Inflation quietly erodes your purchasing power — meaning that even if your investments grow in nominal value, they may not actually make you wealthier in real terms. Understanding the difference between nominal return and real return is essential for making informed financial decisions.

What Is Nominal Return?

Your nominal return represents the percentage gain (or loss) of your investment without adjusting for inflation. It’s the raw number you typically see in statements and advertisements. For example, if you invest ₹100,000 and after one year it grows to ₹108,000, your nominal return is 8%.

However, this value doesn’t account for inflation — that silent tax reducing your money’s real worth.

What Is Real Return?

The real return adjusts your nominal return by factoring in inflation. It reveals the true growth of your purchasing power. If inflation is 5% and your nominal return is 8%, your real return is not 8% — it’s approximately 2.86%.

The relationship between nominal return, real return, and inflation is expressed through this formula:

Real Return ≈ Nominal Return - Inflation RateFor more accuracy, economists use this precise formula:

Real Return = ((1 + Nominal Return) / (1 + Inflation Rate)) - 1Example Calculation

Let’s see how both returns compare visually:

Even though your nominal gain is 8%, inflation reduces your effective purchasing power to an actual gain of only 2.86%.

Simple Real Return Calculator

You can try this quick interactive example to understand it better. Enter your values below:

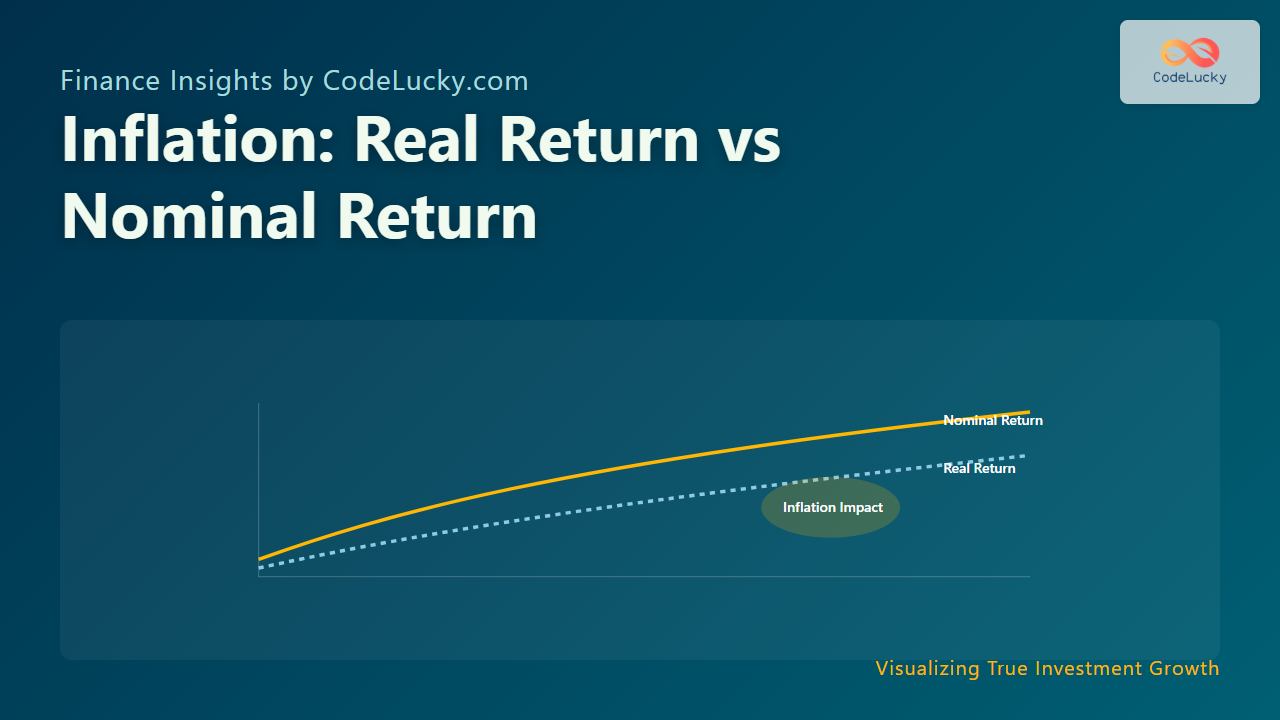

Visualizing the Relationship

This diagram highlights that inflation acts as a drag on your nominal returns, shrinking your real buying capacity.

Why Real Return Matters

Real return gives investors a realistic picture of wealth growth. Two investors may boast similar nominal returns, but their actual profit differs sharply if they experience different inflation environments. For instance:

- Investor A earns a nominal return of 8% in an economy with 5% inflation → Real Return = 2.86%

- Investor B earns the same nominal 8% in a 2% inflation economy → Real Return = 5.88%

Impact of Negative Real Returns

If inflation exceeds nominal return, your real return becomes negative. This means your money loses value even though your account balance rises.

Example: If a savings account earns 4% while inflation runs at 6%, your real return is:

((1 + 0.04) / (1 + 0.06)) - 1 = -1.89%So, your purchasing power drops by 1.89%, even though your balance increases nominally.

Comparing Returns Over Time

Consider a 5-year period of steady nominal returns and inflation:

| Year | Nominal Return | Inflation | Real Return |

|---|---|---|---|

| 1 | 8% | 4% | 3.85% |

| 2 | 7% | 6% | 0.94% |

| 3 | 5% | 7% | -1.87% |

| 4 | 9% | 5% | 3.81% |

| 5 | 10% | 6% | 3.77% |

This table shows how seemingly stable nominal returns hide a wide range of real results once inflation is considered.

At a Glance: Nominal vs Real Return

Nominal Return looks attractive on paper, but Real Return reflects your actual financial progress. Tracking both helps investors make better decisions — whether choosing assets, comparing mutual funds, or evaluating fixed deposits.

Conclusion

Understanding the impact of inflation on investment performance empowers you to separate illusion from reality. Always focus on real returns, because growing numbers on paper mean little if they can’t buy more in the real world. Smart investors adjust their portfolios accordingly — aiming for inflation-beating investments that truly preserve and grow wealth.