Working Capital Management is one of the most crucial concepts in Corporate Finance, as it directly affects the liquidity, profitability, and long-term sustainability of a business. This article explains in detail what working capital is, how to manage it effectively, and how every financial decision around it can shape business performance.

What Is Working Capital?

In simple terms, Working Capital (WC) represents the short-term financial health of a company. It is the excess of current assets over current liabilities:

Formula:

Working Capital = Current Assets – Current Liabilities

Working capital ensures that a company has enough resources to cover short-term obligations and continue operations without interruptions.

Types of Working Capital

- Permanent Working Capital: The minimum amount required to ensure smooth business operations at any time.

- Temporary or Variable Working Capital: The extra capital needed during seasonal or peak business demand.

For example, a garment manufacturer will need more working capital before the festive season to handle higher orders and inventory buildup.

Importance of Working Capital Management

Managing working capital efficiently ensures:

- Liquidity for operational continuity.

- Optimized inventory and receivable cycles.

- Lesser dependence on external borrowings.

- Improved return on investment (ROI).

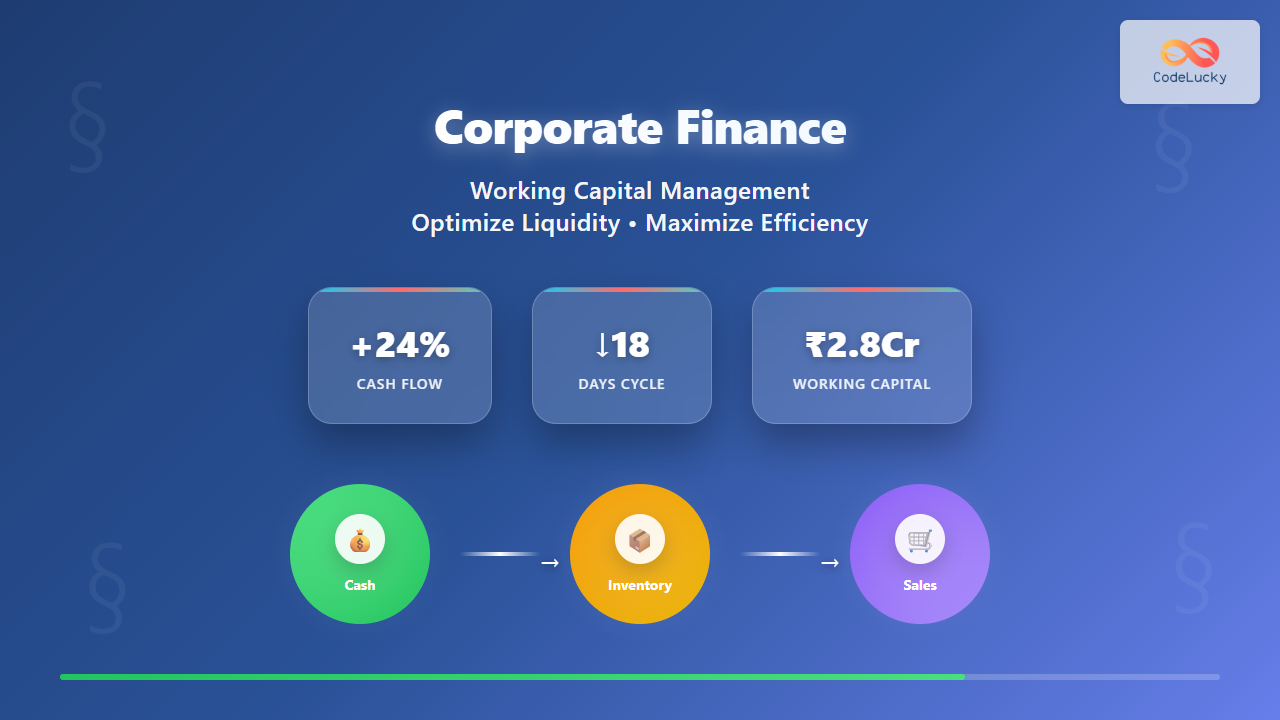

Working Capital Cycle (WCC)

The Working Capital Cycle measures how quickly a company can convert its current assets into cash. It includes inventory acquisition, sales, and collection of receivables.

Formula:

WCC = Inventory Days + Receivable Days – Payable Days

The shorter the cycle, the better the liquidity position.

Example: Working Capital Cycle Calculation

Suppose ABC Ltd. has:

- Average Inventory Period = 45 days

- Average Collection Period = 25 days

- Average Payment Period = 30 days

WCC = 45 + 25 – 30 = 40 days

This means ABC Ltd. needs 40 days to turn its working capital into cash.

Components of Working Capital

Effective working capital management requires balancing the following key components:

Inventory Management

Businesses must strike a balance — holding too much inventory locks up cash, while too little can lead to stockouts and lost sales.

Receivables Management

Companies must define credit policies and follow up on collections efficiently to minimize bad debts and improve cash flow.

Payables Management

Delaying payments strategically improves cash reserves but delaying too much can damage supplier relationships. Optimal timing is essential.

Strategies to Improve Working Capital

- Accelerate Receivables: Offer early payment discounts to reduce collection time.

- Optimize Inventory: Use just-in-time (JIT) or lean inventory techniques.

- Extend Payables: Negotiate longer credit terms with suppliers.

- Streamline Operations: Automate invoicing and adopt efficient forecasting tools.

Interactive Example: Working Capital Decision Impact

Imagine this scenario:

Company: GrowMore Pvt. Ltd.

Current Assets: ₹500,000

Current Liabilities: ₹300,000

Additional Supplier Credit: +₹50,000

Inventory Optimization: -₹60,000

Before adjustment: WC = ₹500,000 – ₹300,000 = ₹200,000

After adjustment: WC = (₹500,000 – ₹60,000) – (₹300,000 – ₹50,000) = ₹190,000

Although working capital decreased slightly, liquidity efficiency improved through better cash flow management — a positive outcome overall.

Working Capital Financing

Companies often use financing options like bank overdrafts, trade credit, or short-term loans to manage temporary deficits in working capital. The choice depends on interest rates, cost of capital, and repayment flexibility.

Conclusion

Effective Working Capital Management ensures a steady balance between profitability and liquidity. By optimizing the working capital cycle, businesses can unlock value, reduce financing costs, and strengthen their financial foundation. Mastering this area is essential for every financial manager aiming for operational excellence and sustainable growth.