Planning for retirement is one of the most critical aspects of financial stability. Many people underestimate how much money they’ll need when their active income stops. The key concept that anchors retirement planning is your retirement corpus — the total amount you need to sustain your desired lifestyle after retirement. In this article, you’ll learn how to calculate it scientifically with clear formulas, examples, and visual explanations.

Understanding What a Retirement Corpus Is

Your retirement corpus is the total sum required to cover all your post-retirement expenses, typically from your retirement age until your expected lifespan. The corpus must account for inflation, medical costs, and lifestyle goals such as travel or hobbies.

Let’s break this into simple components to visualize how the calculation works.

Step-by-Step: How to Calculate Your Retirement Corpus

1. Estimate Your Current Monthly Expenses

Start by listing your current monthly expenses — everything from groceries to leisure. Let’s assume your total current monthly expense is ₹50,000.

Current Expense (E) = ₹50,000/month2. Adjust for Inflation

Inflation reduces money’s purchasing power over time. To find how much your current expenses will become at retirement, use the Future Value of Money formula:

Future Expense = E × (1 + i)ⁿ

where:

E = Current monthly expense

i = Inflation rate (example: 6% or 0.06)

n = Years until retirement

Example: Suppose you plan to retire in 25 years and inflation averages 6%.

Future Expense = 50,000 × (1 + 0.06)²⁵ = ₹214,593/month

This means you’ll need about ₹2.15 lakh per month to maintain the same lifestyle after 25 years.

3. Estimate Number of Retirement Years

Assume you’ll live until age 85 and retire at 60 — that’s 25 years of retirement life.

Retirement Duration (n₂) = 25 years

4. Calculate Yearly Expense at Retirement Start

Yearly Expense = Future Monthly Expense × 12

Yearly Expense = ₹2,14,593 × 12 = ₹25,75,116

5. Adjust for Post-Retirement Inflation

Even after retirement, prices continue to rise. We’ll use the Present Value of Future Expenses formula to find the corpus needed:

Retirement Corpus = Yearly Expense × [(1 - ((1 + r)/(1 + i))ⁿ²) / (i - r)]

Where:

- r = Post-retirement return on investment (say 8% or 0.08)

- i = Inflation rate after retirement (say 6% or 0.06)

- n₂ = Number of years in retirement

Example Calculation:

Corpus = 25,75,116 × [(1 - ((1.08)/(1.06))²⁵) / (0.06 - 0.08)]

Corpus ≈ ₹4.2 crore

This means you’ll need about ₹4.2 crore at the time of retirement to sustain ₹2.15 lakh per month expenses for 25 years.

How to Build the Corpus

Now that you know the target, let’s figure out how to accumulate it. You can invest monthly via SIPs in mutual funds or other investments that yield long-term growth.

Using SIP Formula

If you plan to invest a fixed monthly amount, the Future Value of SIP formula is:

Future Value = SIP × [((1 + r)ⁿ - 1) × (1 + r)] / r

Example: Suppose you invest ₹20,000 per month for 25 years at 10% annual return (0.0083 monthly).

Future Value = 20,000 × [((1 + 0.0083)³⁰⁰ - 1) × (1 + 0.0083)] / 0.0083

≈ ₹2.6 crore

You would need to increase your SIPs or invest additional lump sums to reach ₹4.2 crore.

Interactive Example (Try This Yourself)

You can simulate your own corpus calculation using simple variables in a spreadsheet or calculator:

Inputs:

Current Monthly Expense: ______

Inflation Rate (%): ______

Years to Retirement: ______

Post-Retirement Return (%): ______

Expected Life Expectancy (Years): ______

See how your corpus estimate changes dynamically!

