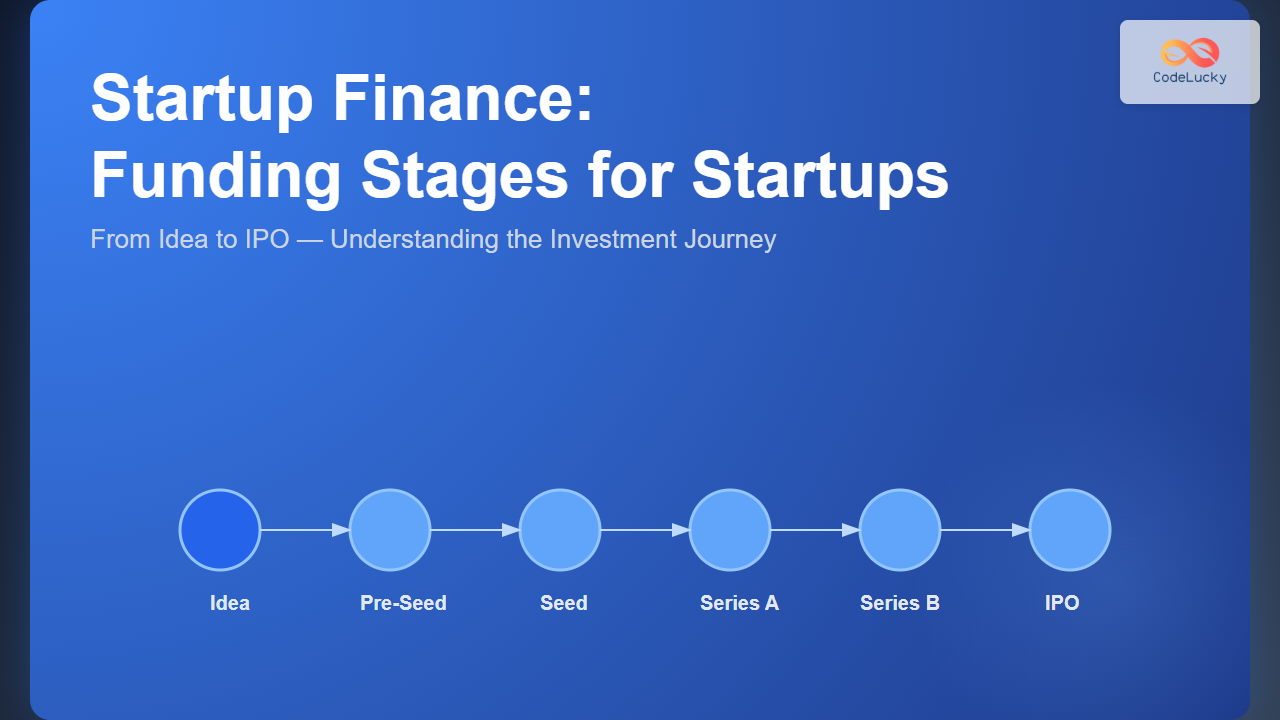

Overview of Startup Funding Stages

This flowchart illustrates how a startup typically progresses through its funding lifecycle. Let’s explore each stage in detail.

1. Bootstrapping and Idea Stage

Before external investors come into play, most founders begin with bootstrapping — funding their startup using personal savings, freelance income, or family support. This phase focuses on validating an idea and building a minimum viable product (MVP).

Example: A solo founder builds a mobile app prototype using personal savings to attract early feedback.

Goal: Validate the problem-solution fit.

2. Pre-Seed Stage

The pre-seed stage marks the first formal capital raise. Investors here are usually friends, family, or angel investors who believe in the founder’s vision.

Purpose: Develop MVP, initial market testing, and business model validation.

Typical investment: $50,000 – $250,000

Example: A startup creating a SaaS productivity tool raises funds from angel investors to hire developers and test user demand.

3. Seed Stage

The seed stage validates market fit and prepares the startup for scalability. Investors often include seed funds, accelerators, or early-stage venture capital firms.

Focus: Product refinement, marketing tests, and building an initial user base.

Typical investment: $250,000 – $2 million

Example: An edtech startup with 5,000 pilot users raises seed funding from an accelerator to optimize its adaptive learning algorithm.

4. Series A Funding

At this stage, startups have measurable traction—revenue, growing users, or a proven core business model. Series A investors want scalable systems and long-term profit potential.

Purpose: Expand teams, automate processes, and strengthen product-market fit.

Typical investment: $2 million – $10 million

Example: A fintech startup showing 20% monthly user growth raises Series A from a major VC to enter two new cities.

5. Series B Funding

The Series B stage focuses on scaling up—national or international expansion, advanced product development, and marketing automation. Companies here have substantial revenue streams but need additional capital for acceleration.

Typical investment: $10 million – $30 million

Investors: Venture capital firms, corporate investors, and private equity.

Example: A health tech firm that achieved profitability in one region seeks Series B to expand globally.

6. Series C and Beyond

Startups raising Series C and later rounds often seek market dominance, acquisitions, or to prepare for an Initial Public Offering (IPO). At this stage, they are mature businesses aiming for exponential growth.

Investors: Investment banks, hedge funds, private equity firms.

Typical investment: $30 million and beyond.

Example: A logistics unicorn raises Series D to acquire a smaller competitor, consolidating its market leadership.

7. IPO or Exit

The IPO (Initial Public Offering) is the final stage for many startups. It allows public investors to buy shares, providing liquidity to founders and early investors. Alternatively, some startups choose acquisition as their exit route.

Example: An e-commerce brand acquired by a global conglomerate for $500 million, providing handsome returns to initial investors.

Interactive Understanding: Funding Flow Simulation

Use the simple interactive logic below to visualize funding progression in a conceptual sense:

function getFundingStage(revenue, growthRate) {

if (revenue < 10000) return "Pre-Seed";

if (revenue < 50000) return "Seed";

if (growthRate > 15) return "Series A";

if (growthRate > 30) return "Series B";

return "Later Stage or IPO Ready";

}

console.log(getFundingStage(20000, 20)); // "Series A"

This simple example shows how startups evolve financially as measurable metrics improve.

Key Takeaways

- Funding stages mark a startup’s natural progression from idea to maturity.

- Each stage attracts different investors with different expectations.

- Strong metrics and business clarity are crucial before approaching VCs.

- Strategic timing and valuation discipline ensure long-term founder control.

Conclusion

Mastering startup funding stages isn’t just about chasing money—it’s about understanding growth cycles and aligning resources accordingly. With careful planning and transparent communication, founders can navigate from their first pitch deck to a successful IPO or acquisition.