Inflation is one of the most crucial economic phenomena that affects every layer of personal finance — from the cash sitting in your savings account to the returns you expect from long-term investments. Whether you are a beginner investor or a seasoned financial planner, understanding how inflation alters the real value of money, savings, and investments can completely transform your financial decisions.

What Is Inflation?

At its core, inflation measures the rate at which the general price level of goods and services rises over time. As prices increase, the purchasing power of money decreases. For instance, if the inflation rate is 5%, a cup of coffee that costs ₹100 today will cost ₹105 a year later — meaning the same amount of money buys fewer goods.

How Inflation Affects Savings

Inflation erodes the real value of your savings if the interest you earn on them is less than the inflation rate. The concept is simple — if inflation grows faster than your earned interest, your money’s buying power declines, even if the nominal value appears to increase.

Example:

Let’s say you keep ₹1,00,000 in a savings account earning 4% annual interest while inflation stands at 6%. Here’s how the real value changes:

| Year | Nominal Balance (₹) | Adjusted for 6% Inflation (₹) | Real Value Loss (₹) |

|---|---|---|---|

| 1 | 1,04,000 | 98,113 | -1,887 |

In real terms, your ₹1,04,000 after one year can only buy goods worth ₹98,113 from the previous year. You lost ₹1,887 in purchasing power — even though your bank statement shows a gain.

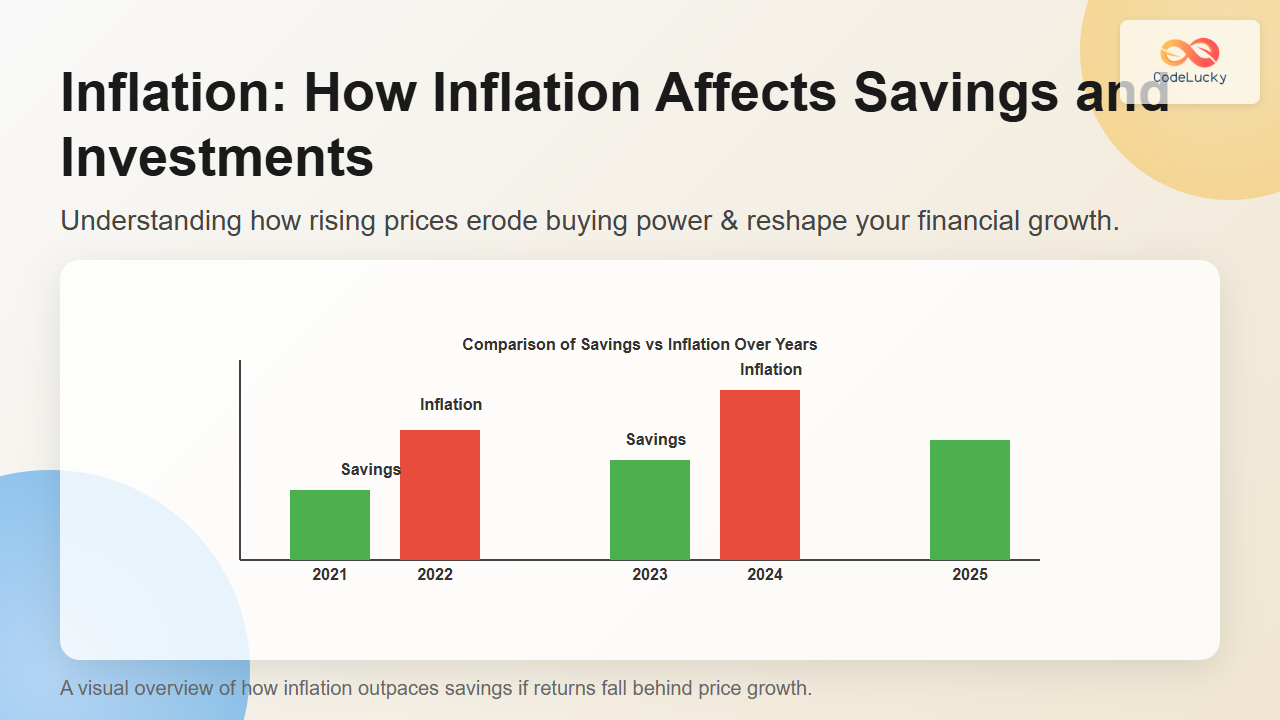

Visualizing the Decline of Savings Value Over Time

The above diagram illustrates how savings value continually drops when inflation outpaces interest earnings. Over five years, a simple 2% gap between interest and inflation can erode nearly 10% of real wealth.

Inflation’s Impact on Investments

Unlike fixed savings, investments often have potential to outperform inflation. However, inflation still plays a crucial role in determining real returns — the actual growth of purchasing power after accounting for inflation.

1. Fixed-Income Investments

Bonds, fixed deposits, and pension instruments provide stable but fixed returns. If inflation rises above the interest rate, the real return becomes negative. For example, a bond yielding 6% provides only a 0% real return when inflation is also 6%.

2. Equity and Mutual Funds

Equities can act as a hedge against inflation because companies often adjust prices with inflation, helping their revenues (and stock values) grow. However, inflation-driven cost increases may pressure profits, affecting market performance temporarily.

3. Real Estate

Real estate investments tend to appreciate in tandem with inflation, especially in high-growth urban markets. Rents and property values generally rise with inflation, providing both income and capital growth potential.

4. Gold and Commodities

Gold historically performs well during inflationary periods as investors view it as a “store of value.” Commodities like oil, metals, and agricultural goods also rise with inflation, making them attractive inflation-hedged investments.

Understanding Real Return

The real return is the actual increase in purchasing power after adjusting for inflation. It’s calculated as:

Real Return Formula:

Real Return = Nominal Return − Inflation Rate

Example:

If your mutual fund gives 10% annual return and inflation is 6%, your real return equals 4%. Over time, even small differences here can heavily influence long-term wealth growth.

Interactive Thought Experiment

Try this quick exercise. Imagine you have ₹1,00,000:

- If inflation = 5% and you earn 3% interest, your real return is -2%.

- If inflation = 5% and you invest in equity earning 9%, your real return is +4%.

- What does that reveal? Inflation punishes idle or slow-growing money, rewarding inflation-beating strategies.

Strategies to Safeguard Against Inflation

To protect your wealth from inflation’s eroding effect, focus on diversification and smart investment allocations:

- Invest in inflation-beating assets. Equities, index funds, real estate, and precious metals have historically outperformed inflation over long horizons.

- Maintain liquid emergency savings. Keep 3–6 months of expenses in easy-access accounts; don’t overcommit to inflation-sensitive cash instruments.

- Use inflation-indexed instruments. In India, consider instruments like Inflation-Indexed Bonds (IIBs) or RBI Floating Rate Savings Bonds.

- Regularly review portfolio. Adjust holdings as inflation expectations and economic conditions change.

- Reinvest returns smartly. Compound real growth by reinvesting gains into higher-performing or inflation-protected sectors.

Key Takeaways

- Inflation diminishes money’s purchasing power, affecting both savers and investors.

- Fixed-income assets suffer most when inflation exceeds nominal interest rates.

- Equities, real estate, and commodities can mitigate inflation risks over time.

- Diversification and vigilance are your best defenses against inflation’s silent attack on wealth.

Conclusion

Inflation isn’t inherently bad — moderate inflation signals healthy economic growth. The real challenge lies in preparing your finances to thrive under it. Recognizing how inflation affects savings and investments helps you make informed, inflation-conscious decisions for enduring wealth and stability. The goal isn’t to avoid inflation; it’s to outgrow it.