Budgeting is one of the most powerful financial practices for achieving stability, saving more efficiently, and reaching your goals faster. Whether you’re managing a household, freelancing, or running a small business, understanding how to create a monthly budget step by step is essential.

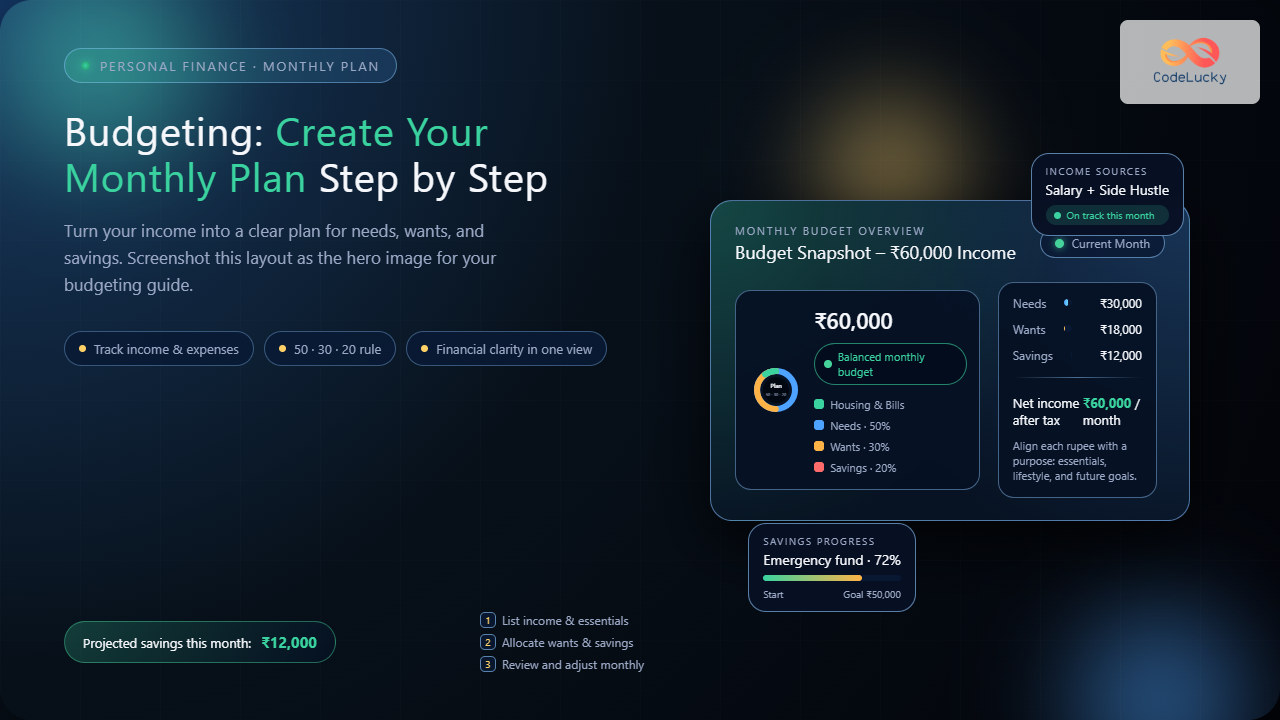

In this detailed guide, we’ll cover how to plan your monthly budget effectively, with examples, visual breakdowns, and even interactive elements to help you apply the concepts in real life.

Why Budgeting Matters

Budgeting helps you take control of your money instead of letting your expenses control you. It ensures that you spend intentionally, save consistently, and plan for future goals. Without a budget, it’s easy to overspend or lose track of where your income goes each month.

Step 1: Calculate Your Net Monthly Income

Start with the total money you actually take home after taxes, insurance, and deductions. This includes income from your primary job, side hustles, investments, or other sources.

Example: If your total earnings are ₹70,000 and your deductions total ₹10,000, your net monthly income is ₹60,000.

Step 2: List All Fixed and Variable Expenses

Expenses fall into two main categories:

- Fixed expenses: Rent, EMIs, insurance, and subscriptions—these rarely change each month.

- Variable expenses: Groceries, dining, entertainment, transportation—these can change monthly.

Example Breakdown:

| Category | Type | Amount (₹) |

|---|---|---|

| Rent | Fixed | 15,000 |

| Utilities | Fixed | 2,000 |

| Groceries | Variable | 8,000 |

| Transport | Variable | 3,000 |

| Leisure | Variable | 2,000 |

Step 3: Categorize Your Spending

Organize your spending into logical groups so you can track patterns more effectively. A simple pie chart view can be visualized through a budget allocation diagram like below:

Step 4: Set Realistic Financial Goals

Decide what your short-term and long-term financial goals are. These could include building an emergency fund, paying off debt, or saving for travel.

- Short-term goals: Save ₹10,000 in 3 months for emergencies.

- Long-term goals: Pay off home loan within 10 years.

Defining clear goals gives your budget purpose—motivating you to stick to it.

Step 5: Implement the 50/30/20 Rule

The 50/30/20 rule is a simple yet powerful budgeting framework:

- 50% of income for needs (essentials)

- 30% for wants (discretionary spending)

- 20% for savings and debt repayment

Step 6: Track Your Spending

Use tools like Google Sheets, budgeting apps, or a simple notebook to record your expenses. Update it weekly for better control. Consistent tracking helps you identify leaks and optimize spending habits.

Interactive Example:

Try this basic interactive calculation using formulas in your spreadsheet:

=Net_Income - SUM(Fixed_Expenses:Variable_Expenses)This real-time calculation instantly shows how much you can save each month.

Step 7: Review and Adjust Monthly

Life changes—so should your budget. Revisit your plan every month to ensure it aligns with your income, expenses, and goals.

Bonus: Tips to Maintain Your Monthly Budget

- Automate bill payments to avoid late fees.

- Use cash envelopes for variable categories like dining or entertainment.

- Set reminders for savings transfers on payday.

- Celebrate milestones when you hit savings targets.

Example: A Complete Monthly Budget Snapshot

| Category | Planned (₹) | Actual (₹) | Difference (₹) |

|---|---|---|---|

| Rent | 15000 | 15000 | 0 |

| Groceries | 8000 | 7800 | +200 |

| Transport | 3000 | 3500 | -500 |

| Savings | 12000 | 12000 | 0 |

| Entertainment | 2000 | 1700 | +300 |

This approach helps you visualize your financial standing clearly—making adjustments easy and transparent.

Final Thoughts

Creating a monthly budget is not just about numbers—it’s about intention and discipline. By following these steps, you’re building a sustainable plan that brings peace, financial independence, and progress toward your dreams.

Start today, take control of your finances, and let your budget become your most powerful ally on your road to financial freedom.