Corporate finance revolves around how a company manages its capital structure—the mix of debt and equity used to fund operations, investments, and growth. Understanding this balance is crucial for financial stability and long-term value creation. This article will help you master the capital structure basics, explore its components, and visualize key relationships through diagrams and examples.

What Is Capital Structure?

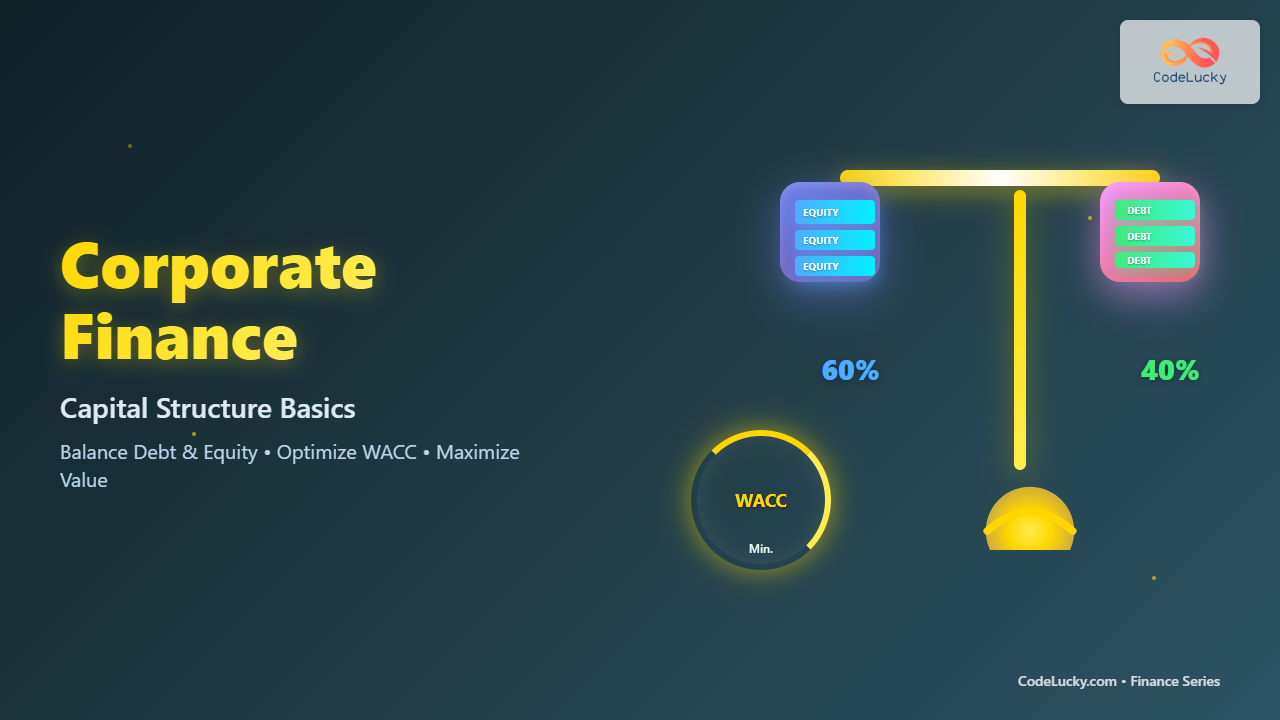

Capital structure represents how a company finances its assets using a combination of debt (borrowed funds) and equity (owner’s funds). Together, these sources fund business activities and influence profitability, risk, and firm valuation.

For instance, if a company’s total capital is ₹100 crore, composed of ₹60 crore equity and ₹40 crore debt, its capital structure will have a Debt-to-Equity (D/E) ratio of 0.67. This ratio indicates that for every ₹1 of equity, the firm owes ₹0.67 in debt.

Key Components of Capital Structure

- Equity Capital: Funds raised from shareholders in exchange for ownership. It includes common and preferred shares. Equity doesn’t require repayment but entails profit sharing (dividends).

- Debt Capital: Borrowed funds from banks, bonds, or other instruments. Debt requires periodic payments of interest and principal but doesn’t dilute ownership.

- Hybrid Instruments: These combine elements of both equity and debt, such as convertible debentures or preference shares.

How Capital Structure Affects a Business

The right mix of debt and equity directly affects a company’s cost of capital, financial risk, and valuation. Let’s analyze how:

- Financial Leverage: Using debt amplifies potential returns but also increases risk during downturns. High leverage means higher fixed obligations.

- Cost of Capital: Too much equity means expensive financing; too much debt raises financial risk. The goal is to minimize the Weighted Average Cost of Capital (WACC).

- Control: Debt holders have no voting rights, while equity investors share ownership and decision power. Firms balance these to maintain control.

Example: Comparing Two Firms

Let’s compare Firm A (Low Debt) and Firm B (High Debt). Both have ₹10 crore in assets and earn ₹2 crore EBIT (Earnings Before Interest and Taxes).

| Metric | Firm A (Low Debt) | Firm B (High Debt) |

|---|---|---|

| Debt | ₹2 crore @ 10% interest | ₹6 crore @ 10% interest |

| Interest | ₹0.20 crore | ₹0.60 crore |

| EBT | ₹1.80 crore | ₹1.40 crore |

| Tax (30%) | ₹0.54 crore | ₹0.42 crore |

| Net Income | ₹1.26 crore | ₹0.98 crore |

| Return on Equity (ROE) | 12.6% | 16.3% |

Notice that Firm B has higher ROE due to leverage, but it also faces greater risk if profits fall, as interest payments remain fixed.

Optimal Capital Structure

The goal of financial management is to find the optimal capital structure—the mix that minimizes WACC and maximizes firm value. Too much debt raises bankruptcy risk, whereas too little lowers return on equity.

Theories of Capital Structure

- Net Income (NI) Approach: Increasing debt reduces WACC since interest is tax-deductible.

- Net Operating Income (NOI) Approach: Capital structure has no effect on firm value; WACC remains constant.

- Traditional Approach: An optimal range exists where WACC is minimized by balancing debt and equity.

- Modigliani–Miller (MM) Proposition: In perfect markets, capital structure doesn’t affect firm value. However, tax benefits and bankruptcy costs in real markets change this outcome.

Capital Structure Decision Factors

- Business Risk: Stable earnings allow higher debt; volatile sectors prefer equity-heavy financing.

- Tax Policy: Higher corporate taxes make debt attractive due to interest deductibility.

- Market Conditions: Bullish markets favor equity issues; bearish cycles prefer debt.

- Company Control: Founders may prefer debt to avoid share dilution.

- Flexibility: Firms maintain borrowing capacity for future needs, aiming for long-term adaptability.

Interactive Example: Adjusting Capital Structure

Try this thought experiment — toggle the equity-debt ratio in your mind: if debt rises, interest cost and risk increase, but tax advantages grow. If equity rises, stability improves, but cost may increase. The ideal zone lies where the marginal benefit of debt equals the marginal cost.

Visual Overview

Conclusion

Understanding capital structure is essential for any corporate finance strategy. It’s not just about balancing numbers—it’s about finding the right equilibrium between growth, risk, and shareholder expectations. A well-planned capital structure ensures financial stability, lowers overall financing costs, and enhances firm value over time.

To explore deeper financial modeling and WACC optimization examples, continue the CodeLucky Finance Series for hands-on insights into valuation, leverage, and investment strategies.