Choosing the right bank account is one of the first and most important decisions in personal finance. Whether you’re managing day-to-day expenses, saving for the future, or running a business, understanding the types of bank accounts can help you make better financial choices. In this article, we’ll explore the major account types, their features, benefits, and examples to guide you in choosing the right one for your needs.

What Is a Bank Account?

A bank account is a secure place where individuals or businesses can deposit, withdraw, or manage their money electronically. Banks offer different types of accounts designed for specific financial needs — from saving small amounts regularly to managing heavy business transactions.

Main Types of Bank Accounts

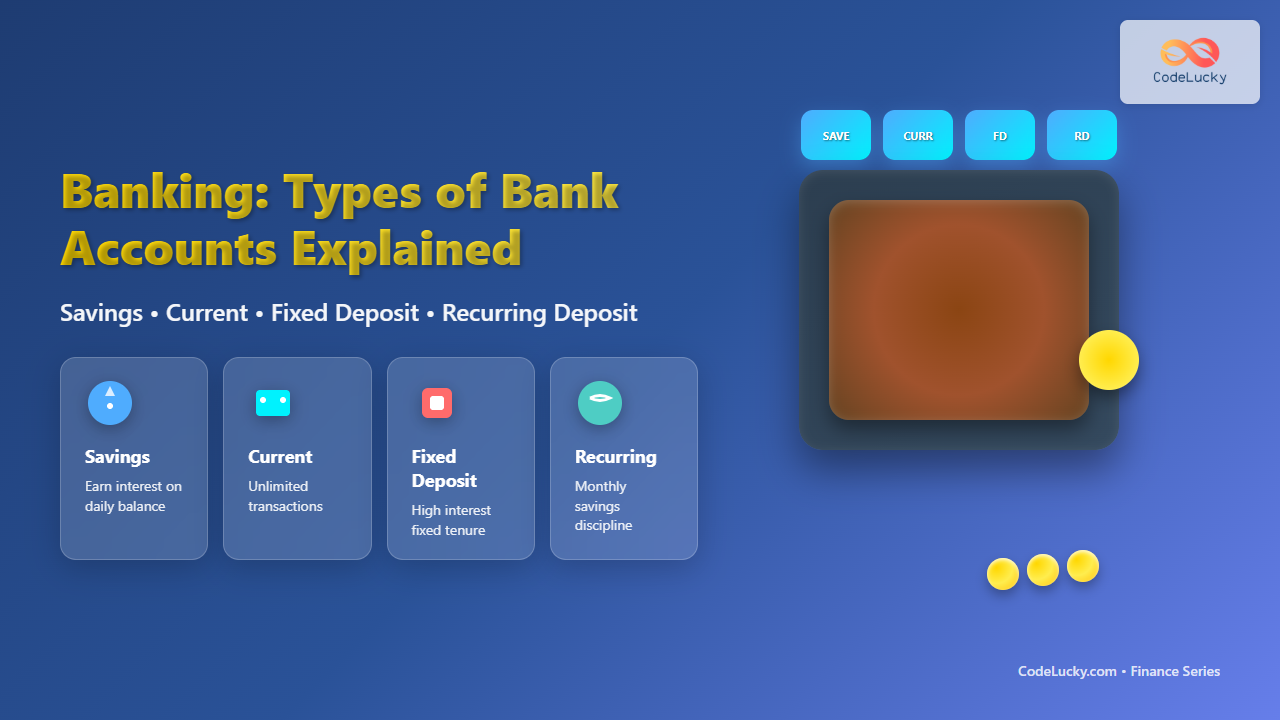

Broadly, there are four main categories of bank accounts used in India and worldwide:

- Savings Account

- Current Account

- Fixed Deposit (FD) Account

- Recurring Deposit (RD) Account

1. Savings Account

A savings account is designed for individuals who want to deposit money and earn interest on their balance. It is ideal for salaried individuals, students, and families. Most banks offer online access, debit cards, and interest ranging from 3% to 6% per annum, depending on the institution.

Key Features:

- Suitable for regular personal savings.

- Earns interest on deposited funds.

- Comes with an ATM or debit card for easy withdrawal.

- Low minimum balance requirements (sometimes zero balance).

Example:

If you deposit ₹50,000 in a savings account with 4% annual interest, you’ll earn ₹2,000 in a year, credited directly to your account balance.

Interactive Example:

Use this quick calculator to estimate your savings growth:

Enter Amount: 50000

Interest Rate: 4%

Years: 1

Projected Balance = 50000 + (50000 * 4 / 100) = 52,000

2. Current Account

A current account is meant for businesses and professionals that need to make frequent transactions. Unlike a savings account, it doesn’t earn interest, but it allows unlimited withdrawals and deposits.

Key Features:

- Designed for high-volume transactions.

- No interest is paid on the balance.

- Overdraft facility available in many banks.

- Higher minimum balance required (e.g., ₹10,000–₹50,000).

Example:

A business owner receiving daily payments from clients and making regular supplier transfers will benefit from a current account’s flexibility and online access.

3. Fixed Deposit (FD) Account

A fixed deposit account is a type of term deposit where a lump sum is invested for a fixed period at a fixed interest rate. It offers higher returns than a savings account and is a popular low-risk investment option.

Key Features:

- Fixed tenure from 7 days to 10 years.

- Higher interest rates (5%–8%) depending on duration and bank.

- Premature withdrawal may attract a small penalty.

- Interest can be paid monthly, quarterly, or on maturity.

Visual Flow:

Example:

A deposit of ₹1,00,000 in a 3-year FD at 7% interest grows to roughly ₹1,23,000 at maturity — ideal for people seeking stable returns without market risk.

4. Recurring Deposit (RD) Account

A recurring deposit account allows you to save a fixed amount every month. It is suitable for individuals who want to develop a savings habit and earn steady returns over time.

Key Features:

- Monthly deposit accounts with tenures from 6 months to 10 years.

- Fixed interest rate, typically similar to FD rates.

- Premature closure available with minor penalty.

Example:

If you deposit ₹2,000 monthly for 2 years at 6% interest, you’ll receive approximately ₹50,000 at maturity.

Other Types of Bank Accounts

In addition to the four main types, banks also offer specialized accounts catering to specific groups:

- Salary Accounts: Provided to employees for direct salary credit with extra benefits like zero balance and easy transfers.

- Senior Citizen Accounts: Offer higher interest on savings and FDs.

- NRI Accounts (NRE/NRO): Designed for Indians living abroad to manage income earned both in India and overseas.

- Joint Accounts: Two or more people can operate the same account jointly — popular among couples or business partners.

How to Choose the Right Bank Account

Choosing the right bank account depends on your financial goals and usage patterns. Here’s a quick guide:

| Purpose | Recommended Account Type |

|---|---|

| Daily savings and small expenses | Savings Account |

| Business transactions | Current Account |

| Long-term safe investment | Fixed Deposit Account |

| Monthly saving discipline | Recurring Deposit Account |

Conclusion

Understanding the different types of bank accounts helps you manage money more effectively. Whether it’s growing your savings, handling business operations, or planning future goals, the right account acts as a reliable financial foundation. Take time to compare interest rates, service fees, and features before choosing your bank account — your financial goals will thank you later.

Authored by the CodeLucky Finance Editorial Team