Bonds are one of the most popular investment options in the financial world, offering stable returns and lower risk compared to stocks. However, to truly understand bonds, you must grasp the concept of bond interest rates—how they are set, what influences them, and how they affect the price of your bond investment. In this article, you’ll get a detailed explanation of how bond interest rates work, with examples and easy-to-follow visuals.

What Is a Bond?

A bond is essentially a loan made by an investor to a borrower—typically a government, corporation, or municipality. In return, the borrower agrees to pay back the principal amount (the face value) at a future date, while paying interest (called the coupon) periodically throughout the life of the bond.

Example: Suppose you buy a ₹1,000 government bond with a 5% annual interest rate (coupon). This means you’ll receive ₹50 per year until the bond matures, after which you’ll get your ₹1,000 back.

Key Terms You Should Know

- Face Value: The amount you will receive at bond maturity (e.g., ₹1,000).

- Coupon Rate: The annual interest payment expressed as a percentage of the face value.

- Yield: The actual return on your bond investment based on the purchase price and coupon payments.

- Maturity Date: The date when the bond issuer repays the principal.

How Bond Interest Rates Work

The relationship between bond prices and interest rates is inverse. When interest rates in the market rise, bond prices fall, and when rates fall, bond prices rise.

This inverse relationship exists because investors always seek the best return. If new bonds are issued with higher interest rates, existing bonds with lower coupons become less valuable, reducing their price in the secondary market.

Bond Interest Rate Example

Let’s break this down with a simple example:

- You buy a 10-year bond with a ₹1,000 face value and 5% coupon (so ₹50 interest per year).

- After one year, new bonds are issued at 6%.

- Your bond still pays ₹50 per year, but now investors can get ₹60 from new bonds of the same value.

- To attract buyers, you’d need to sell your bond at a lower price (below ₹1,000).

This adjustment ensures that, even though your bond’s interest payment is fixed, its effective yield aligns with the new market rate.

Bond Yield: The Real Return

Bond yield tells you the actual return on your investment. It can differ from the coupon rate if you didn’t buy the bond at face value.

The formula for the current yield is:

Current Yield = (Annual Coupon Payment / Current Market Price) × 100

Example: If your bond pays ₹50 annually but its market price drops to ₹900,

Current Yield = (50 / 900) × 100 = 5.56%

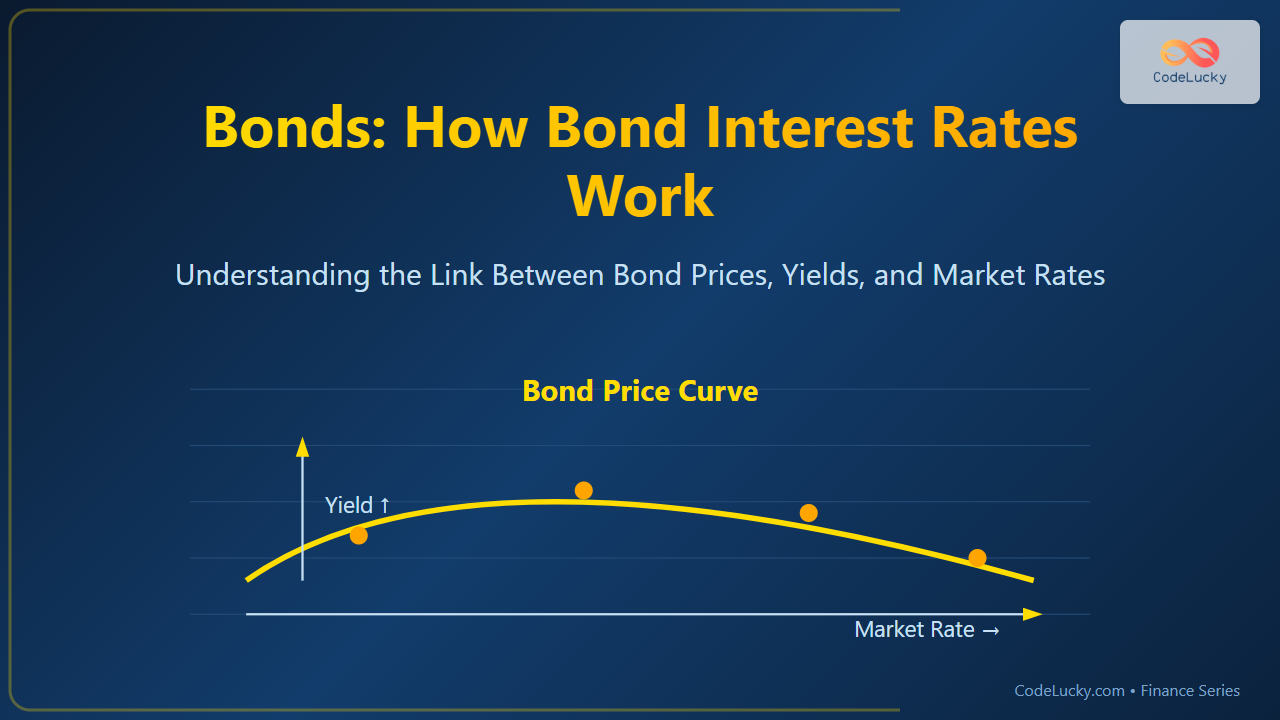

Visualizing Bond Price and Yield Relationship

Factors Influencing Bond Interest Rates

Multiple factors can influence the bond interest rate (or yield), including macroeconomic and issuer-specific elements.

- Central Bank Policy: When a central bank raises benchmark interest rates, new bonds will offer higher coupons.

- Inflation Expectations: Higher inflation erodes fixed returns, leading to higher yields.

- Credit Risk: Bonds from riskier issuers must offer higher interest rates to attract investors.

- Demand and Supply: More demand for safe assets like government bonds can push yields lower.

- Economic Growth: In strong economies, rates tend to rise as borrowing demand increases.

Interactive Example: Calculate Bond Price Sensitivity

You can play with bond interest rate sensitivity using this simple calculator concept (to be coded interactively by developers):

Enter Face Value (₹): 1000

Enter Coupon Rate (%): 5

Enter Market Interest Rate (%): 6

Calculate -> Output: Bond Current Price = (Coupon / Market Rate)

= (50 / 0.06) = ₹833.33 (approx)

This shows that as the market rate rises, your bond’s value drops to ₹833 from ₹1,000.

Yield Curve: The Shape of Expectations

The yield curve is a chart showing how bond yields vary across different maturities (short-term vs. long-term). A normal yield curve slopes upward, reflecting higher yields for longer-term bonds due to greater risk and inflation uncertainty.

Sometimes the yield curve “inverts,” meaning short-term yields exceed long-term ones—a potential recession indicator.

How Investors Can Use This Knowledge

Understanding how bond interest rates work helps investors make better decisions:

- Predict Bond Price Movement: If you expect interest rates to rise, avoid long-term bonds since they’ll lose value faster.

- Diversify Portfolios: Mix short- and long-term bonds to balance returns and reduce risk.

- Identify Opportunities: When rates peak, buying bonds can lock in attractive fixed returns before rates drop again.

Conclusion

Bond interest rates lie at the heart of the fixed-income market. Their movement influences not only bond prices but also broader financial trends, including lending, inflation, and investment strategies. By understanding how rates, yields, and prices interact, you gain a deeper insight into the world of investing—and position yourself to make smarter, more informed decisions.