Risk management sits at the heart of successful investing. Without understanding how to balance return and risk, even high-performing assets can harm your financial stability. One of the most effective methods to manage risk is through asset allocation — a strategy that spreads investments across various asset classes to minimize losses and optimize returns over time.

What Is Asset Allocation?

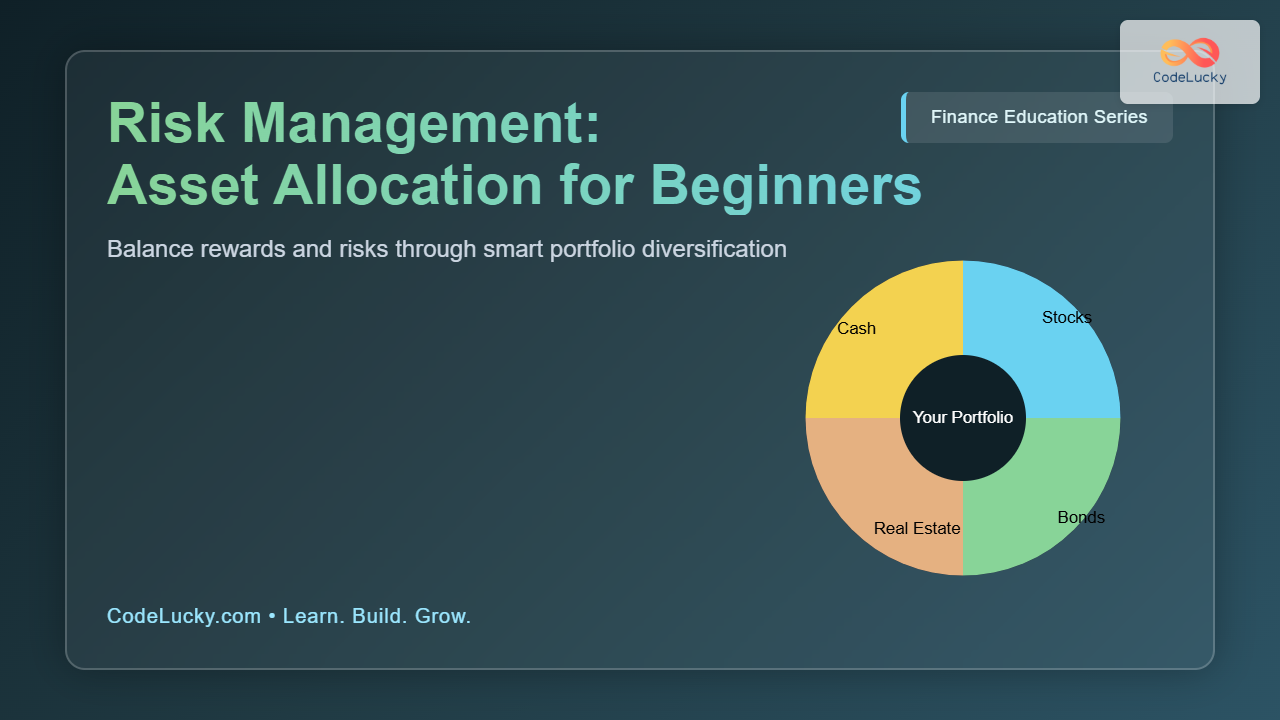

Asset allocation is the process of dividing your investment portfolio among different asset categories such as equities, bonds, real estate, and cash equivalents. Each asset class has its unique risk and return characteristics. By blending them in the right proportions, investors can achieve a smoother growth curve and lower overall risk.

Why Asset Allocation Matters

Different assets respond differently to market conditions. When equities drop, bonds often rise or stay stable. This negative correlation helps cushion losses. Proper asset allocation ensures that you are not putting all your eggs in one basket, reducing the impact of any single asset’s volatility on your overall portfolio.

- Diversification: Minimizes individual asset risk by spreading across sectors and asset types.

- Risk control: Aligns your exposure with personal risk tolerance and investment goals.

- Stability: Maintains balance during market swings for smoother returns.

- Consistency: Encourages a disciplined, long-term approach.

Understanding Risk and Return

Every investment carries a trade-off between risk and return. Stocks can generate higher returns but fluctuate more. Bonds are safer but yield lower growth. A good investor matches investments to their financial goals and holding period.

For example, a young investor might choose 80% in equity and 20% in bonds, seeking long-term growth. Someone nearing retirement may prefer a safer 40% equity, 60% fixed income mix.

Types of Asset Classes

Here are the key categories most portfolios include:

- Equities (Stocks): Represent ownership in companies. Higher returns, higher volatility.

- Bonds (Fixed Income): Provide regular interest payments. Lower risk, steady income.

- Real Estate: Tangible assets offering value appreciation and rental income.

- Commodities: Physical goods like gold or oil, acting as inflation hedges.

- Cash/Alternatives: Highly liquid, low-return options providing stability.

How to Decide Your Asset Allocation

Your ideal mix depends on several personal factors:

- Age: Younger investors can tolerate more equity risk; retirees need income stability.

- Risk tolerance: Assess whether you can handle market volatility emotionally and financially.

- Investment goal: Short-term goals need safer assets; long-term ones can take on more risk.

- Time horizon: The longer your horizon, the more volatility you can endure for higher returns.

Example Portfolio Allocations

| Investor Type | Stocks | Bonds | Real Estate | Cash/Alternatives |

|---|---|---|---|---|

| Conservative | 30% | 50% | 10% | 10% |

| Balanced | 50% | 30% | 10% | 10% |

| Aggressive | 70% | 20% | 5% | 5% |

Rebalancing — Keeping the Portfolio Aligned

Over time, certain assets may grow faster than others, skewing your allocation. Periodic rebalancing (e.g., annually) restores your original ratio. This disciplined action reduces risk and locks in profits before markets reverse.

Interactive Example: Create Your Allocation

You can apply asset allocation principles interactively. Try this simple example below. Enter your own values to see your blend.

<script>

function calculateAllocation(){

let total = 100;

let stock = parseInt(prompt("Enter % allocation for Stocks:"));

let bond = parseInt(prompt("Enter % for Bonds:"));

let others = total - (stock + bond);

alert(`Your allocation summary:\nStocks: ${stock}%\nBonds: ${bond}%\nOther Assets: ${others}%`);

}

</script>

<button onclick="calculateAllocation()">Try Custom Allocation</button>

Final Thoughts

In finance, there’s no one-size-fits-all formula. Asset allocation is personal and evolves with your circumstances. The key principle: diversify broadly, review periodically, and align investments with life goals. That’s the essence of risk management through asset allocation — the foundation of a resilient, long-term wealth strategy.