Portfolio Building is often the first major step for anyone entering the world of investing. For beginners, the challenge isn’t just picking the right assets—but understanding how different investments work together to manage risk and achieve long-term growth. In this guide, we’ll explore beginner-friendly portfolio examples, asset allocation strategies, and visual tools to make portfolio construction easier and more intuitive.

What Is a Portfolio?

An investment portfolio is a collection of assets—like stocks, bonds, mutual funds, and sometimes cash equivalents—owned by an individual or institution. The goal of portfolio building is to balance potential returns with acceptable levels of risk, tailored to your time horizon, financial goals, and risk tolerance.

Why Portfolio Building Matters

Without a structured portfolio, investors often make emotional decisions driven by market volatility. A well-constructed portfolio provides:

- Diversification – Spreads risk across various asset classes.

- Stability – Reduces overall volatility in returns.

- Goal Alignment – Ensures investments support your personal financial objectives.

Basic Principles of Beginner Portfolios

Before jumping into examples, let’s outline a few principles every beginner should follow:

- Start simple: Add broad-based assets like index funds or ETFs.

- Think long-term: Focus on steady compounding rather than daily fluctuations.

- Rebalance annually: Adjust allocations to maintain your original investment proportions.

- Know your risk profile: Conservative, moderate, or aggressive—your comfort with market ups and downs drives your mix.

Portfolio Allocation Types

Every portfolio type reflects an investor’s goal and comfort with risk. Below is a simple visual breakdown of conservative, balanced, and aggressive portfolios:

Beginner Portfolio Examples

1. Conservative Portfolio (Low Risk)

Ideal for retirees or those with a short-term horizon. Focused on preserving capital while earning modest returns.

Example Allocation:

- 70% Bonds (Government or Corporate)

- 20% Large-cap Equity Funds

- 10% Cash or Money Market Instruments

Expected Outcome: Steady but limited growth, lower volatility, and consistent income through bond interest.

