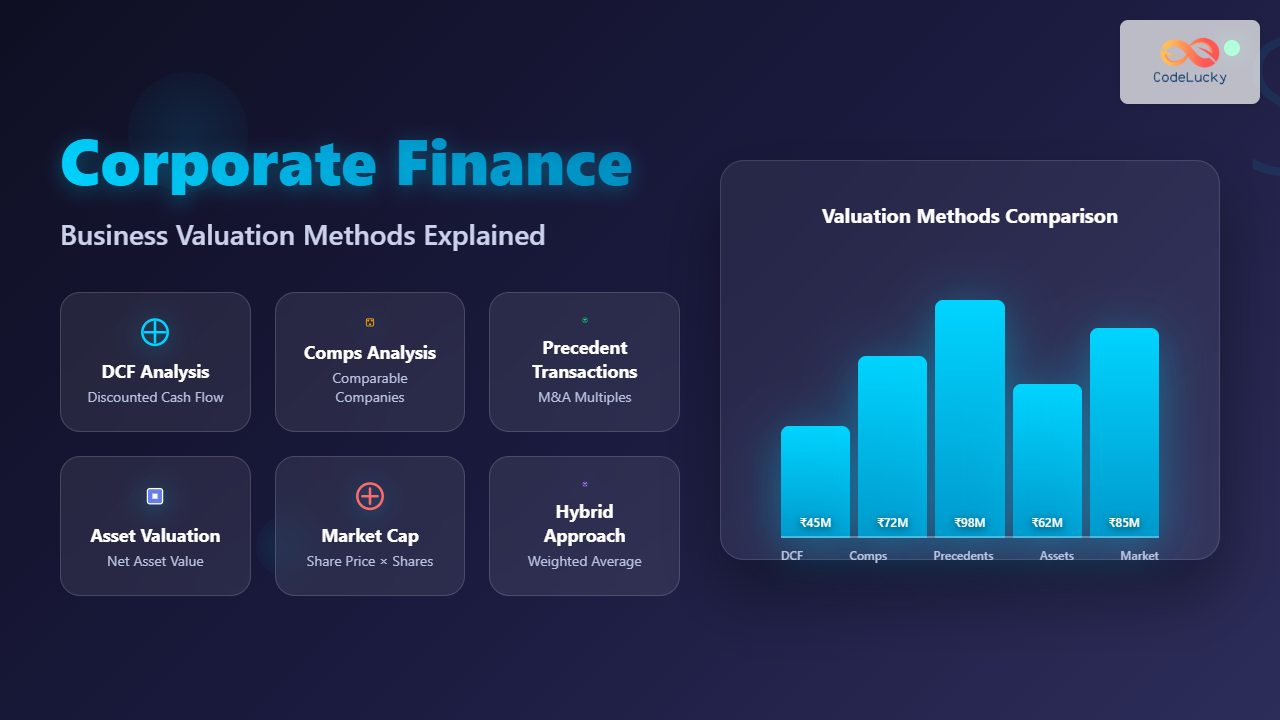

Corporate Finance revolves around one central question: “What is a business truly worth?” Understanding business valuation methods is essential for investors, analysts, and owners to make informed decisions during mergers, acquisitions, fundraising, or performance evaluations. This article explores the most widely used business valuation methods—complete with formulas, examples, and structured diagrams to help you visualize the process.

Overview: Why Business Valuation Matters

Business valuation provides a structured way to measure a company’s economic value. It helps investors decide whether a company is undervalued or overvalued and assists management during strategic decisions such as equity sale, expansion, or partnership negotiations.

1. Discounted Cash Flow (DCF) Method

The DCF method estimates the present value of a business by projecting future cash flows and discounting them using a rate that reflects the risk of those flows. It’s one of the most theoretically sound approaches.

Formula:

\( \text{Value} = \sum_{t=1}^{n} \frac{CF_t}{(1+r)^t} + \frac{TV}{(1+r)^n} \)

- CFₜ = Cash Flow in year t

- r = Discount rate (often WACC)

- TV = Terminal Value

- n = Projection period in years

Example:

Let’s assume a company expects cash flows of ₹10,00,000 per year for 5 years, with a discount rate of 10%. Terminal value is ₹15,00,000.

By applying the formula, we compute the present value of those cash flows and add the terminal value to find the company’s intrinsic worth.

2. Comparable Company Analysis (CCA)

Comparable Company Analysis values a firm by comparing its financial metrics with those of similar publicly traded companies. This technique assumes that companies in the same sector with similar metrics should trade at similar multiples.

Common Multiples:

- Price-to-Earnings (P/E)

- Enterprise Value to EBITDA (EV/EBITDA)

- Price-to-Book (P/B) Ratio

Formula:

\( \text{Value of Target} = \text{Metric of Target} \times \text{Market Multiple of Peers} \)

Example:

If similar firms trade at 10× EBITDA and your firm’s EBITDA is ₹2 crore, your estimated valuation = 10 × ₹2 crore = ₹20 crore.

3. Precedent Transaction Analysis (PTA)

This approach bases valuation on previous transactions involving similar companies. It focuses on the actual prices paid in mergers and acquisitions, providing a realistic market-backed estimate.

Key Steps:

- Identify comparable completed deals.

- Extract multiples such as EV/Revenue or EV/EBITDA.

- Apply average multiples to your firm’s metrics.

For instance, if three prior acquisitions in your industry averaged 8× EBITDA, and your firm’s EBITDA is ₹1.5 crore, your valuation could be 8 × ₹1.5 crore = ₹12 crore.

4. Asset-Based Valuation

The Asset-Based Valuation method is straightforward: it values a company based on the total value of its tangible and intangible assets minus liabilities. It’s commonly used for asset-rich businesses such as real estate, manufacturing, or liquidation scenarios.

Formula:

\( \text{Value} = \text{Total Assets} – \text{Total Liabilities} \)

Example:

If a firm owns ₹50 crore worth of assets and has liabilities of ₹30 crore, the asset-based valuation would be ₹20 crore.

5. Market Capitalization Method

For public companies, the easiest way to assess value is through Market Capitalization. It’s calculated by multiplying the company’s stock price by the number of outstanding shares.

Formula:

\( \text{Market Cap} = \text{Share Price} \times \text{Total Outstanding Shares} \)

Example:

A company with 2 crore shares trading at ₹250 each will have a market capitalization of ₹500 crore.

Choosing the Right Valuation Method

Each method has its strengths depending on the business type, growth stage, and available data:

- Use DCF for startups or cash-flow-driven valuations.

- Comparable Company and Precedent Transaction for market-based perspectives.

- Asset-Based for tangible-heavy businesses or liquidation scenarios.

Interactive Example: DCF Sensitivity Analysis

Try adjusting the discount rate in this interactive input (conceptually represented) to see how valuation changes:

// Interactive example (pseudo)

const discountRate = prompt("Enter discount rate (e.g., 0.1 for 10%)");

const cashFlows = [1000000, 1000000, 1000000, 1000000, 1000000];

const terminalValue = 1500000;

let total = 0;

for (let t = 1; t <= 5; t++) {

total += cashFlows[t-1] / Math.pow(1 + discountRate, t);

}

total += terminalValue / Math.pow(1 + discountRate, 5);

alert("Estimated Value: ₹" + total.toFixed(2));

Conclusion

Valuation is both art and science—while formulas provide structure, assumptions and market context add interpretation. Understanding various business valuation methods enables decision-makers to evaluate companies confidently, negotiate effectively, and plan strategically in the corporate finance landscape.

At CodeLucky.com, our finance guides focus on clarity and practicality, equipping professionals with actionable insights for smarter business decisions.