Budgeting: 50/30/20 Rule for Smart Money Allocation is one of the simplest yet most powerful frameworks for personal financial planning. It offers a clear, actionable method to divide your income into categories that promote balance—meeting needs, enjoying life, and securing your future. This article explores this rule in depth, with visuals, examples, and interactive concepts to help you establish sustainable financial habits.

What Is the 50/30/20 Rule?

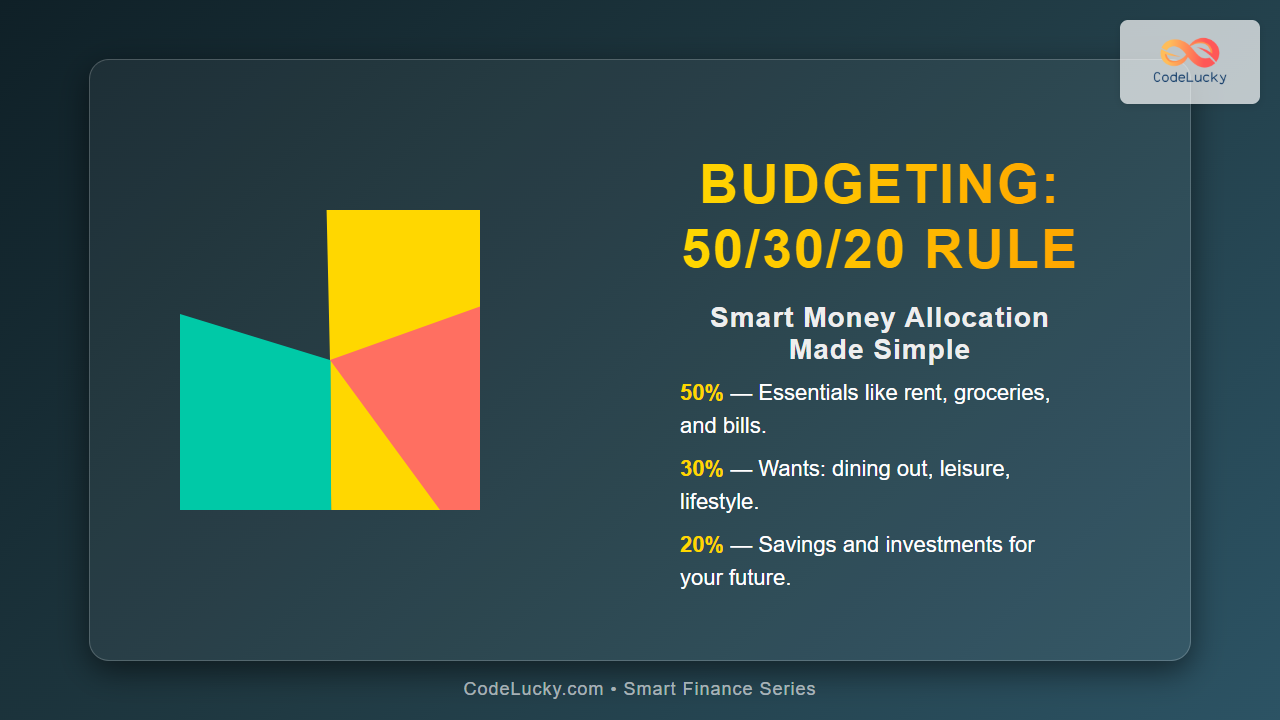

The 50/30/20 rule divides your after-tax income into three main categories:

- 50% for Needs: Essential expenses you must cover to live — rent, groceries, utilities, insurance, loan EMIs, etc.

- 30% for Wants: Non-essential expenditures that improve lifestyle — dining out, shopping, hobbies, and entertainment.

- 20% for Savings and Debt Repayment: Investments, emergency fund contributions, or additional loan payments that build wealth or reduce financial burden.

How the 50/30/20 Rule Works in Practice

Let’s say your monthly take-home pay is ₹1,00,000. Here’s how allocation would ideally look:

| Category | Percentage | Amount (₹) | Example Expenses |

|---|---|---|---|

| Needs | 50% | 50,000 | Rent, Groceries, Electricity, Health Insurance |

| Wants | 30% | 30,000 | Netflix, Dining Out, Shopping, Gym |

| Savings & Debt Repayment | 20% | 20,000 | Mutual Funds, SIPs, Emergency Fund |

Why the 50/30/20 Rule Works

This rule’s effectiveness lies in its simplicity and balance. Many budgeting systems are either too strict or too vague. The 50/30/20 model sets a flexible yet disciplined framework. Here’s what makes it powerful:

- Balanced Lifestyle: You can enjoy your earnings without guilt while still being responsible.

- Built-in Saving Habit: The rule ensures you’re always saving at least 20% of income.

- Adaptability: You can modify the ratio slightly (like 60/20/20) based on personal priorities.

How to Implement the 50/30/20 Budget

- Step 1: Determine Monthly Net Income. Use your take-home income (after taxes and deductions) as a base.

- Step 2: Categorize All Expenses. List down all spends and tag them under needs, wants, or savings.

- Step 3: Monitor and Adjust Monthly. Track expenses using finance apps or spreadsheets; tweak if categories exceed limits.

- Step 4: Automate Savings. Move 20% automatically to a savings or investment account at the start of every month.

Tip: Many salary accounts now allow automated rules for transfers — you can create standing instructions to send 20% of income into investments on payday.

Example Interactive Scenario

Imagine you get a salary increase of ₹20,000. Here’s how your new allocations change dynamically using this model:

- New Monthly Income: ₹1,20,000

- Needs (50%): ₹60,000

- Wants (30%): ₹36,000

- Savings (20%): ₹24,000

You can create an interactive calculator using simple JavaScript to visualize how income changes affect allocations:

This snippet helps readers feel the logic of budgeting interactively and immediately.

Adjusting the Rule to Your Lifestyle

Everyone’s financial circumstances differ. The 50/30/20 rule serves as a guideline, not a restriction. You might adapt it as follows:

- High Rent Cities (like Mumbai or Delhi): Adjust to 60/25/15 — more for needs.

- Debt Repayment Focus: Modify to 50/20/30 — prioritize loan clearance.

- Investment-Oriented: Try 40/30/30 — more for wealth building.

Final Thoughts

Budgeting doesn’t have to feel restrictive or complex. The 50/30/20 rule delivers a clear, practical framework that keeps your financial life stable while offering the flexibility to enjoy your earnings. Implement it for 2–3 months, review your outcomes, and refine proportions to match your lifestyle goals. Over time, this simple habit builds lasting financial freedom.

Take control of your money — start with the 50/30/20 rule today, and watch how clarity transforms your finances.