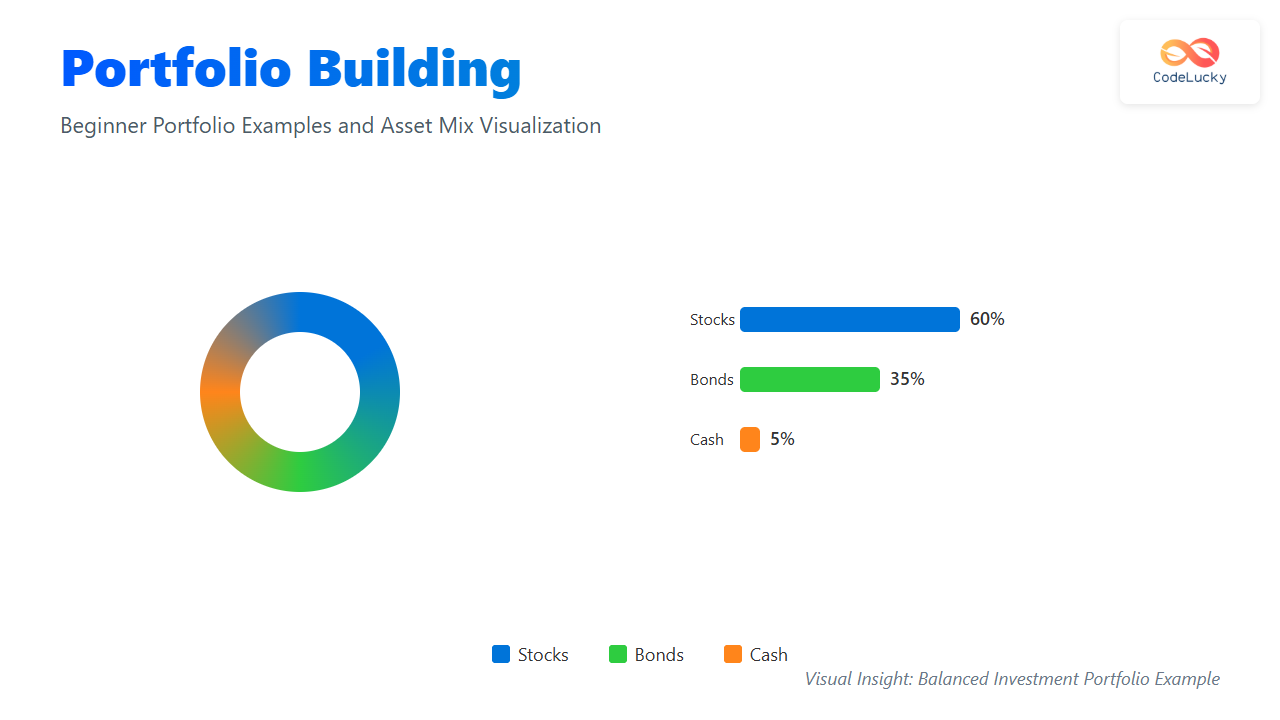

2. Balanced 60/40 Portfolio (Moderate Risk)

This classic model balances growth and safety, often recommended as a starter portfolio for beginners.

Example Allocation:

- 60% Stocks (Domestic + International Index Funds)

- 35% Bonds (Corporate & Treasury)

- 5% Cash EquivalentsExpected Outcome: Moderate growth with moderate volatility, resilient during market corrections.

3. Growth Portfolio (Aggressive)

Suitable for young investors with long-term goals. Focuses on maximizing capital appreciation through equities.

Example Allocation:

- 80% Stocks (Large, Mid, and Small Cap)

- 15% Bonds (Short-term)

- 5% Alternative Assets or CashExpected Outcome: High long-term returns with higher short-term risk exposure.

Building Your Own Portfolio: Step-by-Step

- Define your goals: Retirement, home purchase, or children’s education.

- Assess your risk: Use a risk questionnaire or simple self-evaluation chart.

- Choose broad-based funds: Index ETFs or mutual funds are good beginner-friendly options.

- Diversify geographically: Mix domestic and international funds.

- Automate contributions: Use SIPs (Systematic Investment Plans) to invest monthly.

- Rebalance annually: Sell or buy assets to restore your target mix.

Risk-Return Relationship Visualization

Interactive Simulation Idea

To help users actively understand portfolio behavior, CodeLucky.com can integrate a small interactive calculator (via JavaScript) that allows users to slide between risk levels and see sample portfolio allocations update in real-time.

<input type="range" id="riskRange" min="0" max="100" value="50" oninput="updatePortfolio(this.value)">

<div id="portfolioOutput">Balanced portfolio: 60% stocks, 35% bonds, 5% cash</div>

<script>

function updatePortfolio(risk){

let result = document.getElementById('portfolioOutput');

if(risk < 30) result.textContent = 'Conservative portfolio: 25% stocks, 70% bonds, 5% cash';

else if(risk < 70) result.textContent = 'Balanced portfolio: 60% stocks, 35% bonds, 5% cash';

else result.textContent = 'Aggressive portfolio: 80% stocks, 15% bonds, 5% cash';

}

</script>

Portfolio Rebalancing Example

Rebalancing ensures your portfolio doesn’t drift away from your intended risk level. Suppose your 60/40 portfolio grows and now looks like this:

After rebalancing, you would sell some stocks and buy more bonds to return to your original 60/40 ratio, preserving risk discipline over time.

Common Mistakes to Avoid

- Chasing short-term performance – Last year’s top fund may not repeat its success.

- Ignoring rebalancing – Portfolios drift over time and need periodic correction.

- Lack of emergency funds – Always keep cash reserves for unexpected expenses.

- Over-diversification – Too many funds can dilute performance without reducing risk significantly.

Conclusion

Building your first investment portfolio is less about picking the “perfect” asset and more about maintaining discipline, diversification, and consistency. Whether you start with a simple 60/40 mix or an ETF-based strategy, the key is to stay invested and review your plan regularly. Use these beginner examples as frameworks, and evolve them as your financial knowledge and risk appetite grow.

By understanding portfolio construction early on, beginners can transform investing from a guessing game into a structured plan for long-term financial freedom.