Investing Basics: Risk vs Return is one of the most fundamental but frequently misunderstood topics in personal finance. Whether you’re saving for retirement, building a portfolio, or just beginning your investing journey, knowing how risk and return interact helps you make smarter and more confident decisions.

What is Risk in Investing?

Risk represents the possibility that your investment’s actual returns will differ from expected returns — it’s essentially the uncertainty of outcomes. Some investments, like government bonds, have low risk because they offer predictable returns. Others, such as equities and cryptocurrencies, are riskier due to price fluctuations and market sentiment.

Common types of investment risk include:

- Market Risk: The risk that your investment’s value will drop due to market fluctuations.

- Credit Risk: The possibility that a borrower or bond issuer might default on payments.

- Liquidity Risk: The difficulty of converting an asset into cash without a significant loss in value.

- Inflation Risk: The danger that inflation will erode your investment’s real returns.

- Interest Rate Risk: Especially relevant for bonds, when rising rates lower bond prices.

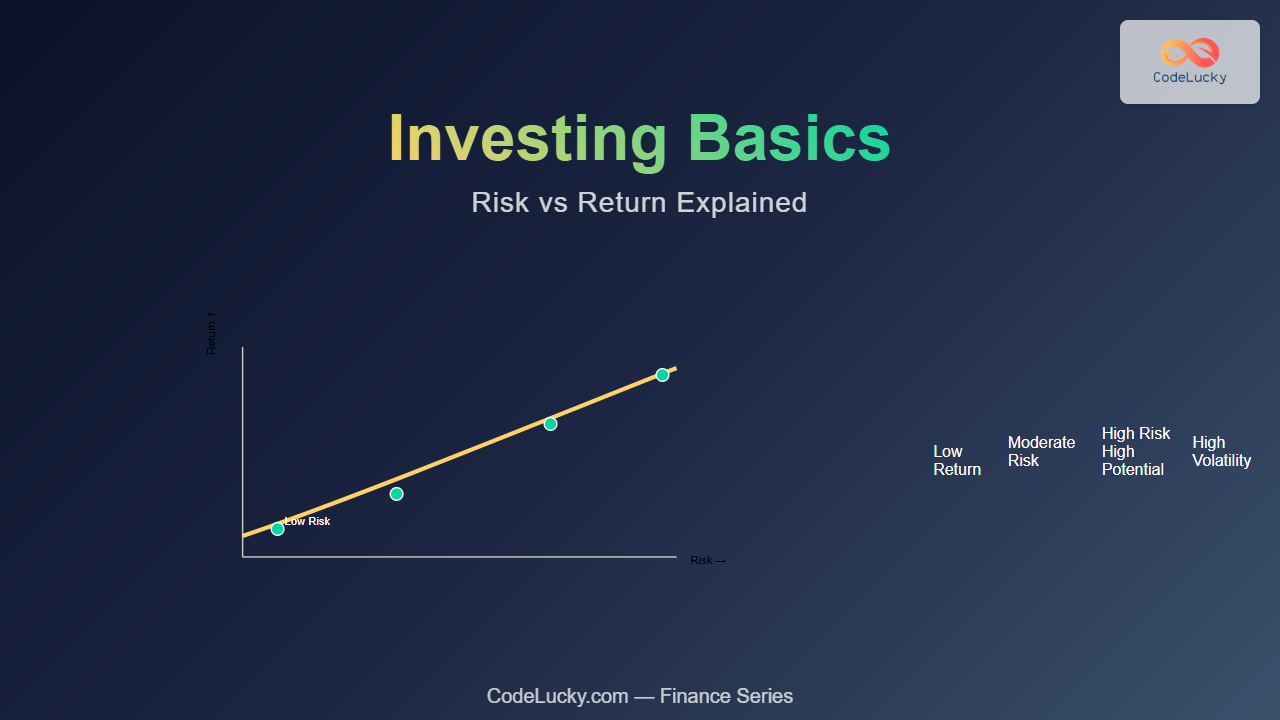

Visual: How Risk and Return Relate

This simple diagram summarizes the idea: higher risk can bring higher potential returns — but also greater chances of loss.

What Does Return Mean?

Return is the profit or loss an investor earns from an investment over a particular period. It’s often expressed as a percentage.

Return can come in different forms:

- Capital Gains: The increase in value of your asset over time.

- Dividends or Interest: Regular income from stocks or bonds.

- Total Return: The combination of income and appreciation over time.

Example:

If you invest ₹10,000 in a stock and it grows to ₹11,000 in a year, your simple return = ((11,000 - 10,000) / 10,000 × 100 = 10%).

The Risk-Return Tradeoff

The Risk-Return Tradeoff means that to earn higher returns, you need to accept higher risks. Safe investments provide lower but more stable returns, while riskier assets can either outperform or disappoint dramatically.

The concept helps investors match their risk tolerance with appropriate investment strategies. For example, short-term goals call for safer assets, whereas long-term investors can afford temporary volatility for potential higher gains.

Examples of Risk vs Return in Real Life

| Investment Type | Risk Level | Expected Annual Return |

|---|---|---|

| Savings Account | Very Low | 3–4% |

| Government Bonds | Low | 5–6% |

| Mutual Funds (Balanced) | Moderate | 8–10% |

| Equity / Stocks | High | 12–15% (variable) |

| Startups / Crypto | Very High | 20%+ (highly volatile) |

While high-risk options can generate significant returns, they can also incur major losses. Successful investors balance their exposure based on time horizon, goals, and comfort with volatility.

Visualizing the Relationship: Risk vs Return Curve

The curve shows that returns tend to increase with higher risk levels, but not proportionally. There’s no guarantee that taking more risk always produces better returns.

How to Manage Risk Effectively

Risk can’t be eliminated — but it can be managed. Smart investors use diversification, research, and proper planning to balance risk with expected returns.

- Diversify: Spread your investments across multiple asset classes to reduce exposure to any single source of risk.

- Asset Allocation: Mix growth and income-generating assets depending on goals.

- Regular Monitoring: Periodically review your portfolio to adjust for performance and market changes.

- Long-Term Perspective: Time can smooth out volatility; patience often rewards investors.

- Emergency Fund: Always keep liquidity for short-term needs to avoid forced selling.

Example Interactive Thought

Imagine you can invest ₹1,00,000 in three options:

- Option A: Savings with 3% guaranteed

- Option B: Balanced mutual fund with possible 8% average

- Option C: Cryptocurrency with potential 50% gain or 40% loss

Which one would you pick? The answer depends on your personal risk appetite, financial goals, and time horizon. This helps you visualize and reflect on your comfort with uncertainty—an essential skill in investing.

Building a Balanced Portfolio

In this sample diversified portfolio, high-return equities are balanced with safer fixed-income and tangible assets. This mix helps smooth outcomes while optimizing returns for moderate-risk investors.

Key Takeaways

- Risk and return are two sides of the same coin — you can’t get one without the other.

- Every investor has a unique risk profile; align it with your goals and time frame.

- Diversification and discipline outperform short-term speculation.

- There’s no “one-size-fits-all” approach — find your balance between safety and growth.

Final Thoughts

Understanding Risk vs Return isn’t about predicting markets — it’s about making informed decisions. Once you accept that every investment involves trade-offs, you’ll start investing with clarity and confidence. Over time, disciplined investors who embrace balanced risk often achieve consistent long-term growth.

At CodeLucky.com, we believe mastering fundamentals like this is the first step toward financial independence.