Credit Score: Hard Inquiry vs Soft Inquiry — Understanding how your credit report is accessed is crucial for maintaining a healthy credit score. Every time a lender or service provider reviews your credit, it’s categorized as either a hard inquiry or a soft inquiry. These two types may look similar, but they have distinctly different effects on your creditworthiness.

What Is a Credit Inquiry?

A credit inquiry occurs when a person or organization checks your credit report from credit bureaus like TransUnion, Equifax, or Experian. It shows who accessed your credit history and when, providing transparency and accountability.

Every inquiry records the date, company name, and purpose. There are two main categories of inquiries:

- Hard Inquiry – Occurs when a lender reviews your credit for lending purposes.

- Soft Inquiry – Happens when you or a company checks your credit for informational or promotional reasons.

Hard Inquiry: What It Means

A hard inquiry (also called a hard pull) happens when you apply for a financial product like a credit card, loan, or mortgage. Lenders use your credit report to assess your credit risk and lending eligibility. Each hard pull is recorded in your report and can impact your credit score.

Examples of hard inquiries:

- Applying for a home loan or car loan.

- Submitting a credit card application.

- Requesting a student loan or personal loan.

How it affects your score: Hard inquiries typically lower your credit score by a few points (usually 2–5). Multiple hard inquiries within a short period can signal credit risk, especially if they’re from various lenders. However, credit scoring models often treat multiple mortgage or auto loan inquiries within 14–45 days as one event, understanding that rate shopping is normal.

Soft Inquiry: What It Means

A soft inquiry (or soft pull) occurs when your credit report is accessed for non-lending purposes. These checks don’t affect your credit score because they are not tied to new credit applications.

Examples of soft inquiries:

- Checking your own credit score via apps like Credit Karma or CIBIL.

- Background checks by employers (with permission).

- Pre-approved credit card or loan offers.

Soft inquiries are visible only to you in your credit report—they don’t appear to lenders or affect lending decisions. Hence, checking your own credit score regularly is safe and recommended.

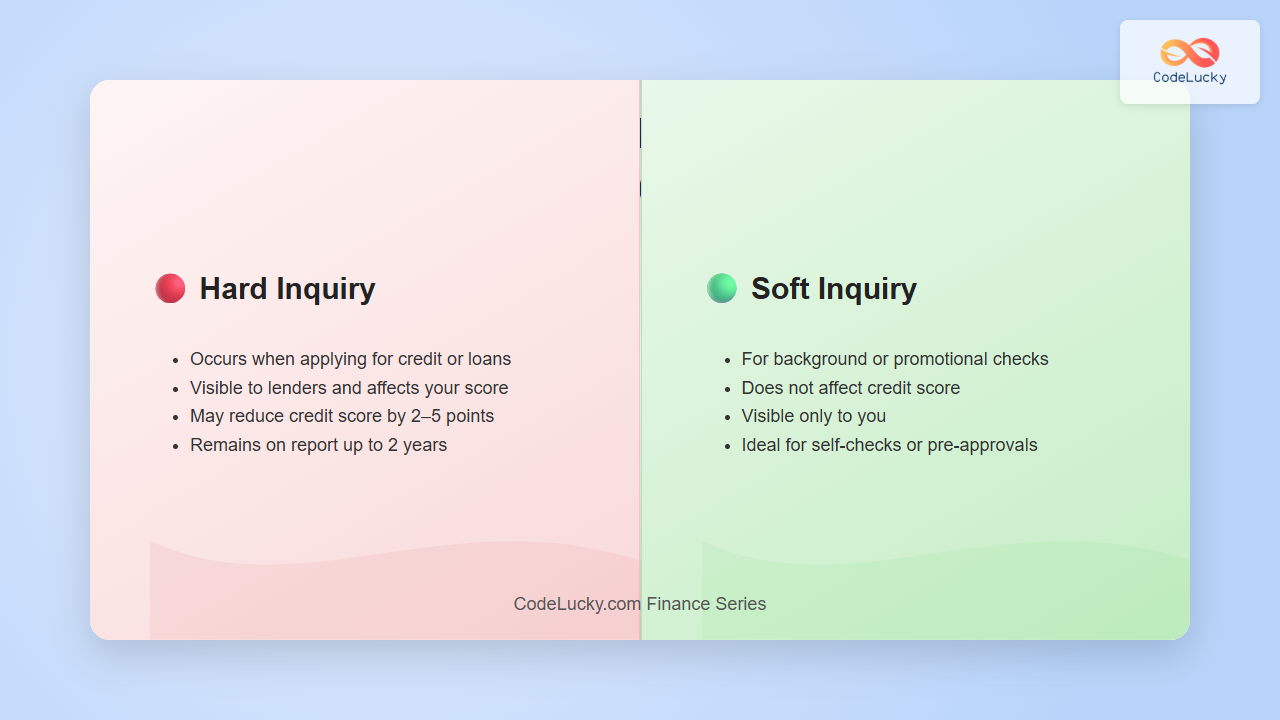

Key Differences Between Hard and Soft Inquiries

| Aspect | Hard Inquiry | Soft Inquiry |

|---|---|---|

| Purpose | For lending decisions (e.g., loan, credit card) | For personal checks or promotional offers |

| Appears on Credit Report | Visible to lenders and impacts credit score | Visible only to you, no impact on score |

| Credit Score Impact | May lower score temporarily (2–5 points) | No impact |

| Examples | New credit card, car loan | Checking your own credit, employer check |

| Lifespan on Report | Typically stays for up to 2 years | Does not affect credit report visibility to lenders |

Visual Comparison of How Inquiries Work

Example Scenario: Applying for Credit

Imagine you’re applying for a car loan and also checking your credit score through an app. The car loan application triggers a hard inquiry because the lender is evaluating your creditworthiness before approving your loan. Meanwhile, your self-check through a finance app triggers a soft inquiry, which doesn’t affect your score at all.

Best Practices to Manage Credit Inquiries

- Check your credit regularly: Use apps or bureau websites to monitor your credit safely (soft inquiry).

- Space out credit applications: Avoid multiple hard inquiries in a short period unless rate shopping.

- Review your credit report: Check for unauthorized hard inquiries, which could indicate identity theft.

- Use pre-qualification tools: Many lenders offer “pre-approved” checks through soft inquiries only.

Interactive Example: Impact Simulation

Use this simple logic to simulate how inquiries affect your credit score:

// Simple illustrative example

let creditScore = 750;

let hardInquiries = 3;

let softInquiries = 10;

let hardImpact = hardInquiries * 3; // assume 3 points per hard inquiry

let softImpact = 0;

let newScore = creditScore - hardImpact - softImpact;

console.log("Updated Credit Score:", newScore);

Output Example:

Updated Credit Score: 741Conclusion

Understanding the difference between hard and soft credit inquiries helps you maintain a strong credit profile. Hard inquiries matter when applying for loans or credit cards, whereas soft inquiries are harmless and essential for tracking your financial health. By managing how often and when you apply for credit, you can control your score trajectory effectively.

Stay informed, plan wisely, and keep your credit report transparent — because every inquiry tells a story about your financial responsibility.