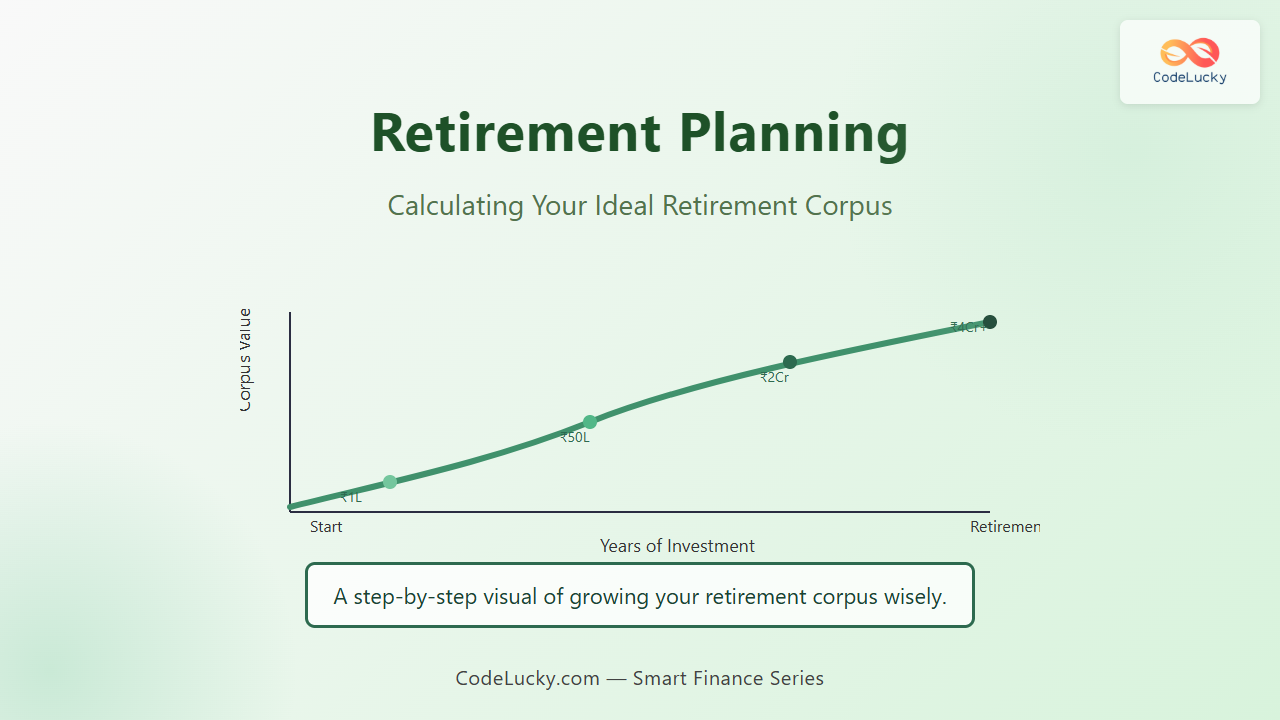

Visual Roadmap of Retirement Corpus Growth

Key Factors That Impact Retirement Corpus

- Inflation: Even a 1% rise reduces real value significantly over decades.

- Return on Investment: Higher returns reduce required savings.

- Retirement Age: Retiring earlier increases required corpus.

- Debt and Liabilities: Must be cleared before retirement to avoid stress on corpus.

- Medical Planning: Health insurance is essential to protect your corpus.

Pro Tips for Effective Retirement Planning

- Start early — even small SIPs benefit from compounding.

- Review your plan every year to adjust for lifestyle or market changes.

- Diversify investments: combine equity, debt, and fixed income.

- Consider setting up an emergency fund even for post-retirement expenses.

- Use online calculators to test multiple inflation and return scenarios.

Final Thoughts

Retirement corpus calculation isn’t just math; it’s the roadmap to financial independence. The earlier you start, the more your investments can work for you. Once you identify your target corpus, focus on disciplined saving through SIPs, diversified investments, and annual reviews. By projecting your expenses realistically and accounting for inflation, you ensure that your retirement is secure, peaceful, and exactly the way you envision it.