Money management is one of the most essential skills for personal and professional success. It determines not only how well you live today but how secure your future will be. Managing your income, tracking your expenses, and understanding cash flow allows you to make informed financial decisions, reduce debt, and grow wealth over time.

Understanding the Core Concepts

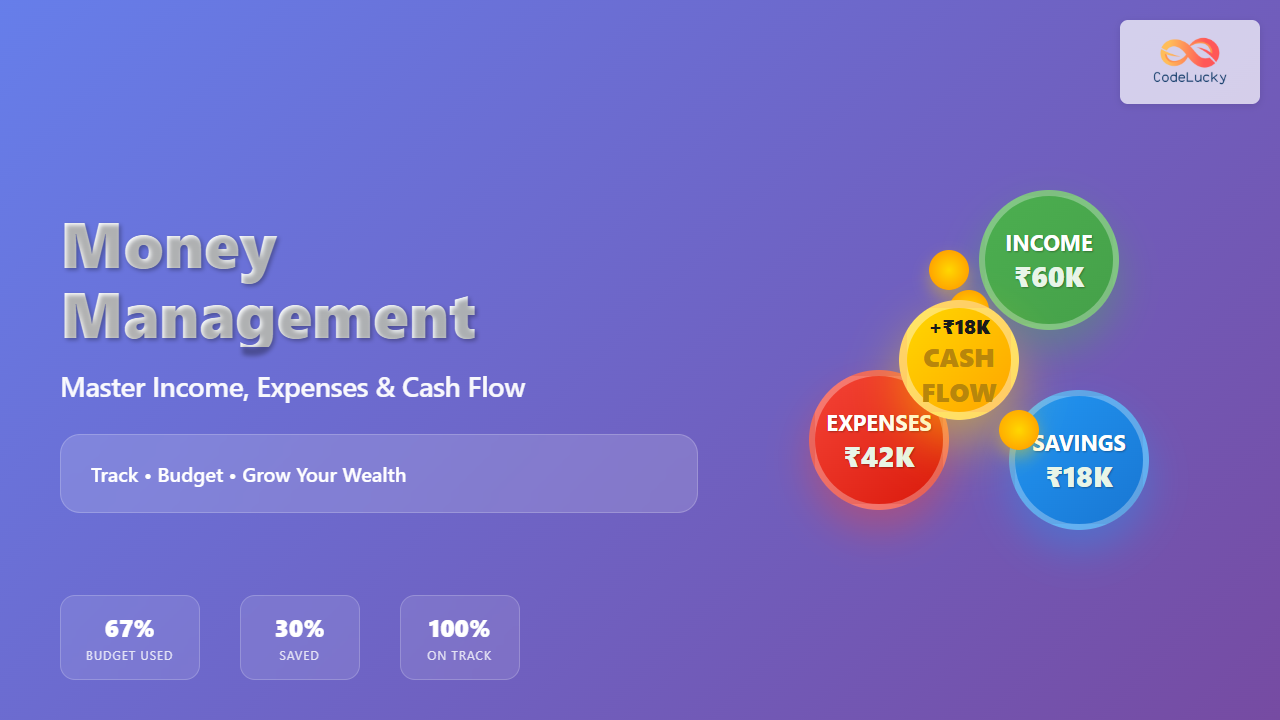

At its core, money management revolves around three pillars — Income, Expenses, and Cash Flow. Let’s break them down with clarity and simple examples.

1. Income: The Inflow of Money

Income is the money you earn through various sources. These can include:

- Active income: Salary, wages, or freelance earnings.

- Passive income: Interest, dividends, or rental profits.

- Portfolio income: Returns from stocks, mutual funds, or other investments.

For instance, if you earn ₹50,000 per month from your job and ₹5,000 from rental property, your total monthly income is ₹55,000.

2. Expenses: The Outflow of Money

Expenses represent every category where money flows out. These include both fixed expenses (like rent and insurance) and variable expenses (like food, travel, or entertainment).

A good rule is the 50/30/20 budgeting principle:

- 50% of income for needs.

- 30% for wants.

- 20% for savings and debt repayment.

For example, if your monthly income is ₹60,000:

- ₹30,000 → Needs (rent, food, transport)

- ₹18,000 → Wants (entertainment, travel)

- ₹12,000 → Savings (emergency fund, investments)

3. Cash Flow: The Lifeline of Your Finances

Cash flow represents the ongoing movement of your money — how much comes in versus how much goes out. It’s the difference between your total income and total expenses within a time period.

The simple formula is:

Cash Flow = Total Income − Total ExpensesIf you earn ₹60,000 and expenses total ₹45,000, your net cash flow is ₹15,000. A positive cash flow allows saving, investing, and growth; a negative one signals overspending or financial mismanagement.

Why Understanding Cash Flow Matters

Cash flow is a dynamic indicator of financial health. It impacts your ability to handle emergencies, repay loans, or invest for the future. Positive cash flow acts like oxygen — the more consistent it is, the better your financial stability and choices.

Here’s how different cash flow situations impact your financial lifestyle:

| Type | Description | Example |

|---|---|---|

| Positive Cash Flow | Income exceeds expenses | Earn ₹70,000, spend ₹50,000 → Save ₹20,000 |

| Negative Cash Flow | Expenses exceed income | Earn ₹50,000, spend ₹60,000 → Shortfall ₹10,000 |

| Neutral Cash Flow | Income equals expenses | Earn ₹60,000, spend ₹60,000 → No savings |

Example: Monthly Cash Flow Statement

Let’s visualize a simple example of how to track and understand personal cash flow.

| Category | Income (₹) | Expense (₹) |

|---|---|---|

| Salary | 50,000 | – |

| Freelance Project | 10,000 | – |

| Rent | – | 15,000 |

| Groceries | – | 8,000 |

| Transport | – | 5,000 |

| Entertainment | – | 4,000 |

| Investments & Savings | – | 10,000 |

| Total | ₹60,000 | ₹42,000 |

| Net Cash Flow | ₹18,000 (positive) | |

Practical Tips for Effective Money Management

- Track every expense: Use mobile apps or spreadsheets to record daily spending.

- Prioritize savings first: Treat savings like a mandatory bill.

- Build an emergency fund: Aim for 3–6 months of essential expenses.

- Reduce unnecessary debt: Pay off high-interest loans early.

- Invest wisely: Use mutual funds, SIPs, or index funds for long-term growth.

- Review regularly: Compare planned vs actual spending monthly.

Make It Interactive: A Simple Budget Simulation

You can experiment with an interactive calculator snippet like the one below to simulate your income and expenses. This simple example helps users visualize their financial balance dynamically.

<label>Monthly Income: </label><input type="number" id="income" value="60000">

<br>

<label>Monthly Expenses: </label><input type="number" id="expenses" value="42000">

<br>

<button onclick="calculateCashFlow()">Calculate Cash Flow</button>

<p id="result"></p>

<script>

function calculateCashFlow(){

const i = parseFloat(document.getElementById('income').value);

const e = parseFloat(document.getElementById('expenses').value);

const result = i - e;

document.getElementById('result').innerText = result >= 0 ?

'Positive Cash Flow: ₹' + result :

'Negative Cash Flow: ₹' + result;

}

</script>

Conclusion

Money management is not just about cutting costs — it’s about optimizing resources. When you understand the relationship between your income, expenses, and cash flow, you gain control over your financial destiny. Start tracking, planning, and adjusting today; the earlier you begin, the faster your wealth compounds into stability and freedom.

At CodeLucky.com, we believe every rupee saved and invested wisely is a step closer to financial independence.