Credit utilization is one of the most influential factors in determining your credit score. Mastering how it works can help you unlock better loan rates, higher credit limits, and long-term financial stability. In this detailed guide from CodeLucky.com, let’s explore how credit utilization impacts your credit health with practical examples and visual breakdowns.

What Is Credit Utilization?

Credit utilization refers to the percentage of your available credit that you’re currently using. It measures how much credit card balance you carry compared to your total credit limit. This ratio reflects your dependency on credit in the eyes of lenders.

Here’s the formula:

Credit Utilization Ratio (%):

(Total Credit Used ÷ Total Credit Limit) × 100

Example Calculation

If you have two credit cards with the following details:

- Card A: ₹50,000 limit with ₹15,000 used

- Card B: ₹30,000 limit with ₹9,000 used

Total credit used = ₹24,000 and total credit available = ₹80,000.

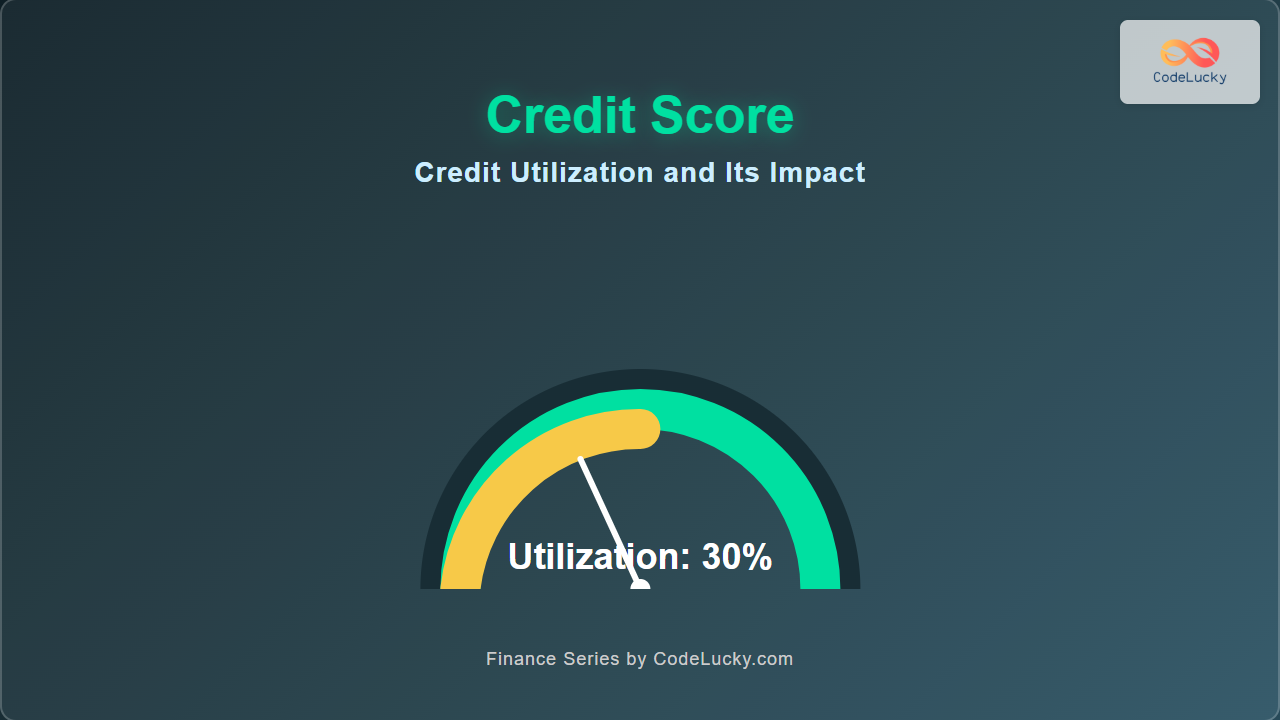

Credit Utilization = (24,000 ÷ 80,000) × 100 = 30%

This means you’re utilizing 30% of your available credit, which is usually considered a healthy ratio.

Ideal Credit Utilization Ratio

Financial experts generally recommend keeping your utilization below 30%. Higher utilization may signal financial stress and could lower your credit score.

If your utilization crosses 50%, lenders may view you as a higher-risk borrower. On the other hand, keeping it too low (<10%) may not demonstrate enough credit activity to improve your score meaningfully.

Why Credit Utilization Matters

Your credit utilization ratio directly influences about 30% of your total credit score calculation. Here’s how it fits within major credit scoring models:

This visual highlights that while paying bills on time remains the top factor, credit utilization plays a nearly equal role.

Impact of High Credit Utilization

When your utilization increases, it can quickly reduce your credit score, even if you make payments on time. That’s because scoring algorithms interpret high utilization as a sign you’re relying too heavily on borrowed funds.

For instance, if you have ₹1,00,000 total credit and use ₹80,000:

- Utilization = 80%

- This signals high credit dependency

- Your credit score could drop by 40–100 points depending on your profile

How to Keep Credit Utilization Low

Here are practical strategies to keep your credit utilization ratio under control:

- Pay Balances Early: Make payments before the billing cycle ends to ensure a lower reported balance.

- Request Credit Limit Increases: Higher credit limits reduce your utilization, but avoid overspending.

- Distribute Balances: Spread purchases across multiple cards rather than maxing out one.

- Set Alerts: Use credit monitoring apps to track your utilization in real-time.

- Make Multiple Payments: Reducing balances biweekly helps lower your reported utilization.

Interactive Example: Calculate Your Credit Utilization

You can quickly estimate your utilization using this interactive HTML calculator snippet:

<label for="used">Total Credit Used (₹):</label><br>

<input type="number" id="used" placeholder="e.g. 25000"><br><br>

<label for="limit">Total Credit Limit (₹):</label><br>

<input type="number" id="limit" placeholder="e.g. 100000"><br><br>

<button onclick="calcUtilization()">Calculate</button>

<p id="result"></p>

<script>

function calcUtilization() {

const used = parseFloat(document.getElementById('used').value) || 0;

const limit = parseFloat(document.getElementById('limit').value) || 1;

const ratio = ((used / limit) * 100).toFixed(2);

document.getElementById('result').textContent =

'Your Credit Utilization is: ' + ratio + '%';

}

</script>

This simple calculator visually demonstrates how even small repayments can reduce your utilization ratio instantly.

Credit Utilization and Long-Term Financial Goals

Maintaining a manageable utilization ratio not only boosts your credit score but also helps you qualify for better mortgage, vehicle, or business loan terms. A consistently low utilization history shows lenders that you’re financially disciplined.

Conclusion

Credit utilization isn’t just a number—it’s a reflection of your credit behavior. By keeping it under 30%, paying off balances strategically, and monitoring your usage, you can steadily climb to an excellent credit score. Consistent attention to this simple ratio can transform your financial health over time.

For more finance insights, guides, and tools, explore the Finance Series at CodeLucky.com.