Economic Concepts: Market Structures Overview forms the foundation of understanding how markets operate in the modern economy. Market structures describe the organization and characteristics of a market—how many buyers and sellers exist, how products are differentiated, and how firms influence prices. Understanding these concepts helps businesses develop strategies and governments design better economic policies.

What Is a Market Structure?

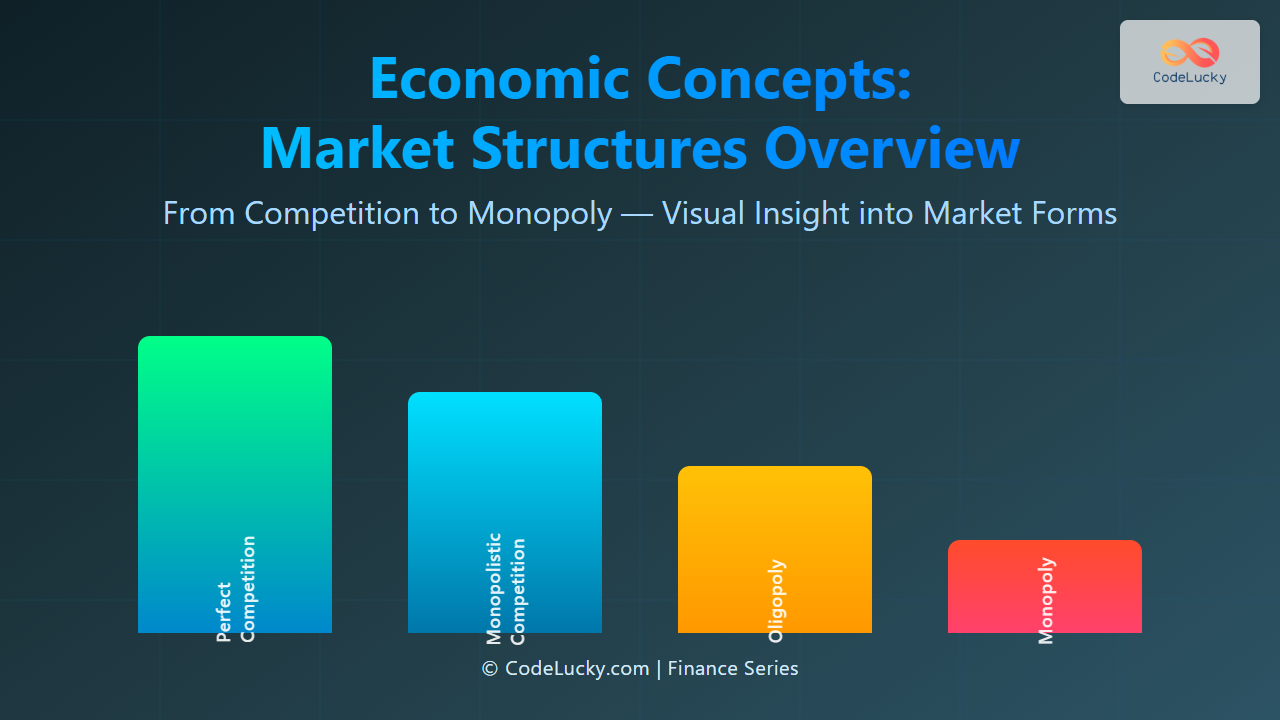

A market structure refers to the systematic characteristics of a market that influence how firms make decisions and how prices are set. Economists categorize market structures into four major types, ranked from most competitive to least:

- Perfect Competition

- Monopolistic Competition

- Oligopoly

- Monopoly

Each structure differs in the number of firms, product uniformity, entry barriers, and pricing power. Let’s explore each with intuitive examples and visual explanations.

1. Perfect Competition

Perfect competition represents an idealized market where a large number of small firms sell identical products. No single firm can influence the market price — they are all price takers. The market sets the price through the natural interaction of demand and supply.

Example: The agricultural market is one of the closest real-world models of perfect competition. Farmers produce homogeneous goods like wheat or rice, and the price they receive depends purely on supply and demand.

Key Characteristics:

- Large number of sellers and buyers.

- Homogeneous (identical) products.

- No barriers to entry or exit.

- Firms are price takers.

2. Monopolistic Competition

In monopolistic competition, many firms compete, but they sell differentiated products. Each business has some degree of pricing power because consumers perceive their product as slightly unique.

Example: The restaurant industry or clothing brands. Each restaurant offers different flavors, ambiance, or service quality, which distinguishes them despite similar menus.

Key Characteristics:

- Many sellers with differentiated products.

- Low barriers to entry.

- High emphasis on marketing, branding, and innovation.

- Some control over pricing due to perceived uniqueness.

3. Oligopoly

Oligopoly describes markets dominated by a small group of large firms. Each firm holds significant market power, and their pricing and output decisions are interdependent. When one firm changes price or strategy, others often respond strategically.

Example: The global airline industry, or India’s telecom sector (e.g., Jio, Airtel, Vi), are examples of oligopolies. A price cut by one often triggers responses from competitors.

Key Characteristics:

- Few firms dominate the market.

- Significant barriers to entry (high startup cost, infrastructure).

- Products may be homogeneous (steel) or differentiated (smartphones).

- Strategic behavior—collusion or competitive pricing.

4. Monopoly

A monopoly exists when a single company controls the entire supply of a product or service, facing no direct competition. This firm has enormous pricing power, often constrained only by government regulation or consumer demand.

Example: Utility companies such as electricity providers or railways are often natural monopolies because duplication of infrastructure would be inefficient.

Key Characteristics:

- Single firm controls the market.

- Impossible or extremely high barriers to entry.

- Unique or patented product.

- Firm determines price and quantity supplied.

Visual Comparison of Market Structures

This comparison highlights how competition decreases as we move from perfect competition to monopoly, while pricing power and barriers to entry increase.

Interactive Understanding: Price and Quantity

You can visualize how competition affects pricing through this simple thought experiment:

- In perfect competition, if one firm increases its price, consumers instantly switch to others — forcing prices down.

- In monopolistic competition, firms rely on brand image to sustain slightly higher prices.

- Within an oligopoly, firms monitor each other’s prices and may engage in price matching or tacit collusion.

- In a monopoly, the firm decides both price and output to maximize profit without fearing competition.

Market Structure Effects on Consumers and Economy

Competition level directly affects innovation, efficiency, and pricing:

- Perfect competition offers the lowest prices and highest efficiency but limited innovation.

- Monopolistic competition encourages variety and creativity through differentiation.

- Oligopolies can lead to technological innovation, but risk collusion.

- Monopolies, while stable, can result in inefficiencies and higher consumer prices.

Conclusion

Market structures shape how economies function and evolve. From the dynamic equilibrium of perfect competition to the dominance of a monopoly, each structure demonstrates a different balance between competition, consumer welfare, and profit-making power. Understanding them is key for investors, policymakers, and entrepreneurs aiming to navigate the intricate landscapes of modern economies.

For more economic insights, guides, and visual breakdowns, stay tuned to CodeLucky.com—a place where business logic meets clarity.