Credit Score: How to Improve a Low Credit Score

Your credit score plays a crucial role in shaping your financial life. Whether you want to get a new credit card, apply for a home loan, or even rent an apartment, lenders often use your credit score to decide your reliability. A low score doesn’t mean the end of your financial opportunities. You can always rebuild it with consistent actions and awareness.

In this guide, we’ll walk you through what a credit score is, the factors that affect it, and the most effective ways to improve it — step by step.

What Is a Credit Score?

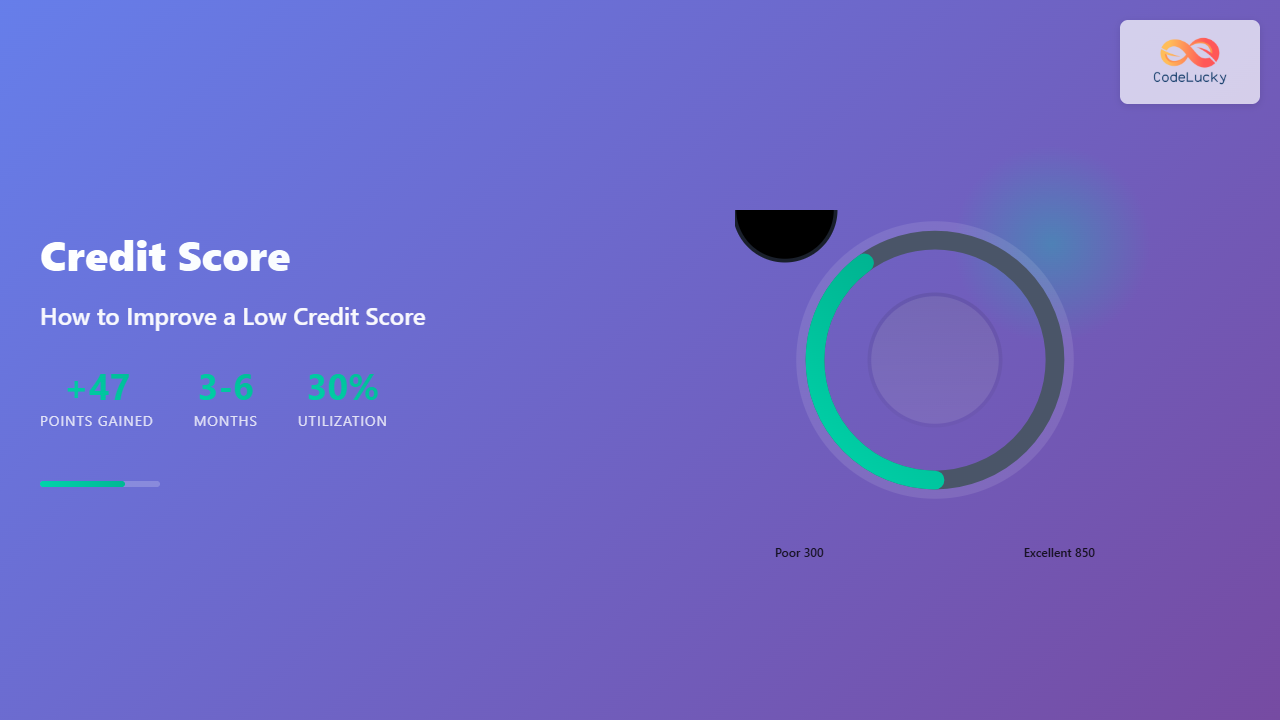

A credit score is a three-digit number ranging typically between 300 and 850. It represents your creditworthiness — the likelihood that you’ll repay borrowed money. The higher the score, the more trustworthy you appear to lenders.

Credit scores are calculated using data from your credit report, including your payment history, debt levels, and credit mix.

This breakdown clearly shows that payment history and credit utilization contribute the most, making them your top areas of focus when working to improve your score.

Credit Score Ranges

Here’s how scores are typically categorized:

| Score Range | Category | Creditworthiness |

|---|---|---|

| 300–579 | Poor | High risk; difficult to get approved for credit |

| 580–669 | Fair | Acceptable; may face higher interest rates |

| 670–739 | Good | Average; most lenders view you as responsible |

| 740–799 | Very Good | Favorable interest rates and approvals |

| 800–850 | Excellent | Top-tier credit opportunities |

Common Reasons for a Low Credit Score

- Late or missed payments on loans or credit cards.

- High outstanding debt compared to your credit limit.

- Errors in your credit report not corrected in time.

- Too many recent credit applications.

- Lack of credit history or credit mix.

Step-by-Step Plan to Improve a Low Credit Score

Improving your credit score is about taking the right actions consistently. Here’s a systematic approach:

1. Check Your Credit Report

Visit authorized credit bureaus or online portals to access your credit report. In India, for instance, you can request free annual reports from CIBIL, Experian, or Equifax.

Example: Ravi found that an old closed loan still showed as “active” on his CIBIL report. After he raised a dispute, the incorrect entry was removed, improving his score by 40 points within two months.

2. Dispute Any Errors

Errors can seriously affect your credit score. If you spot inaccuracies such as duplicate accounts, incorrect balances, or outdated information, contact your credit bureau immediately.

3. Pay Bills on Time

Payment history accounts for around 35% of your score. Setting reminders or automating payments ensures you never miss a due date.

Pro tip: Even a single late payment may stay on your report for up to seven years, so consistency is key.

4. Reduce Credit Utilization

Keep your credit card balances below 30% of your available credit limit. For example, if your card’s limit is ₹1,00,000, try not to exceed ₹30,000 in outstanding balance.

5. Limit New Credit Applications

Each new credit inquiry can lower your score slightly. Apply for credit only when necessary, and space out applications by at least six months.

6. Diversify Your Credit Mix

Lenders like to see a combination of credit types—credit cards, loans, and possibly a mortgage. It shows you can handle different kinds of financial responsibilities.

7. Monitor Your Progress

Regularly monitoring your score helps track improvements and alerts you to any unexpected drops.

Interactive Example: Understanding Credit Utilization

Try this quick interactive calculation (conceptually):

Credit Utilization = (Total Credit Used / Total Credit Limit) × 100

Example: (₹20,000 / ₹1,00,000) × 100 = 20%

If your result is under 30%, you’re managing credit wisely. If it’s over 50%, focus on paying down debts.

How Long Does It Take to Improve a Credit Score?

Rebuilding credit takes patience. Small positive actions compound over time. Usually, noticeable improvements appear within three to six months of consistent effort, though severe issues can take longer to fix.

Conclusion: Your Credit Journey Is a Marathon

Improving your credit score isn’t about quick fixes; it’s about building trustworthy habits. Check your reports regularly, maintain low balances, and be punctual with payments. Over time, these actions compound to unlock better loans, lower interest rates, and improved financial confidence.

Remember, every responsible payment and wise financial decision you make paves the way toward a stronger credit future.