Financial statements give an overview of a company’s performance, but interpreting them effectively requires more than just reading numbers. Ratio analysis helps you decode these numbers, comparing core metrics to evaluate liquidity, profitability, and financial strength. Whether you’re an investor, business owner, or student of finance, understanding ratio analysis is crucial for informed decisions.

What Is Ratio Analysis?

Ratio analysis is a quantitative method used to evaluate a company’s financial performance by comparing various line items from its financial statements. By forming ratios, you can identify trends, strengths, and weaknesses across time or in comparison with competitors.

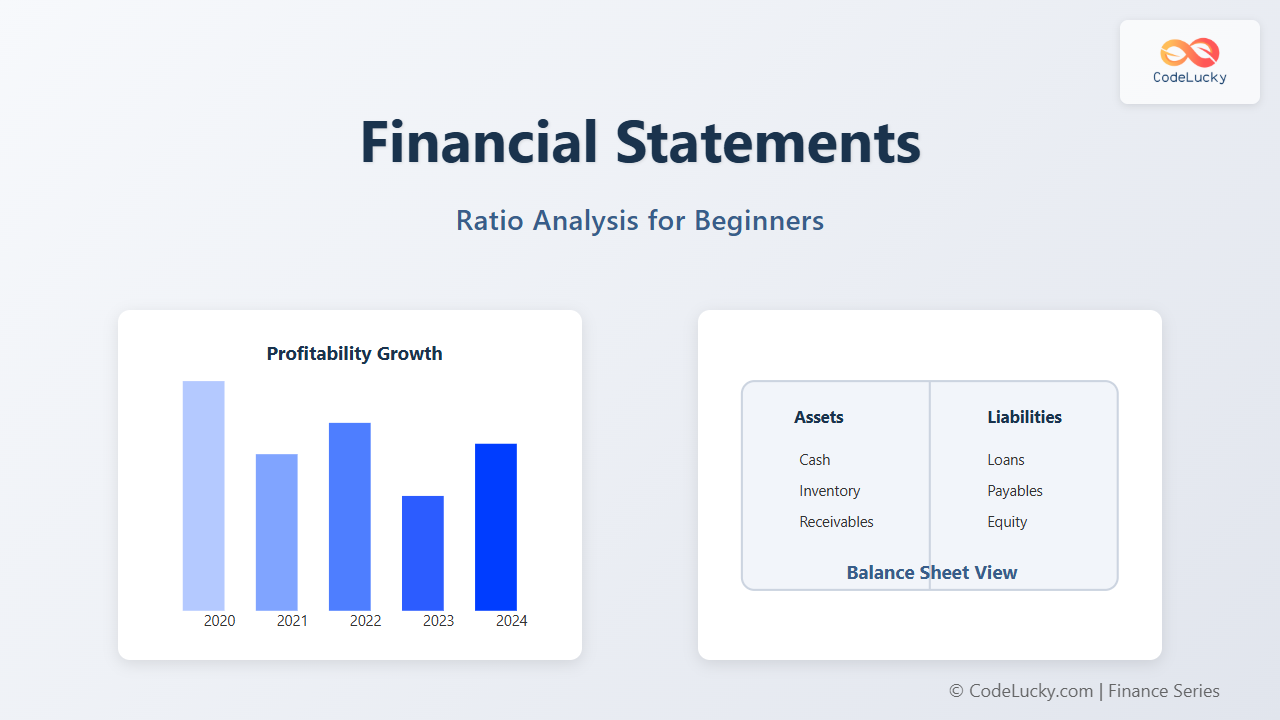

Financial statements include the balance sheet, income statement, and cash flow statement. Together, they supply the data from which ratios are derived to assess performance across different dimensions.

Major Types of Financial Ratios

1. Liquidity Ratios

Liquidity ratios measure a company’s ability to pay short-term debts with current assets.

- Current Ratio: Current Assets ÷ Current Liabilities

- Quick Ratio (Acid-Test): (Current Assets − Inventory) ÷ Current Liabilities

Example: Suppose Company A has the following data:

- Current Assets: ₹500,000

- Inventory: ₹100,000

- Current Liabilities: ₹250,000

Then,

Current Ratio = 500,000 ÷ 250,000 = 2.0

Quick Ratio = (500,000 – 100,000) ÷ 250,000 = 1.6

This means Company A has enough current assets to cover its short-term obligations comfortably.

2. Profitability Ratios

Profitability ratios evaluate a company’s ability to generate income relative to revenue, assets, or equity.

- Gross Profit Margin: (Gross Profit ÷ Net Sales) × 100

- Net Profit Margin: (Net Profit ÷ Net Sales) × 100

- Return on Equity (ROE): (Net Income ÷ Shareholders’ Equity) × 100

Example: If a company earns ₹400,000 in revenue and ₹100,000 in net profit,

Net Profit Margin = (100,000 ÷ 400,000) × 100 = 25%

This shows that 25% of each rupee in sales translates into profit, indicating strong profitability.

3. Solvency Ratios

Solvency ratios measure long-term stability and the ability to meet long-term obligations.

- Debt-to-Equity Ratio: Total Liabilities ÷ Shareholders’ Equity

- Interest Coverage Ratio: EBIT ÷ Interest Expense

Example: If the company’s total liabilities are ₹1,200,000 and shareholders’ equity is ₹800,000:

Debt-to-Equity Ratio = 1,200,000 ÷ 800,000 = 1.5

A value of 1.5 indicates moderate leverage — for every ₹1 of shareholder equity, there’s ₹1.5 of debt.

4. Efficiency or Activity Ratios

Efficiency ratios evaluate how effectively a company is using its assets to generate sales.

- Inventory Turnover Ratio: Cost of Goods Sold ÷ Average Inventory

- Accounts Receivable Turnover: Net Credit Sales ÷ Average Accounts Receivable

Example: If Cost of Goods Sold = ₹1,000,000 and Average Inventory = ₹200,000,

Inventory Turnover = 1,000,000 ÷ 200,000 = 5 times

This means inventory is sold and replenished five times a year, reflecting good efficiency.

Visual Summary of Key Ratios

Interactive Example: Try Calculating

You can try this mini interactive calculator for practice. Enter your values to compute simple ratios (no server required — works in browser consoles).

// Quick JS example for practice (run in browser console)

function currentRatio(assets, liabilities) {

return (assets / liabilities).toFixed(2);

}

function netProfitMargin(netProfit, revenue) {

return ((netProfit / revenue) * 100).toFixed(2) + "%";

}

// Example:

console.log("Current Ratio:", currentRatio(500000, 250000));

console.log("Net Profit Margin:", netProfitMargin(100000, 400000));

Why Ratio Analysis Matters

Ratio analysis paints a comprehensive picture of both short-term liquidity and long-term sustainability. Investors use it to judge stability and returns, lenders assess creditworthiness, and managers rely on it to improve efficiency and profitability. Regular ratio tracking helps you detect early signs of trouble and benchmark performance against industry standards.

Final Thoughts

Ratio analysis transforms raw financial data into actionable insights. By mastering the key ratios — liquidity, profitability, solvency, and efficiency — you can assess financial health, make smarter investments, and guide better management decisions. Start with the basics, practice with real data, and over time, you’ll gain the intuition to spot strengths and weaknesses instantly.

Related Reads: