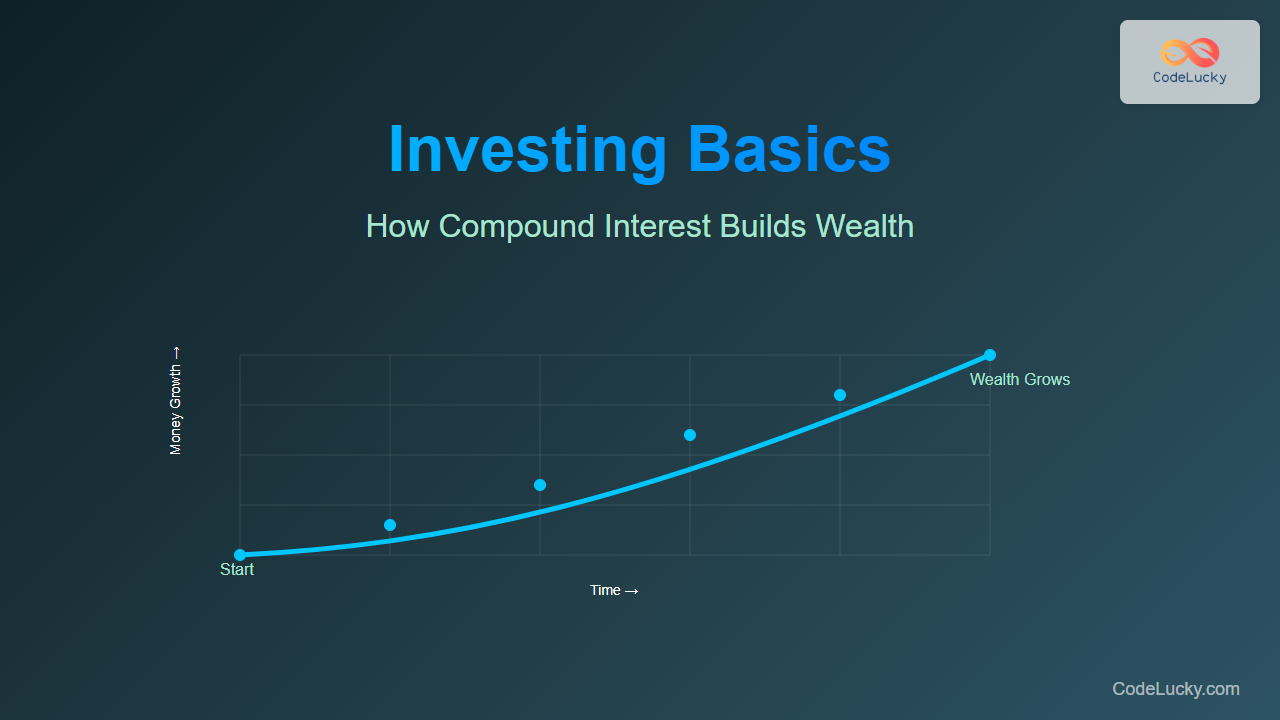

Investing Basics: How Compound Interest Builds Wealth Efficiently Over Time

Compound interest is often called the “eighth wonder of the world”—and for good reason. It has the remarkable ability to transform small, consistent investments into substantial wealth over time. In this detailed guide by CodeLucky.com, we’ll explore how compound interest works, why time plays a critical role, and how you can use this financial principle to build lasting prosperity.

What Is Compound Interest?

Compound interest is the process where your earnings generate more earnings. In simple terms, it’s interest on interest. When you invest money, you earn interest on your initial amount (the principal). Over time, as interest gets added to your account, you start earning interest on the new, larger balance.

The formula for compound interest is:

A = P (1 + r/n)^(n × t)

- A = Final amount

- P = Principal (initial investment)

- r = Annual interest rate (decimal)

- n = Times interest is compounded per year

- t = Number of years

The Power of Time and Compounding

Compounding grows stronger with time. The longer your money remains invested, the more exponential its growth becomes. Let’s illustrate this with an example.

Example: Compounding Over 20 Years

If you invest ₹1,00,000 at an annual interest rate of 8% compounded yearly, here’s how your wealth will evolve:

| Year | Amount (₹) |

|---|---|

| 1 | 1,08,000 |

| 5 | 1,46,932 |

| 10 | 2,15,893 |

| 15 | 3,17,217 |

| 20 | 4,66,095 |

Notice how the growth accelerates in later years. That’s the essence of compounding—the more time you give it, the more powerful it becomes.

Compound vs. Simple Interest

It’s important to understand how compound interest differs from simple interest. Under simple interest, you earn returns only on your original investment. With compound interest, you earn on both your principal and accumulated interest.

That small difference creates a huge gap over time, especially when dealing with larger amounts or multiple years.

Interactive Example: Estimate Your Compound Growth

Try this quick thought exercise. Imagine:

- You invest ₹5,000 every month (SIP model).

- Annual interest rate = 10%.

- Investment duration = 20 years.

The approximate future value will be:

FV = P × [(1 + r/n)^(n×t) - 1] / (r/n)

Result: You’ll accumulate roughly ₹34,40,000 from ₹12,00,000 total invested—nearly triple your contribution, all thanks to compounding.

Key Strategies to Maximize Compound Interest

- Start early: Even small amounts can grow significantly with time.

- Stay invested: Don’t withdraw your returns—let them compound.

- Reinvest dividends and interest: This accelerates compounding.

- Choose higher compounding frequency: Quarterly or monthly compounding works faster than annual.

- Increase contributions over time: Regular top-ups amplify your compounding effect.

The Rule of 72: Estimate Doubling Time

The “Rule of 72” is a handy shortcut. Divide 72 by your annual interest rate to estimate how many years it will take for your investment to double.

Years to double = 72 / Interest Rate

At 8% interest, your investment doubles in about 9 years. At 12%, it doubles in just 6 years!

Why Compound Interest Is a Wealth Builder

Compound interest rewards patience, consistency, and discipline. It’s the ultimate multiplier for your money—turning small sacrifices today into future financial independence. Whether through savings, fixed deposits, or mutual fund SIPs, using compound interest smartly can pave your way to wealth creation.

Final Thoughts

Compound interest may seem simple, but its long-term power is extraordinary. The earlier you start, the less you have to contribute to achieve your desired wealth. As financial author Albert Einstein famously noted, “He who understands it, earns it; he who doesn’t, pays it.”

Now that you know how compound interest works, take action—start investing today and let time multiply your efforts!