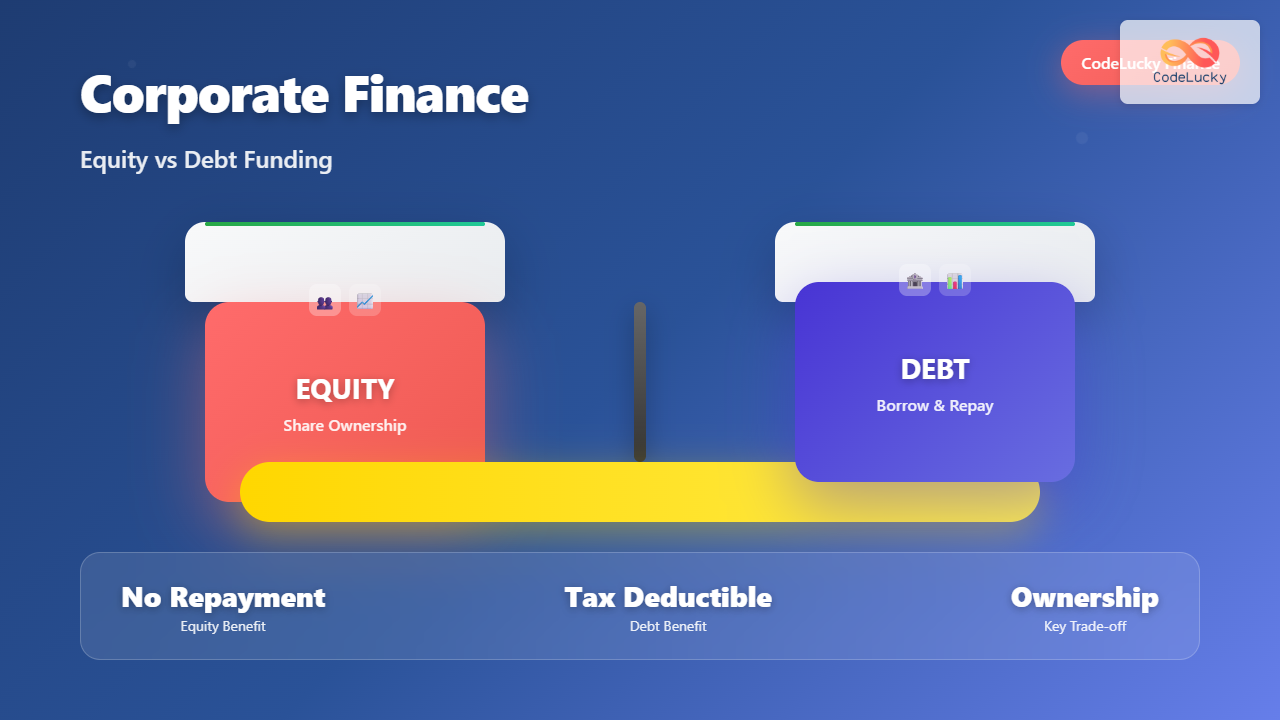

Corporate Finance is all about how businesses raise, manage, and utilize funds to achieve their goals. Among the most significant decisions a company makes is choosing between equity and debt as funding sources. Understanding the difference helps companies align their financing with strategic growth, risk appetite, and long-term vision.

What Is Corporate Finance?

Corporate finance deals with the capital structure of a business — the mix of debt (borrowed money) and equity (owner’s money) that funds operations. A company’s decision on this mix directly impacts profitability, control, and sustainability.

Understanding Equity Funding

Equity funding means raising capital by selling ownership stakes in the company. It doesn’t require repayment, but involves sharing control and profits with investors.

How Equity Funding Works

When a company issues shares to investors — venture capitalists, angel investors, or even through an IPO — it receives money in return for ownership. This capital can be used for product development, expansion, or operational needs.

Example of Equity Funding

Imagine a startup named TechBoost Pvt. Ltd. needs ₹10 crore to build a new AI product. Instead of borrowing, it sells 20% of its equity to investors. The company has no repayment obligation, but it gives away a fifth of ownership and future profits.

Pros of Equity Funding

- No repayment obligation or interest burden.

- Attracts investors who bring expertise and networks.

- Improves creditworthiness by reducing debt ratio.

Cons of Equity Funding

- Loss of ownership and control.

- Shares future profits with investors.

- Complex valuation and compliance requirements.

Understanding Debt Funding

Debt funding involves borrowing money with a promise to repay it with interest. It could be in the form of bank loans, bonds, or debentures. The lender does not own any part of the company.

How Debt Funding Works

A company borrows a fixed amount for a fixed period and pays periodic interest. Debt is an obligation but allows the founders to retain 100% ownership.

Example of Debt Funding

AutoGear Ltd. needs ₹5 crore to open a new factory. It takes a business loan at 10% annual interest payable over five years. The debt must be repaid regardless of whether profits are achieved, but the company retains full ownership.

Pros of Debt Funding

- Retain complete ownership and control.

- Interest payments are tax-deductible.

- Predictable repayment structure.

Cons of Debt Funding

- Increases financial risk with mandatory repayments.

- High leverage can reduce credit rating.

- Interest burden may affect profitability.

Key Comparison: Equity vs Debt Funding

| Aspect | Equity Funding | Debt Funding |

|---|---|---|

| Ownership | Investors gain ownership stake. | No ownership given to lenders. |

| Repayment | No repayment obligation. | Fixed repayment schedule. |

| Risk | Low financial risk, high dilution risk. | High financial risk due to debt obligations. |

| Tax Benefits | Dividends are not tax-deductible. | Interest payments are tax-deductible. |

| Control | Investors can influence decisions. | Founders retain full control. |

Choosing Between Equity and Debt

The choice depends on a company’s stage, cash flow, and risk tolerance.

Choosing Equity Funding

Startups and high-growth companies prefer equity because they may not have stable cash flow to service debt. Equity brings in capital and mentorship but dilutes control.

Choosing Debt Funding

Established firms with predictable revenue streams often prefer debt due to its lower long-term cost and tax advantages, keeping ownership intact.

Hybrid Funding Models

Many companies balance debt and equity — known as the optimal capital structure. This hybrid approach minimizes cost of capital and maximizes shareholder value.

Final Thoughts

There’s no one-size-fits-all answer in corporate finance. The smartest companies view funding as strategic — balancing risks, returns, and growth opportunities. Whether through equity, debt, or a mix, the goal remains the same: financial sustainability and long-term value creation.

Interactive Exercise: Find Your Funding Strategy

Use this quick decision quiz for practice:

- If your company is in early growth and needs guidance → Equity.

- If you have steady revenue and want full control → Debt.

- If you want balance and tax efficiency → Mix both!

Written by the CodeLucky Finance Editorial Team. For more deep dives, visit CodeLucky.com.