Budgeting is more than a financial buzzword; it’s the foundation of financial freedom. Whether you’re saving for an emergency, a home, or just trying to spend wisely, learning how to track and control your daily expenses helps you stay organized, avoid debt, and achieve your goals faster. This detailed CodeLucky.com guide walks you through strategies, visual tools, and interactive examples to master daily budgeting.

Why Daily Expense Tracking Matters

Most people underestimate how small purchases quickly add up. A daily latte, a quick ride-share, or spontaneous online purchase might not seem significant, but they often derail monthly budgets. Tracking your daily expenses:

- Reveals your real spending habits.

- Helps you identify wasteful categories.

- Keeps you accountable to your financial goals.

- Gives you control over impulse spending.

Think of it as weighing yourself daily when trying to maintain fitness—it’s about awareness and control.

1. Understanding Budget Components

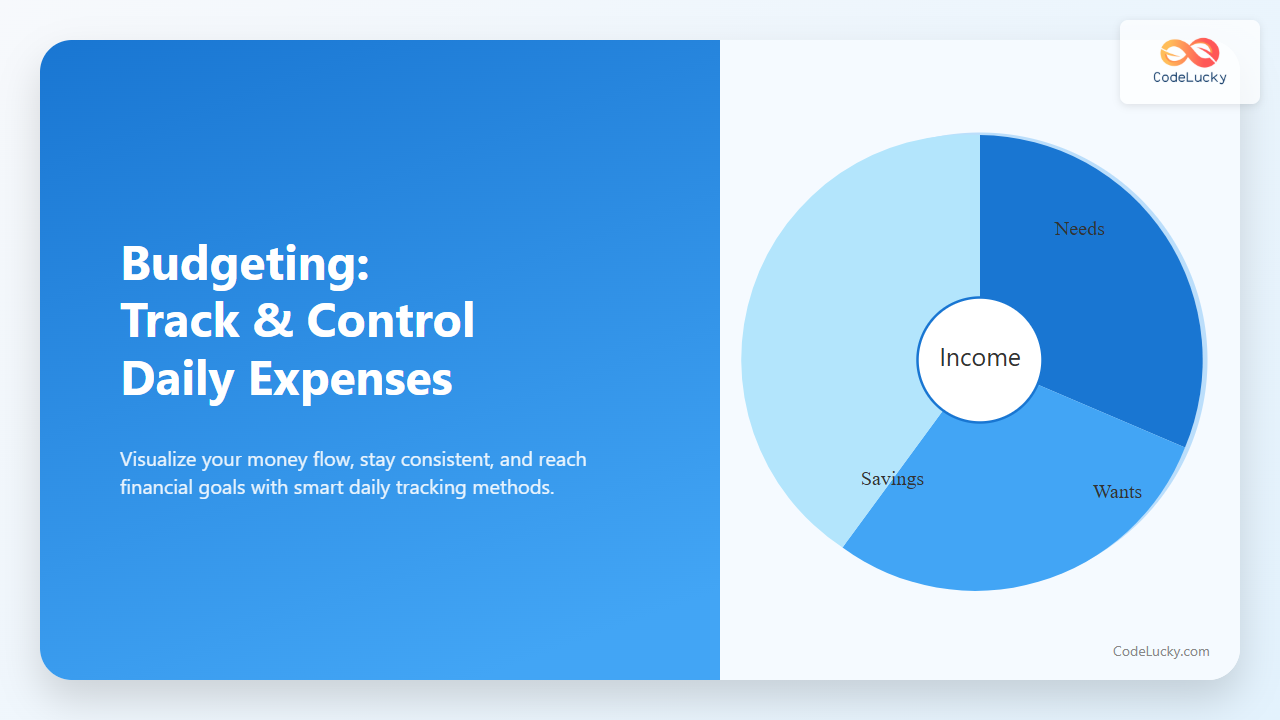

To build a robust budget, start by dividing your income into clear categories. Use the 50/30/20 rule as a foundation:

- 50% for needs (rent, groceries, transport).

