Demand and Supply are the cornerstone concepts of economics that explain how markets function. Every transaction, from buying groceries to trading stocks, follows these invisible forces. Understanding them helps businesses set prices, helps consumers make informed choices, and guides policymakers in maintaining economic stability.

What is Demand?

Demand refers to the quantity of a product or service that consumers are willing and able to purchase at a given price over a specific period. It reflects consumer behavior and their ability to pay. The principle of demand revolves around a simple rule — when the price of a good rises, the demand for it usually falls, and vice versa.

Law of Demand

The Law of Demand states that, other things being equal, as the price of a good decreases, the quantity demanded increases. This inverse relationship can be expressed as:

Price ↑ → Quantity Demanded ↓

Price ↓ → Quantity Demanded ↑

Example of Demand

Imagine the price of coffee in a city drops from ₹200 to ₹150 per cup. More people start buying coffee, perhaps even replacing tea as their go-to beverage. This increased consumption is a direct response to the price change — a demonstration of the Law of Demand.

What is Supply?

Supply represents the quantity of a product that producers are willing and able to sell at various prices during a specific period. It reflects producer behavior and production costs.

Law of Supply

The Law of Supply states that, other things being equal, the quantity of a product supplied increases as its price increases. The relationship between price and quantity is direct.

Price ↑ → Quantity Supplied ↑

Price ↓ → Quantity Supplied ↓

Example of Supply

Suppose farmers realize the market price of wheat has increased. They are likely to allocate more land for wheat cultivation next season, hoping to earn more profit. Hence, the supply of wheat increases.

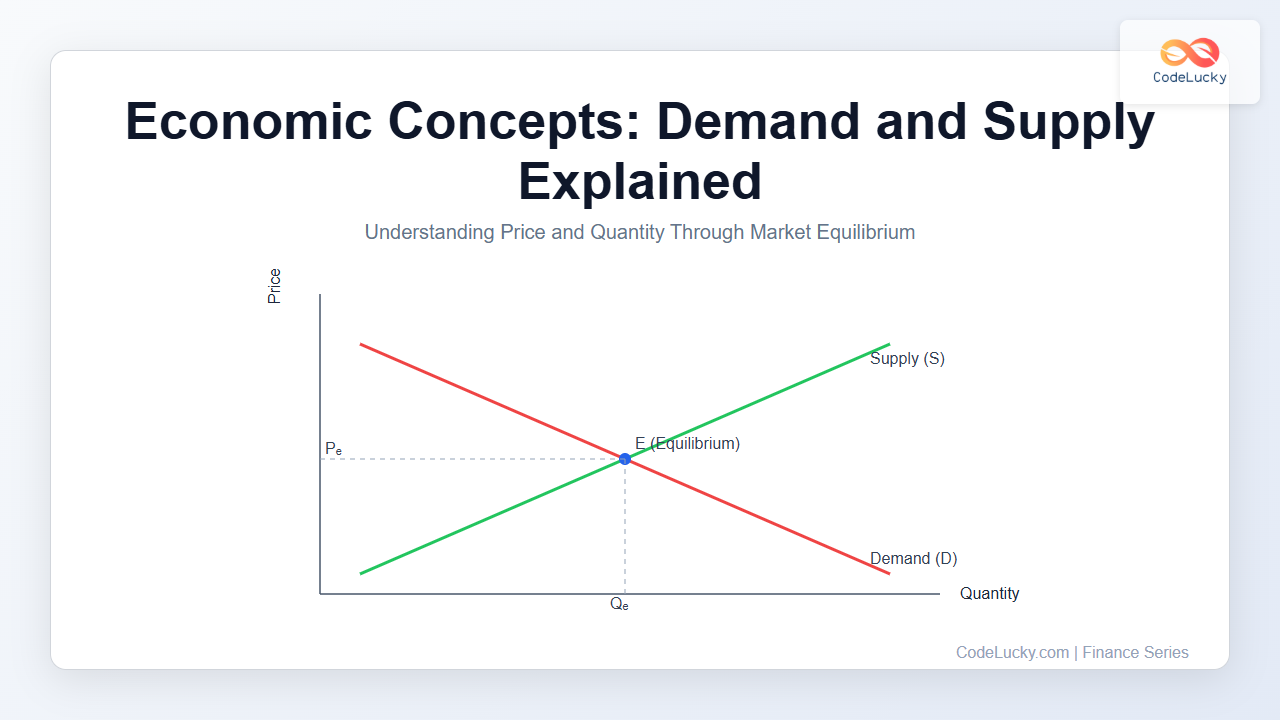

Market Equilibrium

When demand and supply interact freely, they establish an equilibrium price — the price at which the quantity demanded equals the quantity supplied. This balancing point is known as market equilibrium.

Equilibrium Example

At ₹100 per unit, consumers want to buy 500 units of a product, and producers are ready to sell exactly 500. Here, the market reaches equilibrium — neither shortage nor surplus exists.

Shifts in Demand and Supply Curves

Changes in consumer preferences, technology, or external factors can shift demand or supply curves — resulting in a new equilibrium. These shifts do not occur because of price alone but due to underlying market changes.

Factors that Shift Demand

- Consumer income changes

- Preferences or tastes

- Price of substitutes or complementary goods

- Expectations about future price changes

Factors that Shift Supply

- Technology improvements

- Input cost variations

- Government taxes and subsidies

- Natural causes or events

Visualizing Demand and Supply Shifts

Dynamic Market Adjustments

Markets are dynamic. Events like global inflation, interest rate changes, or natural calamities continuously shift demand and supply. While equilibrium may be momentarily disrupted, it tends to readjust naturally through the forces of price and quantity changes.

Interactive Understanding: Try It Yourself

You can simulate demand and supply changes with a simple exercise. Imagine the following table, and mentally predict how market equilibrium shifts:

| Event | Expected Effect on Demand | Expected Effect on Supply | Impact on Price |

|---|---|---|---|

| New Technology Lowers Production Cost | – | Increases | Decreases |

| Consumer Income Rises | Increases | – | Increases |

| Bad Weather Damages Crops | – | Decreases | Increases |

| Government Increases Tax | – | Decreases | Increases |

Conclusion

Demand and Supply form the foundation of every economic system. Understanding these forces empowers individuals to anticipate price changes, businesses to plan production efficiently, and policymakers to guide economic stability. The interaction of these two forces continuously shapes the prices, quantities, and flow of goods and services in any marketplace.

By mastering these economic fundamentals, you enhance your ability to interpret market movements — a skill invaluable for investors, entrepreneurs, and learners alike.