Financial literacy is the foundation of personal and professional success in the modern world. Whether you’re managing your income, planning for retirement, or learning how to invest, understanding basic financial concepts helps you make smarter decisions and secure your future. In this comprehensive guide, we’ll break down financial literacy into clear, practical steps every beginner can follow.

What Is Financial Literacy?

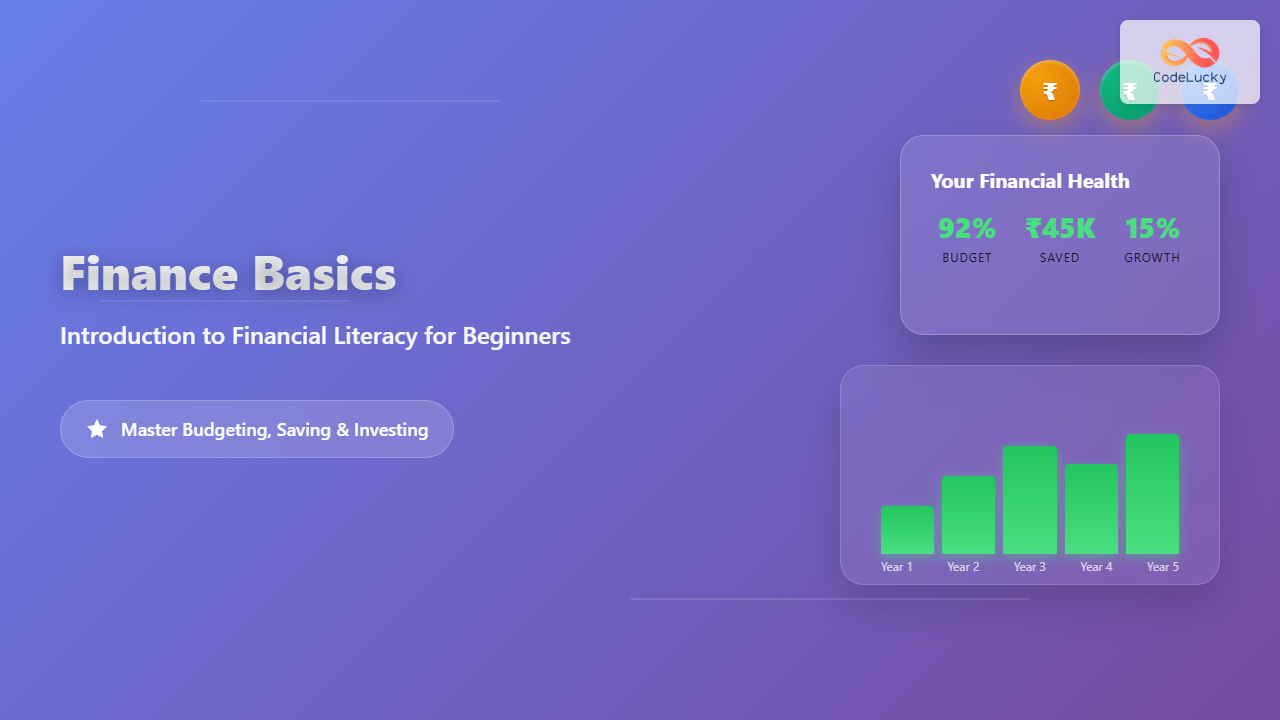

Financial literacy means having the knowledge and skills to manage money effectively. It involves understanding how to budget, save, invest, and make informed financial decisions. A financially literate person knows how to balance income and expenses, avoid unnecessary debt, and grow wealth steadily over time.

Why Financial Literacy Matters

- Reduces financial stress: Understanding money helps you prevent crises and live with confidence.

- Improves quality of life: With smart decisions, you can afford essentials and plan for experiences you value.

- Encourages independence: You don’t rely on others for financial security.

- Builds wealth: Knowledge allows you to use tools like compounding, budgeting, and investing effectively.

Core Components of Financial Literacy

1. Budgeting

Budgeting is the process of planning your income and expenses. A good budget helps you control your money, not the other way around. A common method is the 50/30/20 rule:

- 50% – Needs (rent, food, utilities)

- 30% – Wants (entertainment, travel)

- 20% – Savings or debt repayment

Example:

Monthly Income: ₹50,000

Needs: ₹25,000

Wants: ₹15,000

Savings: ₹10,000

2. Saving and Emergency Funds

Saving is an essential part of financial security. Experts recommend maintaining an emergency fund with 3–6 months’ worth of expenses. This ensures you can handle medical emergencies, job loss, or unexpected bills.

Example Tip: Automate your savings. Set up an auto-transfer every month right after you receive your salary.

3. Understanding Credit

Credit allows you to borrow money to pay for things now and repay later. This can include credit cards, education loans, or home mortgages. However, misuse can lead to high-interest debt.

Healthy Credit Habits:

- Pay bills on time to maintain a good credit score.

- Avoid maxing out your credit card limit.

- Keep your credit utilization below 30%.

4. Investing Basics

Investing helps your money grow through assets like stocks, mutual funds, or real estate. When you invest, you allow your money to work for you instead of just saving it. The earlier you start, the bigger the impact of compound interest.

Simple Example:

If you invest ₹5,000 monthly for 10 years at 10% annual return,

your total contribution: ₹6,00,000

future value: ~₹10,32,000

This shows how time and consistency multiply wealth.

5. Financial Planning

Financial planning is the broader strategy that ties everything together. It considers your income, expenses, assets, liabilities, and long-term goals — from buying a house to retiring comfortably.

Key Steps:

- Set SMART goals (Specific, Measurable, Achievable, Relevant, Time-bound).

- Track income and spending.

- Build an emergency fund and manage insurance.

- Start investing early for long-term growth.

Practical Example: Turning Knowledge into Action

Let’s imagine Ria, a 25-year-old professional earning ₹60,000/month. Using what we discussed:

- Budget: She follows 50/30/20 – ₹30,000 needs, ₹18,000 wants, ₹12,000 savings.

- Savings Plan: Builds a ₹2 lakh emergency fund over time.

- Investments: Starts SIP in index mutual funds for long-term goals.

- Credit: Uses a credit card responsibly for cashback and timely payments.

Within two years, Ria achieves control over her expenses and begins building wealth. Her journey shows that financial literacy is about starting small but staying consistent.

Interactive Self-Check

Answer these quick questions to measure your current financial literacy level:

- Do you track where your money goes every month?

- Have you set a financial goal for the next year?

- Do you know your credit score and how it’s calculated?

- Are you investing regularly?

- Do you have insurance and an emergency fund?

If your answer is “no” to more than two questions, this is your sign to start building your financial knowledge now.

Conclusion

Financial literacy empowers you to take charge of your present and future. It’s not about being rich—it’s about being responsible, informed, and secure. Whether you’re just starting out or rebuilding your finances, small steps today create massive impact tomorrow. Learn, apply, and grow your financial confidence—one chapter at a time.