Banking has evolved far beyond brick-and-mortar branches. Today, finding the right bank means balancing convenience, security, costs, and features that can directly impact your financial journey. Whether you’re opening your first account or switching banks for better benefits, this guide explains how to evaluate options logically and confidently — with clear examples, comparison visuals, and interactive ideas to help you make a smart financial choice.

1. Understanding Different Types of Banks

Before committing to a bank, it’s vital to understand the various types available. Each caters to a different set of needs and priorities.

- Traditional Banks: Offer physical branches with full-service support, loans, and in-person consultation.

- Online Banks: Operate entirely digital, usually providing higher interest rates and lower fees.

- Credit Unions: Member-owned organizations that often offer lower loan rates and higher savings returns.

- Neobanks: Mobile-first financial startups that provide sleek apps, modern budgeting tools, and instant account setup.

2. Key Decision Factors When Choosing a Bank

Your ideal bank depends on your financial goals and daily habits. When comparing banks, pay attention to the following factors:

- Fees and Charges: Look for monthly maintenance fees, ATM usage fees, and overdraft penalties.

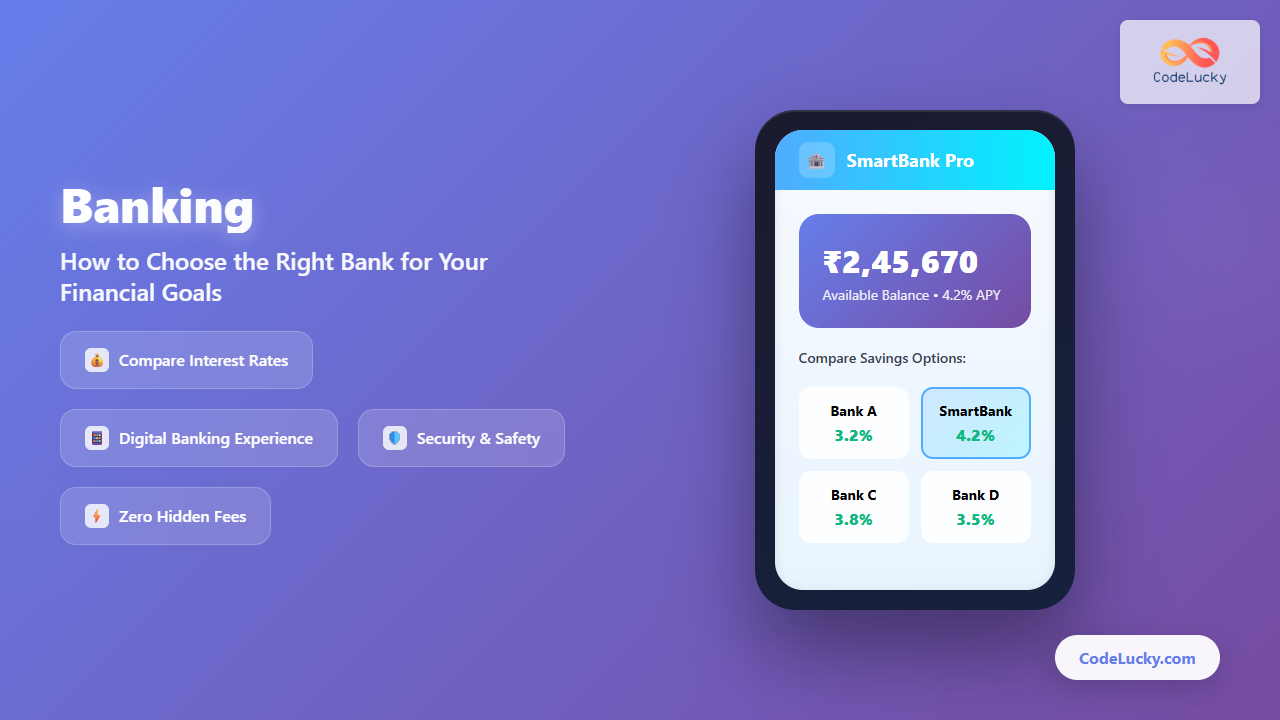

- Interest Rates: Compare savings and FD (fixed deposit) interest rates — small differences can lead to big gains over time.

- Accessibility: Ensure availability of user-friendly mobile apps, nearby ATMs, and branch networks if you need in-person help.

- Customer Service: Review how promptly the bank resolves issues and the quality of their communication channels.

- Security: Check if the bank uses two-factor authentication (2FA), encryption, and fraud alerts.

Example Interactive Idea: Use a simple spreadsheet or app-based comparison table to rank banks by these factors. Assign scores (1–5) for each factor and total them to identify your top choice.

3. Choosing Based on Your Goals

Your financial goal determines the best bank type for you. Here’s how to align choices:

| Goal | Best Bank Type | Reason | Example |

|---|---|---|---|

| Daily transactions | Neobank / Traditional Bank | Convenience and instant transfers | HDFC for branch access, Fi Money for app-based banking |

| Savings growth | Online Bank / Credit Union | Higher returns with fewer fees | AU Small Finance Bank offers high savings rates |

| Business or freelance payments | Traditional or Private Sector Bank | Business account benefits and invoicing tools | ICICI or Axis Bank current accounts |

4. Comparing Interest Rates and Fees

Interest rates and hidden charges can significantly influence your earnings and expenses. Even a 0.5% difference in savings account interest can alter your annual gains.

That ₹500 per year might not seem like much, but when compounded over 10 years, it’s ₹5,000–₹7,000 extra for the same effort — proof that choosing smart matters.

5. Check Digital Experience and Innovation

In India’s fintech landscape, digital experience defines customer satisfaction. Choose banks offering seamless mobile apps, instant UPI payments, biometric login, and 24/7 customer support.

Try testing their mobile application before committing. See if you can:

- Easily view transaction history and statements.

- Use UPI and QR-based payments instantly.

- Access customer support directly through the app.

6. Customer Service and Reputation

Even the best digital bank will disappoint if its customer service fails when you need help. Read verified customer reviews, test chat or phone response times, and check complaint resolution ratings available on RBI or consumer review platforms.

Example: A bank rated 4.5 stars with consistent feedback on quick problem resolution is a better bet than one with flashy features but poor service accessibility.

7. Safety and Regulations

Before finalizing, ensure the bank is governed by the Reserve Bank of India (RBI) and deposits are insured under the Deposit Insurance and Credit Guarantee Corporation (DICGC) up to ₹5 lakh per depositor.

- Look for https-secured online portals.

- Enable fraud alerts via SMS and email.

- Use complex passwords and biometric verification.

8. Final Checklist Before You Decide

Here’s a quick recap to finalize your ideal choice.

- ✅ Compare fees and rates.

- ✅ Check digital tools and app experience.

- ✅ Verify RBI registration.

- ✅ Confirm interest rates and benefits align with your goals.

- ✅ Read customer reviews for firsthand insights.

Conclusion

Choosing the right bank isn’t just about where your money stays — it’s about how efficiently it grows and supports your lifestyle. Evaluate fees, interest rates, security, and usability together, not in isolation. With a data-driven and goal-based approach like the one discussed here, your banking decision will not only be smart but also future-proof.

Written exclusively for CodeLucky.com — empowering readers to make smarter financial and digital decisions every day.