Economics is the study of how people, businesses, and governments make choices about using limited resources. It helps us understand how societies allocate wealth, goods, and services — from personal budgeting to global trade. This introduction aims to clarify key economic concepts, supported by visual diagrams and practical examples.

What Is Economics?

At its core, economics explores the relationship between scarcity and choice. Because resources like land, time, and money are limited, individuals and nations must decide how to use them efficiently.

Economics is divided into two major branches:

- Microeconomics: Studies individual behavior — consumers, firms, prices, and markets.

- Macroeconomics: Looks at the economy as a whole — inflation, unemployment, GDP, and policies that affect an entire nation.

Core Economic Concepts

1. Scarcity and Choice

Scarcity means there are not enough resources to satisfy every desire. For example, a farmer has limited land and must decide whether to grow wheat or rice. The decision involves opportunity cost — the value of what’s given up when choosing one option over another.

Example: If a country uses funds to build highways, it might have to delay constructing schools. The opportunity cost of highways is the number of schools not built.

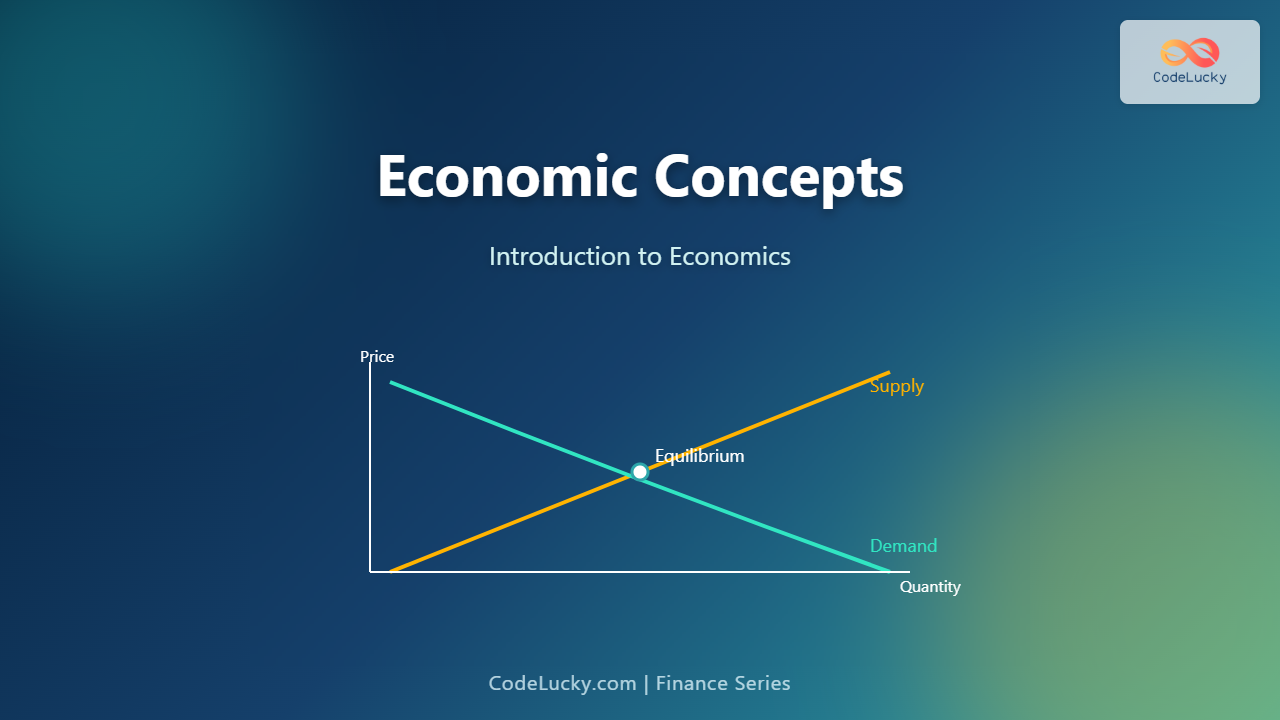

2. Supply and Demand

The law of supply and demand explains how prices form in markets:

- When demand increases and supply is limited, prices rise.

- When supply increases but demand decreases, prices fall.

Example: During festive seasons, demand for gold rises, often resulting in higher prices.

3. Opportunity Cost and Trade-offs

Every decision involves trade-offs. Suppose you spend time learning a skill instead of relaxing — your opportunity cost is leisure time. In economics, rational decision-making means weighing benefits against this cost.

4. Economic Systems

Different countries adopt different systems to manage scarce resources:

- Market Economy: Decisions are based on consumer preference and business competition. Example: United States.

- Command Economy: Government controls production and pricing. Example: North Korea.

- Mixed Economy: Combines market freedom with government regulation. Example: India.

Microeconomics vs. Macroeconomics

These two pillars work together to explain how individual and national decisions interact. Here’s a simple distinction:

| Aspect | Microeconomics | Macroeconomics |

|---|---|---|

| Focus | Individual markets and consumers | National and global economy |

| Examples | Price of coffee, demand for electric cars | GDP growth, inflation rate |

| Key Players | Firms, households | Government, central banks |

Interactive Example: Market Scenario

Imagine a marketplace for smartphones:

- At ₹50,000 per unit, only a few people buy — demand is low.

- At ₹30,000, more consumers enter — demand increases.

- At ₹25,000, demand rises sharply, but suppliers reduce production due to lower profit margins.

This situation continues until equilibrium is reached — where demand equals supply, and price stabilizes.

The Flow of an Economy

Economies circulate resources and money through a process known as the circular flow model. This model shows how households, firms, and governments interact.

Why Economics Matters

Understanding economics helps individuals and nations make better decisions. It answers questions like:

- Why do some countries grow faster than others?

- How do inflation and interest rates affect savings?

- What happens when governments change taxation or spending?

Whether you are an investor, student, or policymaker, economic literacy is a key to interpreting everyday financial news and long-term trends.

Key Takeaways

- Economics studies how limited resources are allocated efficiently.

- Scarcity leads to choice and opportunity cost.

- Supply and demand determine market prices.

- Microeconomics focuses on individuals; macroeconomics studies the entire economy.

- Economic systems vary globally, from market-driven to government-planned.

Stay tuned on CodeLucky.com for detailed explorations of advanced topics such as economic indicators, policy analysis, and global trade models in future articles of the Finance Series.