Break-even analysis is a fundamental concept in business finance that helps entrepreneurs and financial managers identify when their business or product starts generating profit. It determines the point where total costs equal total revenue, meaning there’s no loss or profit — the business has just “broken even.”

What Is Break-Even Analysis?

Break-even analysis is used to evaluate the relationship between cost, sales volume, and profit. It answers a crucial question: How many units must be sold (or how much revenue must be earned) to cover all costs?

This analysis divides costs into two main categories:

- Fixed Costs: Expenses that remain constant regardless of production or sales volume (e.g., rent, insurance, salaries).

- Variable Costs: Costs that change directly with production (e.g., materials, packaging, shipping).

The Break-Even Formula

The break-even point (BEP) can be calculated in two ways — in terms of units or sales revenue.

Break-Even Point (Units):

\( \text{BEP (Units)} = \frac{\text{Fixed Costs}}{\text{Selling Price per Unit} – \text{Variable Cost per Unit}} \)

Break-Even Point (Sales):

\( \text{BEP (Sales)} = \text{BEP (Units)} \times \text{Selling Price per Unit} \)

Example Calculation

Let’s consider a small business selling coffee mugs:

- Fixed Costs = ₹50,000

- Selling Price per Unit = ₹200

- Variable Cost per Unit = ₹120

Step 1: Find the contribution margin = Selling Price – Variable Cost = ₹200 – ₹120 = ₹80.

Step 2: Compute BEP (Units) = ₹50,000 / ₹80 = 625 mugs.

Step 3: Compute BEP (Sales) = 625 × ₹200 = ₹125,000.

Interpretation: The business must sell 625 mugs or achieve ₹125,000 revenue to start making a profit.

Break-Even Analysis Visualization

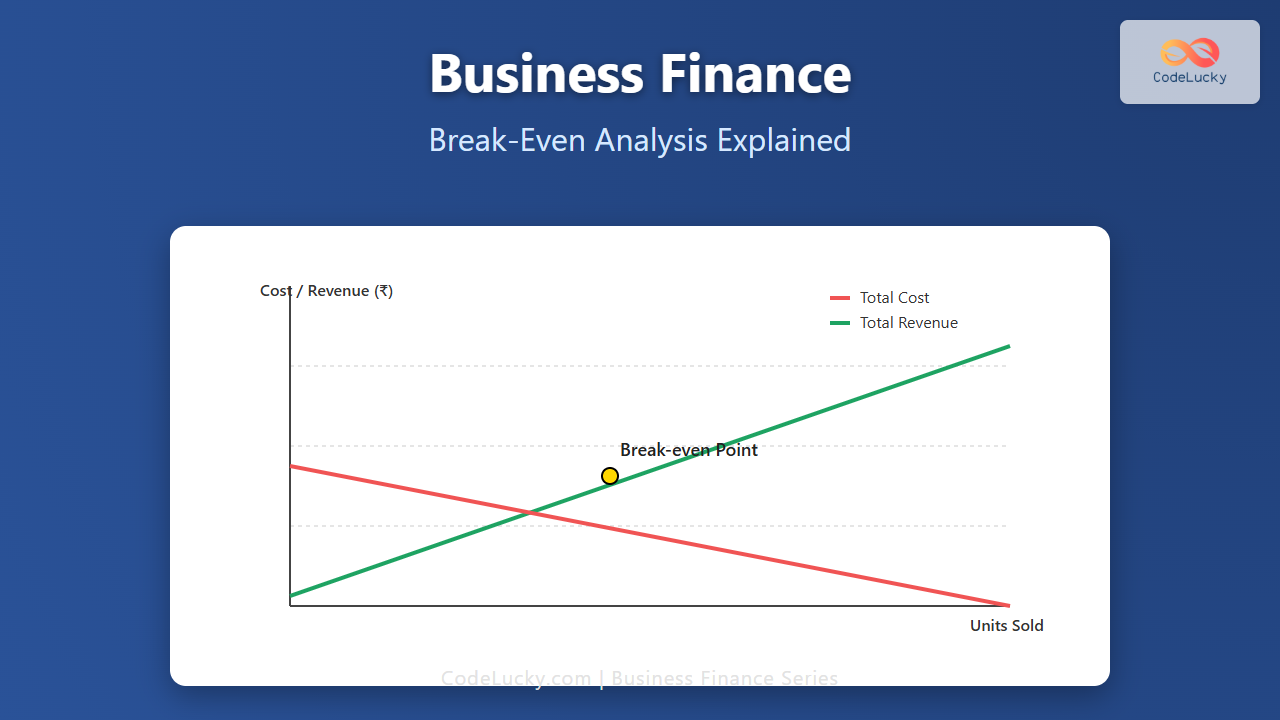

The following graph shows how total revenue and total costs intersect at the break-even point.

This intersection (Break-even Point) divides the graph into two areas: losses to the left and profits to the right.

Interactive Example: Adjust Your Numbers

Try adjusting the following parameters to see how your break-even point changes conceptually:

- If your fixed costs increase, BEP increases — you need to sell more units.

- If your variable cost per unit decreases, BEP decreases — profitability improves faster.

- If your selling price increases, BEP reduces — you reach profit sooner.

Visualizing it another way:

Break-Even Chart Example

The line diagram below illustrates the relationship between cost and revenue over quantity.

Why Break-Even Analysis Matters

Understanding your break-even point helps you make better financial decisions. It enables you to:

- Set realistic pricing strategies.

- Control fixed and variable costs.

- Forecast profitability and manage risks.

- Plan future investments or expansion.

Limitations of Break-Even Analysis

Although helpful, break-even analysis has some limitations:

- It assumes all produced goods are sold—no unsold inventory.

- It assumes fixed and variable costs remain constant, which may not always be true in dynamic markets.

- It doesn’t account for multiple products with different costs and margins.

Real-World Applications

- Startups: To determine viability and set sales targets before launch.

- Manufacturers: To decide whether to automate production or outsource.

- Retail Businesses: To optimize product pricing based on cost structure.

- Service Providers: To evaluate project-level profitability.

Break-Even Analysis Model Overview

Conclusion

Break-even analysis is not just a mathematical tool—it’s a strategic instrument for understanding your business’s cost structure and profitability. By using it effectively, you can make informed decisions, reduce financial risk, and set achievable goals for sustainable growth.

CodeLucky Tip: Incorporate break-even analysis into your annual financial planning. Regularly revisiting these numbers helps ensure your business strategy aligns with real-world cost and revenue changes.