- 30% for wants (entertainment, subscriptions).

- 20% for savings and investments.

This structure ensures your money aligns with your priorities while leaving room for flexibility.

2. Choosing the Right Expense Tracking Method

The method you choose depends on your lifestyle and comfort level. Below are the main tracking options:

| Method | Tools | Best For |

|---|---|---|

| Manual tracking | Notebook, Excel, Google Sheets | People who like visual or handwritten summaries |

| Digital apps | Mint, YNAB, PocketGuard | Those who prefer automation and smart categorization |

| Hybrid method | Daily logs + monthly spreadsheets | Users who enjoy detailed periodic reviews |

For beginners, starting with a simple spreadsheet is the easiest way to visualize where the money goes.

3. Practical Example: Monthly Spending Overview

Here’s a simple interactive HTML-based example you can use to track your daily expenses. Copy this into your browser or a local file:

<table border="1" cellspacing="0" cellpadding="8">

<tr><th>Date</th><th>Category</th><th>Description</th><th>Amount (₹)</th></tr>

<tr><td>2025-12-10</td><td>Food</td><td>Lunch with friends</td><td>300</td></tr>

<tr><td>2025-12-10</td><td>Transport</td><td>Cab fare</td><td>150</td></tr>

<tr><td>2025-12-11</td><td>Groceries</td><td>Vegetables</td><td>250</td></tr>

<tr><th colspan="3">Total</th><th id="total">0</th></tr>

</table>

<script>

let total = 0;

document.querySelectorAll('td:nth-child(4)').forEach(c => total += parseFloat(c.textContent));

document.getElementById('total').textContent = total;

</script>

This quick code helps you total your expenses dynamically — no spreadsheet formulas required.

4. Visualizing Spending Habits

Tracking is good, but visualizing your spending patterns is even better. Use a flow diagram like below to understand how income flows through different expense categories:

This structure creates accountability. You can instantly spot imbalances—for example, if “wants” consistently exceed expectations, you know where to adjust.

5. Setting Smart Daily Limits

Instead of broadly aiming for monthly targets, break budgets into daily caps. For example, if your monthly “wants” are ₹9,000, divide by 30 to get ₹300/day. This approach offers clearer boundaries for lower spending days to offset heavier ones.

When you know your daily limit, overspending by ₹200 one day means compensating by saving ₹200 elsewhere that week. It’s simple accountability through math.

6. Using Automation and Alerts

Most banking apps today allow you to categorize and label each expense automatically. Turn on notifications for every transaction. You’ll instantly know when you’ve breached your limit. For additional control:

- Use IFTTT or Zapier to record expenses from SMS alerts into Google Sheets.

- Set reminders to review totals every Sunday.

- Color-code categories to visualize overspending at a glance.

Example automation flow:

7. Analyzing and Adjusting Strategies

By the end of each month, examine your data. Ask yourself:

- Which categories consistently exceed limits?

- Are my savings on track?

- Did any spontaneous purchases surprise me?

Visualize category patterns like this:

From this analysis, you can reallocate or adjust targets for the next month. For instance, if entertainment took up 25%, lowering that to 15% could boost savings by 10% immediately.

8. Conclusion: Build Habits, Not Restrictions

Budgeting isn’t about restriction—it’s a system for freedom. By tracking your expenses daily, visualizing your spending, and adjusting with intent, you take command of your finances. Over time, these habits build discipline, reduce stress, and create paths to long-term wealth.

At CodeLucky.com, we believe financial control is a skill anyone can master with awareness, structure, and the right digital mindset. Start today—your future self will thank you.

- Why Daily Expense Tracking Matters

- 1. Understanding Budget Components

- 2. Choosing the Right Expense Tracking Method

- 3. Practical Example: Monthly Spending Overview

- 4. Visualizing Spending Habits

- 5. Setting Smart Daily Limits

- 6. Using Automation and Alerts

- 7. Analyzing and Adjusting Strategies

- 8. Conclusion: Build Habits, Not Restrictions