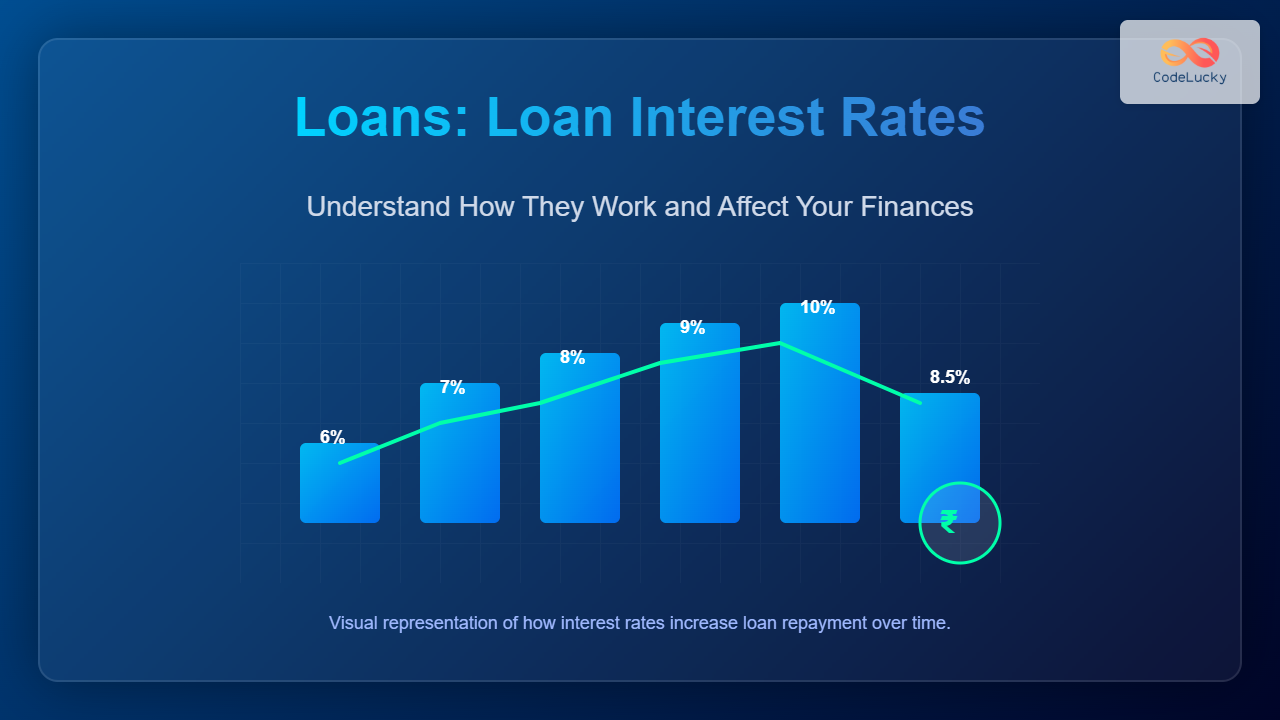

Loans are a crucial part of modern financial systems, allowing individuals and businesses to access funds for education, housing, business expansion, or emergencies. But understanding loan interest rates—how they work, how they’re calculated, and how they affect your repayment—is key to making smart borrowing decisions.

What Are Loan Interest Rates?

A loan interest rate is the cost of borrowing money, expressed as a percentage of the principal (the amount you borrow). It represents how much the lender charges you for using their money.

Simply put:

Interest Rate = (Interest / Principal) × 100%

Example:

If you borrow ₹100,000 at an interest rate of 10% per year, you’ll pay ₹10,000 as interest for that year (if simple interest applies).

Types of Loan Interest Rates

Loan interest rates can vary based on how they are structured. The two most common types are:

1. Fixed Interest Rate

With a fixed rate loan, the interest rate remains the same throughout the loan tenure. This provides stability—your monthly payments won’t change even if market rates do.

Example:

A personal loan with a fixed interest rate of 12% for 5 years will have the same EMI every month, regardless of market conditions.

2. Floating (Variable) Interest Rate

A floating rate loan changes based on a market benchmark (like RBI’s repo rate). If rates drop, you pay less interest; if they rise, repayments can increase.

Example:

A home loan linked to the repo rate may fluctuate from 8.5% to 9.2% as per central bank changes.

How Is Loan Interest Calculated?

1. Simple Interest

Calculated only on the principal amount for the entire loan tenure.

Formula: Interest = (Principal × Rate × Time) / 100

Example:

Loan = ₹100,000 at 10% for 2 years

Interest = (100000 × 10 × 2) / 100 = ₹20,000

Total repayable = ₹120,000

2. Compound Interest

Charge interest on both the principal and accrued interest, so the amount grows each period.

Formula: A = P × (1 + r/n)nt

Where:

- P = Principal

- r = Annual interest rate

- n = Number of compounding periods per year

- t = Time in years

Example:

Loan = ₹100,000, rate = 10%, compounded annually for 2 years

A = 100000 × (1 + 0.10)2 = ₹121,000

Key Factors That Affect Loan Interest Rates

- Credit score: Higher scores mean lower risk to lenders and better rates.

- Loan amount: Higher amounts sometimes attract lower rates if secured.

- Loan tenure: Longer tenures may come with higher overall interest.

- Market conditions: Central bank rate policies influence all loan rates.

- Type of loan: Secured loans (like home loans) generally have lower interest rates than unsecured ones (like personal loans).

Interactive Example: Estimate Your EMI

You can calculate your EMI (Equated Monthly Installment) using this simple formula or a calculator widget (you may embed interactive JS-based calculators on CodeLucky.com).

Formula: EMI = [P × r × (1 + r)n] / [(1 + r)n – 1]

Example:

- Principal (P): ₹500,000

- Rate (r): 10% annual = 0.10/12 = 0.0083

- Tenure (n): 24 months

EMI = [500000 × 0.0083 × (1 + 0.0083)24] / [(1 + 0.0083)24 – 1] = ₹23,072 approx.

Tips to Get the Best Loan Interest Rate

- Maintain a strong credit history (above 750 CIBIL score).

- Compare rates across multiple lenders before applying.

- Choose shorter tenure loans if possible to reduce total interest.

- Opt for loans with transparent terms and no hidden charges.

- Negotiate with your bank for better rates if you have existing relationships.

Conclusion

Understanding how loan interest rates work helps you borrow wisely, save money, and plan your finances better. Whether it’s a personal, business, education, or home loan, always evaluate both the interest type and the total repayment cost before signing the agreement.

Learn more about financial education, smart borrowing, and digital banking tools at CodeLucky.com—your guide to mastering finance and technology in one place.